LLC vs S-Corp vs Sole Proprietorship: Real Estate Guide

LLC vs S-Corp vs Sole Proprietorship for Real Estate Investors: The Ultimate 2026 Comparison Guide

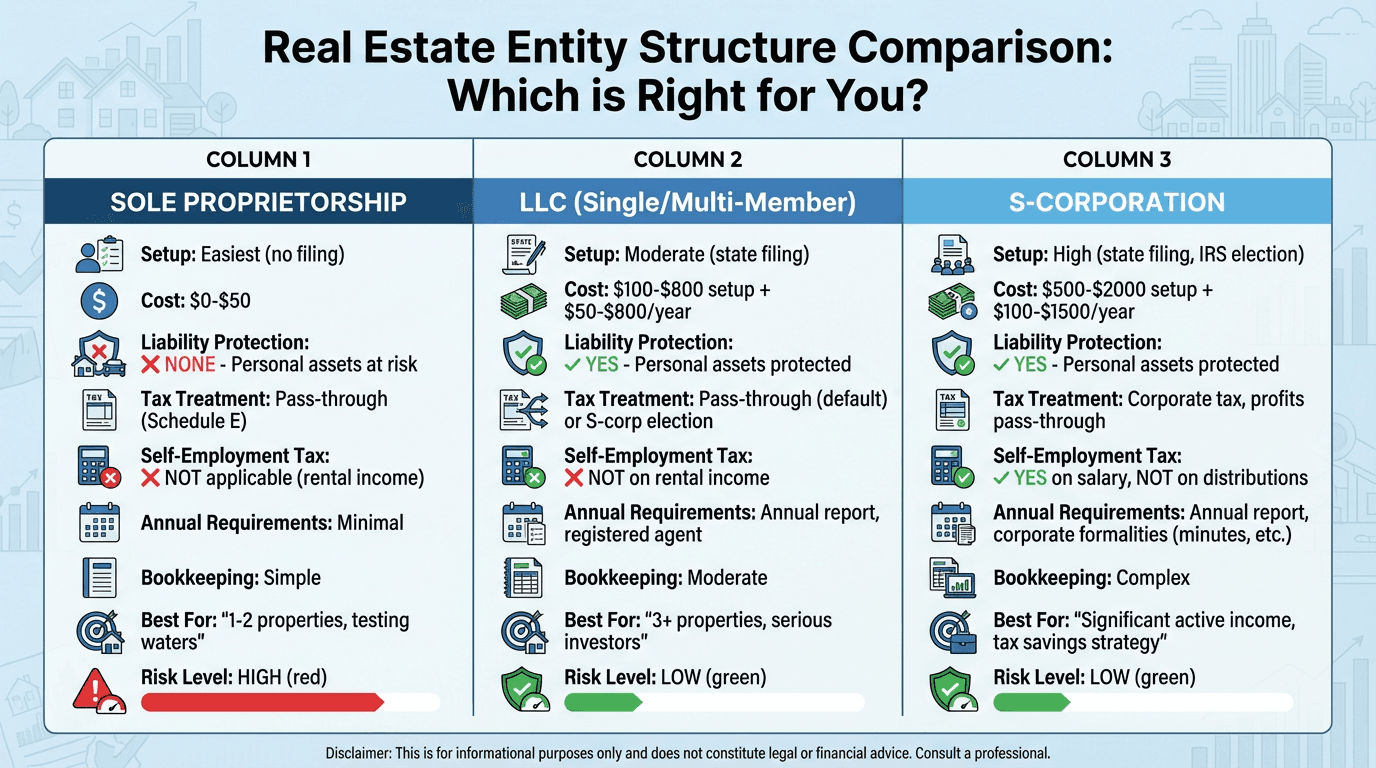

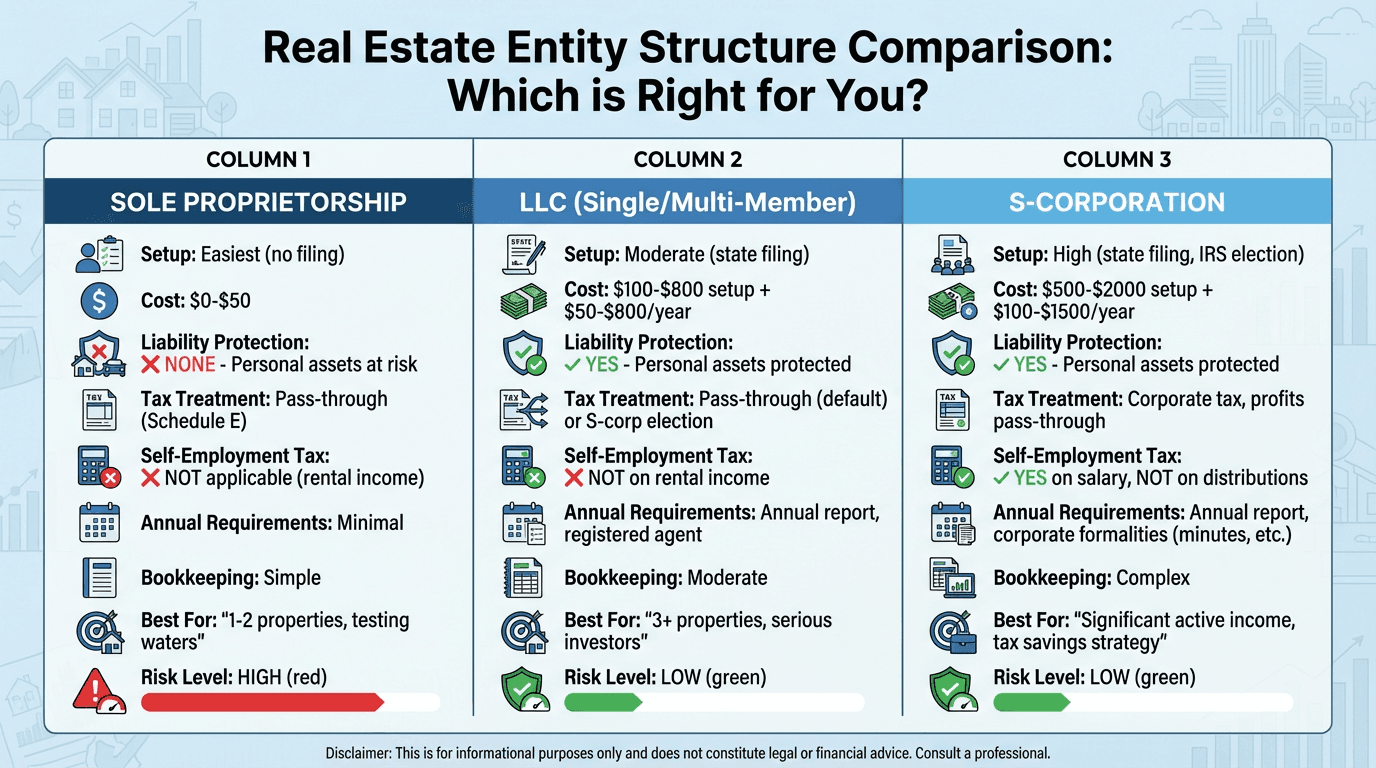

Choosing the right business entity structure is one of the most important decisions you'll make as a real estate investor. The choice between operating as a sole proprietorship, forming an LLC, or electing S-Corporation status can save (or cost) you tens of thousands of dollars in taxes, determine your personal liability exposure, and impact your ability to scale your portfolio.

In this comprehensive guide, we'll break down exactly which entity structure is right for YOUR specific situation—whether you're buying your first rental property, managing a portfolio of 10+ units, or running an active property management or flipping business.

Quick Navigation

- Entity Structure Comparison Chart

- Tax Savings Analysis

- Decision Tree: Which Structure for You?

- State-by-State Formation Costs

- Step-by-Step Setup Guide

The Three Main Entity Structures for Real Estate

1. [object Object]: The Default (and Risky) Option

What It Is:

When you start buying rental properties or flipping houses without forming any legal entity, you're automatically operating as a sole proprietor. There's no paperwork, no filing fees, and no separate business entity—you and your business are legally the same.

Key Characteristics:

- Setup Complexity: None (you're already a sole proprietor by default)

- Formation Cost: $0-$50 (just business licenses if required)

- Annual Maintenance: Minimal (personal tax return only)

- Liability Protection: ❌ NONE - Your personal assets are fully exposed

- Tax Treatment: Pass-through to Schedule E (rental) or Schedule C (flipping)

- Self-Employment Tax: Not applicable for rental income; applies to flipping/active business

Best For:

- Brand new investors testing the waters

- 1-2 rental properties

- Very low-risk situations

- Planning to form LLC soon

Major Risk:

If a tenant sues you, a contractor files a lien, or someone is injured on your property, your personal assets (home, savings, other investments) are at risk. This is why most serious investors move to an LLC as soon as they purchase their first or second property.

2. [object Object]: The Gold Standard for Rental Properties

What It Is:

An LLC is a separate legal entity that owns your rental properties. It provides liability protection (separating your personal assets from business liabilities) while maintaining simple, pass-through tax treatment.

Key Characteristics:

- Setup Complexity: Moderate (file articles of organization with your state)

- Formation Cost: $100-$800 depending on state

- Annual Maintenance: $50-$800/year (annual report, registered agent)

- Liability Protection: ✅ YES - Personal assets protected from business liabilities

- Tax Treatment: Pass-through by default (taxed like sole proprietor but with protection)

- Self-Employment Tax: ❌ Not applicable to rental income (huge advantage!)

- S-Corp Election: ✅ Can elect to be taxed as S-Corp if beneficial

Best For:

- 3+ rental properties

- Buy-and-hold investors

- Anyone serious about real estate investing

- Investors wanting liability protection with simple taxes

Why LLCs Are Perfect for Rental Properties:

-

No Self-Employment Tax on Rental Income

Unlike active business income, rental income is NOT subject to the 15.3% self-employment tax. An LLC's default tax treatment (pass-through) preserves this advantage. -

Full Liability Protection

If a tenant sues, they can only go after the LLC's assets (the property), not your personal home, bank accounts, or other investments. -

Simple Tax Filing

Single-member LLCs file taxes exactly like a sole proprietor (Schedule E), but with legal protection. No separate corporate tax return required. -

Flexible Ownership

Easy to add partners, transfer ownership, or restructure as your portfolio grows. -

Estate Planning Benefits

LLC interests are easier to transfer to heirs than individual properties.

3. [object Object]: Best for Active Real Estate Businesses

What It Is:

An S-Corporation is a tax election (not a separate entity type). You first form an LLC or corporation, then elect S-Corp status with the IRS. This changes how you're taxed—splitting income between "salary" (subject to payroll taxes) and "distributions" (not subject to self-employment tax).

Key Characteristics:

- Setup Complexity: High (LLC formation + S-election + payroll setup)

- Formation Cost: $500-$2,000

- Annual Maintenance: $2,000-$5,000+ (payroll, quarterly taxes, CPA required)

- Liability Protection: ✅ YES - Same as LLC

- Tax Treatment: Pass-through, but requires "reasonable salary" + distributions

- Self-Employment Tax: ✅ Only on salary portion (can save $5K-$20K/year)

- Rental Income: ❌ NO TAX BENEFIT (rental income already exempt from SE tax)

Best For:

- Property management companies

- Real estate agents/brokers

- House flippers

- Real estate wholesalers

- Active businesses with $60K+ profit

When S-Corp Makes Sense:

S-Corporation tax election is powerful for ACTIVE real estate businesses because it allows you to split income:

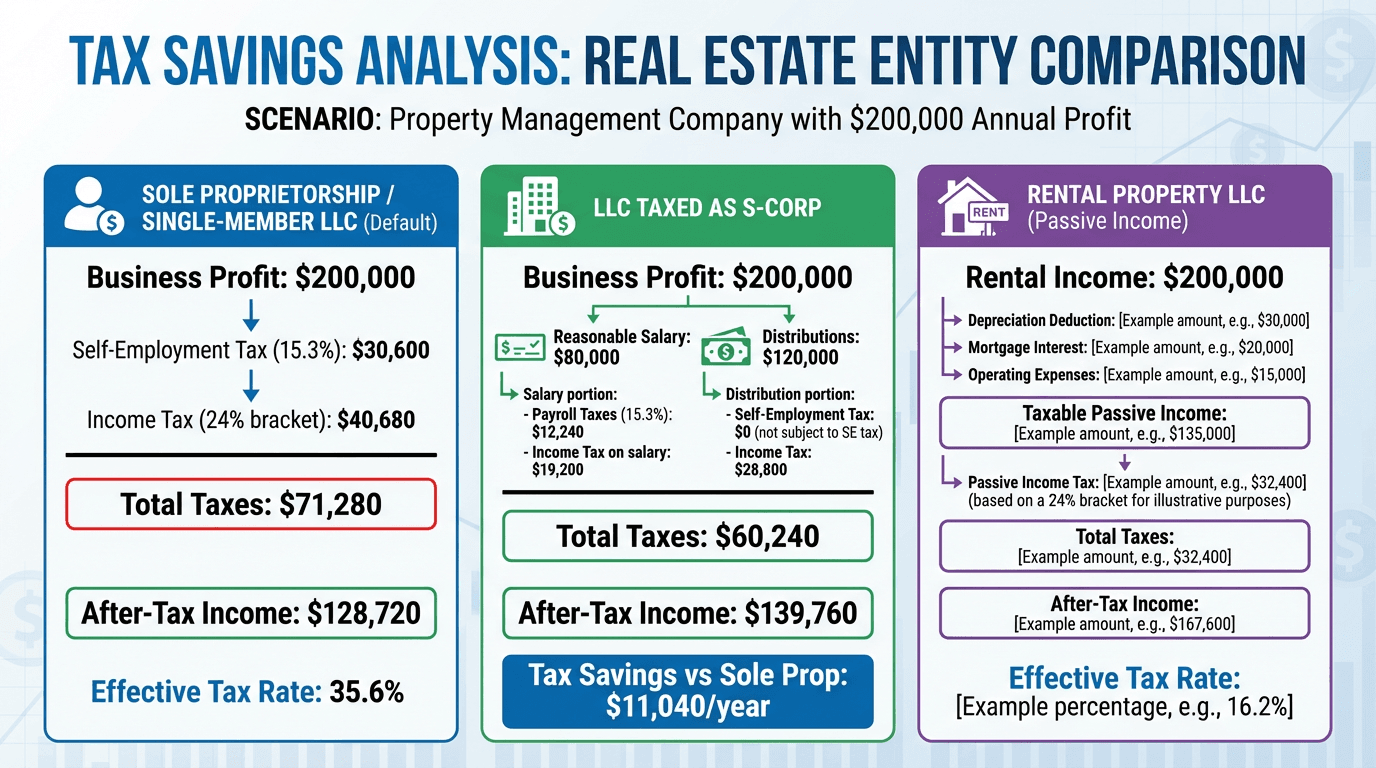

Example: Property Management Company with $200K Annual Profit

As Sole Proprietor/LLC (default):

- Business Profit: $200,000

- Self-Employment Tax (15.3%): $30,600

- Income Tax (24% bracket): $40,680

- Total Tax: $71,280

As S-Corporation:

- Reasonable Salary: $80,000

- Payroll Taxes (15.3%): $12,240

- Income Tax: $19,200

- Distributions: $120,000

- Self-Employment Tax: $0

- Income Tax: $28,800

- Total Tax: $60,240

- Tax Savings: $11,040/year 🎉

Tax Savings Analysis: Real Numbers

Scenario 1: Rental Property Portfolio ($200K Annual Rental Income)

Sole Proprietorship (or Single-Member LLC - default taxation):

- Rental Income: $200,000

- Self-Employment Tax: $0 (rental income exempt)

- Income Tax (24% bracket): $48,000

- Total Tax: $48,000

- Effective Rate: 24%

Why S-Corp Makes NO SENSE for Rental Income:

Since rental income is already exempt from self-employment tax, electing S-Corp status adds complexity (payroll, quarterly filings, CPA costs) with ZERO tax benefit. In fact, you might pay more due to additional compliance costs.

Winner: LLC (default taxation)

Keep it simple. An LLC gives you liability protection without the S-Corp complexity.

Scenario 2: Property Management Company ($200K Annual Profit)

Sole Proprietorship/LLC (default):

- Business Profit: $200,000

- Self-Employment Tax (15.3%): $30,600

- Income Tax (24% bracket): $40,680

- Total Tax: $71,280

- Effective Rate: 35.6%

LLC Taxed as S-Corporation:

- Reasonable Salary: $80,000

- Payroll Taxes: $12,240

- Income Tax: $19,200

- Distributions: $120,000

- Self-Employment Tax: $0

- Income Tax: $28,800

- Total Tax: $60,240

- Tax Savings: $11,040/year 💰

- Effective Rate: 30.1%

Winner: S-Corporation

For active businesses, S-Corp saves significant money on self-employment tax.

Break-Even Point:

S-Corp generally makes financial sense when annual profit exceeds $60,000-$80,000 (enough to justify the $2,000-$5,000 annual compliance costs).

Scenario 3: Mixed Portfolio (Rentals + Property Management)

The Optimal Strategy: Multiple Entity Structure

Many successful real estate entrepreneurs run BOTH rental properties AND active businesses (property management, flipping, wholesaling). The optimal setup:

Entity #1: Single-Member LLC

- Owns all rental properties

- Taxed as pass-through (Schedule E)

- No self-employment tax on rental income

- Annual cost: $100-$800 -Simple tax filing

Entity #2: LLC Taxed as S-Corporation

- Operates property management company

- Receives management fees (active income)

- S-Corp election saves on self-employment tax

- Annual cost: $2,000-$5,000

- Requires payroll and quarterly filings

Why Separate Entities:

- Tax Efficiency: Keep rental income simple (no S-Corp complexity); save on SE tax for active business

- Liability Protection: Isolate rental properties from active business lawsuits

- Clean Books: Separate passive and active income streams

- Financing: Lenders prefer clean rental property LLCs without active business commingling

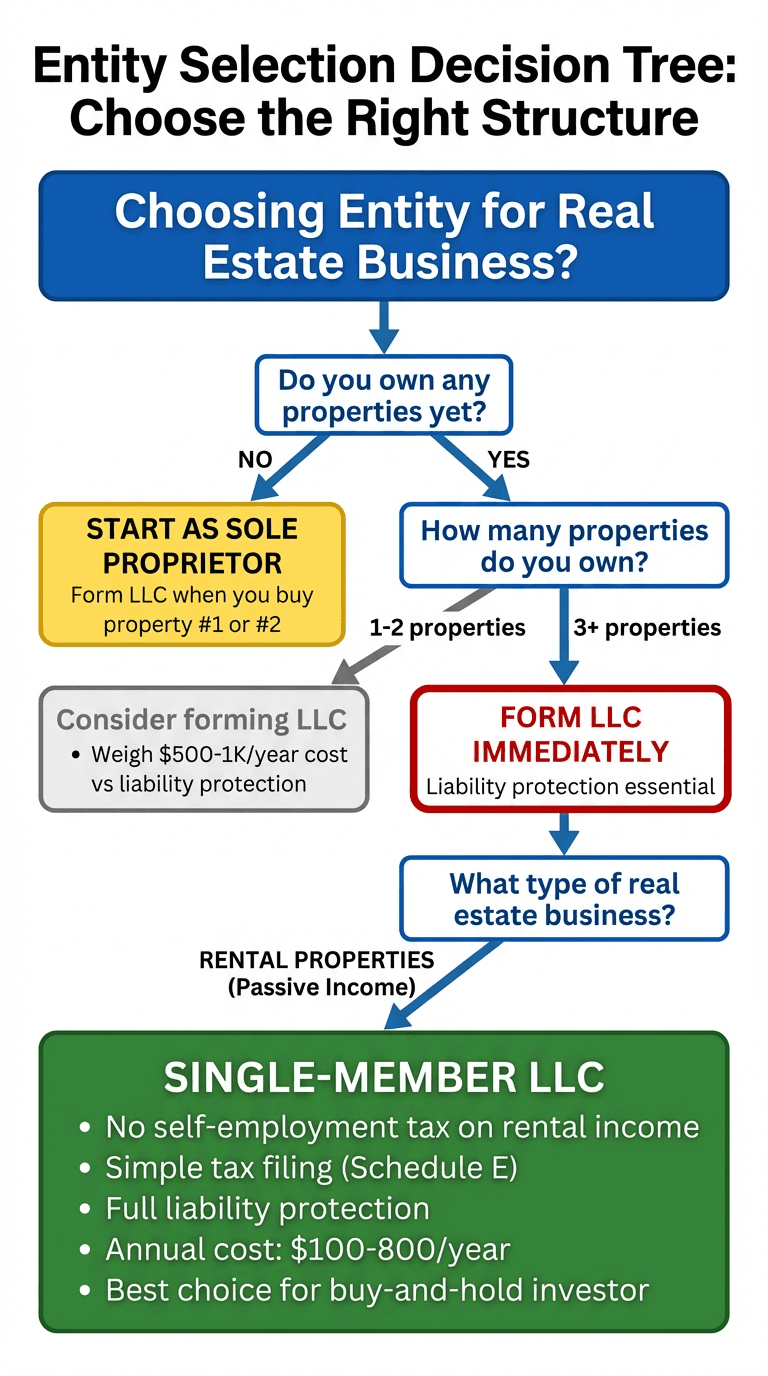

Decision Tree: Which Entity Structure Is Right for You?

Follow This Step-by-Step Decision Framework:

Step 1: Do you own any rental properties yet?

- NO → Stay as sole proprietor for now. Form LLC when you buy property #1 or #2.

- YES → Continue to Step 2

Step 2: How many properties do you own?

- 1-2 properties → Consider forming LLC (weigh $500-1K/year cost vs liability protection)

- 3+ properties → Form LLC immediately. Liability protection is essential.

Step 3: What type of real estate business are you running?

Option A: Rental Properties Only (Passive Income) → RECOMMENDATION: Single-Member LLC

- No self-employment tax on rental income

- Simple tax filing (Schedule E)

- Full liability protection

- Annual cost: $100-$800

- ✅ Best choice for 95% of rental property investors

Option B: Active Real Estate Business (Property Management, Flipping, Wholesaling) → Is annual profit > $60,000?

- NO → Start with LLC, monitor growth

- YES → RECOMMENDATION: LLC Taxed as S-Corp

- Save $5K-$20K/year on self-employment tax

- Requires "reasonable salary" + payroll

- More complex (CPA needed)

- Annual cost: $2,000-$5,000

- Tax savings justifies complexity

Option C: Mixed (Rentals + Active Business) → RECOMMENDATION: Multiple Entity Strategy

- LLC #1: Holds rental properties (pass-through taxation)

- LLC #2 (S-Corp election): Runs property management company

- Maximum tax efficiency + liability protection

- Cleanly separates passive and active income

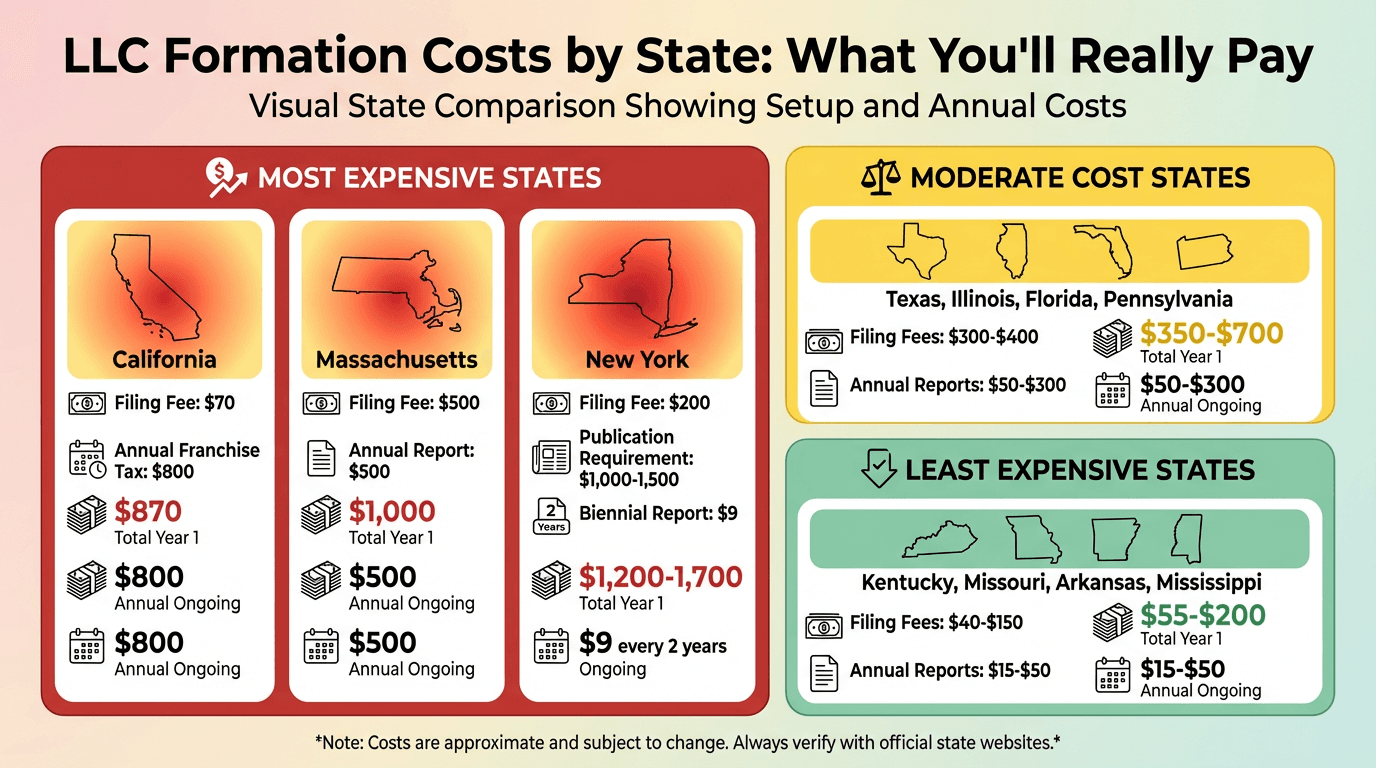

State-by-State Formation Costs

Most Expensive States for LLCs

California:

- Filing Fee: $70

- Annual Franchise Tax: $800 (even with $0 income!)

- Total Year 1: $870

- Annual Ongoing: $800

- 10-Year Cost: $8,070

Massachusetts:

- Filing Fee: $500

- Annual Report: $500

- Total Year 1: $1,000

- Annual Ongoing: $500

- 10-Year Cost: $5,500

New York:

- Filing Fee: $200

- Publication Requirement: $1,000-$1,500 (must publish notice in 2 newspapers)

- Biennial Report: $9

- Total Year 1: $1,200-$1,700

- Ongoing: $9 every 2 years

- 10-Year Cost: $1,245-$1,745

Moderate Cost States

Texas:

- Filing Fee: $300

- Annual Franchise Tax: $0 (no state income tax)

- Biennial Report: $0

- Total Year 1: $300

- Annual Ongoing: $0

- 10-Year Cost: $300 🎉

Florida:

- Filing Fee: $125

- Annual Report: $138.75

- Total Year 1: $263.75

- Annual Ongoing: $138.75

- 10-Year Cost: $1,513

Illinois:

- Filing Fee: $150

- Annual Report: $75

- Total Year 1: $225

- Annual Ongoing: $75

- 10-Year Cost: $900

Pennsylvania:

- Filing Fee: $125

- Annual Report: $7

- Total Year 1: $132

- Annual Ongoing: $7

- 10-Year Cost: $195

Least Expensive States

Kentucky:

- Filing Fee: $40

- Annual Report: $15

- Total Year 1: $55

- Annual Ongoing: $15

- 10-Year Cost: $175 🌟

Missouri:

- Filing Fee: $50

- Annual Report: $0

- Total Year 1: $50

- Annual Ongoing: $0

- 10-Year Cost: $50 🌟

Mississippi:

- Filing Fee: $50

- Annual Report: $25

- Total Year 1: $75

- Annual Ongoing: $25

- 10-Year Cost: $275

Arkansas:

- Filing Fee: $50

- Annual Franchise Tax: $150

- Total Year 1: $200

- Annual Ongoing: $150

- 10-Year Cost: $1,550

Additional Costs to Consider (All States)

Registered Agent:

- Cost: $100-$300/year

- Required: Yes (every state requires a registered agent)

- DIY Option: You can be your own agent (save $100-300/year)

Operating Agreement:

- Cost: $0-$500

- DIY: Use free templates online

- Attorney: $300-$500 for custom agreement

- Required: Not legally required in most states, but highly recommended

EIN (Employer Identification Number):

- Cost: FREE from IRS

- Required: Yes for multi-member LLCs; optional for single-member

- Time: 5 minutes online at irs.gov

Business Licenses:

- Cost: $50-$400 (varies by city/county)

- Required: Depends on location and business type

CPA/Attorney Setup Assistance:

- Cost: $500-$2,000

- Value: Professional guidance on structure, operating agreement, tax strategy

- Worth It?: Often yes, especially for complex situations or multiple properties

Total Year 1 Cost Ranges:

- DIY in Cheap State: $500-$800

- DIY in Expensive State: $1,200-$2,500

- Full Service (Attorney + CPA): $2,000-$5,000

Ongoing Annual Cost Ranges:

- Cheap State: $100-$300

- Moderate State: $300-$600

- Expensive State: $800-$1,500

Step-by-Step Setup Guide

How to Form an LLC (The Right Way)

Step 1: Choose Your State

Most investors form LLCs in the state where their properties are located. However, you might consider:

Form in Property State (Recommended for Most):

- ✅ Avoids "foreign LLC" registration fees

- ✅ Simpler compliance

- ✅ Local courts if disputes arise

- ✅ Lenders often prefer this

Form in Delaware/Wyoming (For Advanced Investors):

- ✅ Strong legal protections

- ✅ No state franchise taxes

- ✅ Privacy benefits

- ❌ Must register as "foreign LLC" in property states (extra fees)

- ❌ More complex

- ❌ Some lenders don't like out-of-state LLCs

Bottom Line: Unless you have a specific reason (multiple states, privacy concerns), form in your property state.

Step 2: Choose Your LLC Name

Naming Requirements:

- Must include "LLC" or "Limited Liability Company"

- Must be unique in your state

- Cannot imply government affiliation

- Cannot use restricted words without licenses (Bank, Insurance, etc.)

Check Name Availability:

- Search your state's Secretary of State website

- Reserve name if available ($10-$50 in most states)

Pro Tips:

- Use a generic name: "Smith Real Estate Holdings LLC" (not "123 Main Street LLC")

- Allows you to add properties without forming new LLCs

- Protects privacy (tenants can't easily identify owner)

Step 3: File Articles of Organization

Where to File:

- Your state's Secretary of State office

- Most states allow online filing

What You'll Need:

- LLC Name

- Registered Agent Name & Address

- Management Structure (member-managed or manager-managed)

- Effective Date

Filing Timeline:

- Online: Usually 3-10 business days

- Mail: 2-6 weeks

- Expedited: Same day to 3 days (extra $50-$200)

Cost: $50-$500 depending on state

Step 4: Create an Operating Agreement

What It Is: A legal document defining how your LLC will operate—ownership percentages, profit distribution, decision-making authority, what happens if a member wants to exit, etc.

Required?

- Only required by law in: California, Delaware, Maine, Missouri, New York

- But you should create one anyway (protects LLC status and prevents disputes)

DIY Options:

- Northwest Registered Agent: Free template with registered agent service

- Rocket Lawyer: $39.99 template

- LegalZoom: $99+ with attorney review

Attorney-Drafted:

- Cost: $300-$1,000

- Worth It: For multi-member LLCs or complex situations

Key Sections to Include:

- Ownership percentages

- Capital contributions

- Profit and loss allocation

- Management structure

- Voting rights and decision-making

- Member meetings requirements

- Adding/removing members

- Dissolution procedures

Step 5: Get an EIN (Employer Identification Number)

What It Is: Like a Social Security number for your business. Required for opening business bank accounts, hiring employees, and filing certain tax forms.

How to Get One:

- Apply free at IRS.gov (5 minutes, instant approval)

- Or file Form SS-4 by mail/fax

Do You Need One?

- Multi-Member LLC: YES (required)

- Single-Member LLC: Optional (can use your SSN)

- But recommended: Protects your SSN, looks more professional

Cost: FREE

Step 6: Open a Business Bank Account

Why It's Critical:

- Maintain "Corporate Veil": Mixing personal and business funds can pierce liability protection

- Clean Books: Simplifies bookkeeping and tax preparation

- Professional: Shows tenants and vendors you're a serious business

What You'll Need:

- Articles of Organization (filed with state)

- EIN Letter

- Operating Agreement

- ID (driver's license)

Best Banks for Rental Property LLCs:

- Mercury: Free, excellent for startups, easy online setup

- Bluevine: No fees, high-yield checking

- Chase Business Complete: $15/month (can waive with minimum balance)

- Bank of America Business Advantage: Good for SBA loans

Step 7: File Annual Reports (Ongoing Compliance)

What It Is: Most states require LLCs to file an annual (or biennial) report confirming business information—registered agent, address, members, etc.

When Due:

- Varies by state (often anniversary of formation or end of fiscal year)

- IMPORTANT: Missing the deadline can result in:

- Late fees ($50-$500)

- LLC dissolution (losing liability protection)

- Reinstatement costs ($100-$500+)

How to Stay Compliant:

- Set calendar reminders

- Use registered agent service (many send reminders)

- Consider LLC management software (Harbor Compliance, CorpNet)

Cost: $0-$800/year depending on state

How to Elect S-Corporation Status

Step 1: Form an LLC First

You cannot "form" an S-Corporation—you elect S-Corp tax treatment for an existing LLC or corporation.

Step 2: File Form 2553 with the IRS

Form: Election by a Small Business Corporation (Form 2553)

Deadline:

- Within 2 months and 15 days of the start of the tax year you want S-Corp treatment

- Or anytime during the preceding tax year

- Miss the deadline? Have to wait until next year

How to File:

- Mail to IRS (address depends on your state)

- Or fax (some states allow)

- Confirm receipt (IRS will send confirmation letter)

Cost: FREE

Step 3: Set Up Payroll

Why Required: S-Corps must pay owners a "reasonable salary" for work performed. The IRS scrutinizes this closely.

What's "Reasonable Salary"?

- Industry standards for similar work

- Your qualifications and time spent

- Safe Range: 30-50% of net profit

- IRS Will Challenge: $30K salary on $200K profit (too low)

Example:

- Net Profit: $150,000

- Reasonable Salary: $60,000 (40%)

- Distributions: $90,000

- Self-Employment Tax Savings: ~$13,770

Payroll Options:

- DIY: QuickBooks Payroll ($45-$125/month)

- Gusto: $40/month + $6/person (recommended)

- ADP: $100-$150/month

- CPA Handles: Usually included in S-Corp package ($200-300/month)

Step 4: File Quarterly Payroll Taxes

Required Forms:

- Form 941: Quarterly federal payroll tax return

- State Quarterly Returns: Varies by state

- Annual Form W-2: For yourself and any employees

- Annual Form 940: Federal unemployment tax

Due Dates:

- Q1 (Jan-Mar): April 30

- Q2 (Apr-Jun): July 31

- Q3 (Jul-Sep): October 31

- Q4 (Oct-Dec): January 31

Penalties for Missing Payroll Tax Deadlines:

- 2% penalty: 1-5 days late

- 5% penalty: 6-15 days late

- 10% penalty: 16+ days late

- Plus interest

Bottom Line: Payroll compliance is complex. Most S-Corp owners use Gusto or hire a CPA.

Step 5: Ongoing S-Corp Compliance

Required:

- Quarterly payroll tax filings (Form 941)

- Annual W-2s and W-3 (by January 31)

- Annual Form 1120-S (S-Corp tax return)

- Reasonable salary documentation

- Meeting minutes (if required by state)

Annual Cost:

- Payroll Software: $500-$1,500/year

- CPA Preparation of Form 1120-S: $800-$2,000

- State Filings: $0-$800/year

- Total: $2,000-$5,000/year

Is It Worth It?

- If S-Corp saves $10K+/year in taxes: YES

- If S-Corp saves $3K/year in taxes: MAYBE (barely breaks even)

- If rental properties only: NO (no tax benefit)

Common Mistakes to Avoid

1. [object Object]

The Mistake: Waiting until you have "enough properties" to justify LLC costs.

The Risk: One lawsuit or major liability event can wipe out years of wealth. LLC formation costs ($500-1K) are trivial compared to potential losses ($100K-$1M+).

The Fix: Form LLC when you purchase property #1 or #2. It's cheap insurance.

2. [object Object]

The Mistake: Assuming S-Corp always saves taxes and electing S-Corp status for rental income.

The Reality: Rental income is already exempt from self-employment tax. S-Corp election adds $2K-$5K/year in compliance costs with ZERO tax benefit.

The Fix:

- Rental Properties: Stay as LLC (default taxation)

- Active Business: Consider S-Corp if profit > $60K

3. [object Object]

The Mistake: Using LLC bank account for personal expenses or paying business expenses from personal account.

The Risk: "Piercing the corporate veil"—courts can disregard your LLC and hold you personally liable if you don't treat it as a separate entity.

The Fix:

- Maintain separate bank accounts

- Pay yourself distributions (from LLC to personal), then pay personal expenses

- Never commingle funds

4. [object Object]

The Mistake: Missing annual report deadlines or failing to update registered agent.

The Result:

- LLC automatically dissolved

- Loss of liability protection

- Reinstatement fees ($100-$500)

- Potential personal liability during dissolution period

The Fix:

- Set calendar reminders for annual filings

- Use registered agent service with compliance alerts

- Keep registered agent current

5. [object Object]

The Mistake: Forming LLC in Delaware or Wyoming for "asset protection" without understanding implications.

The Reality:

- Must still register as "foreign LLC" in property states (extra $200-800)

- More complex compliance

- Some lenders won't finance properties owned by out-of-state LLCs

- Asset protection is similar in most states

The Fix: Form LLC in the state where your properties are located (unless you have specific advanced needs).

6. [object Object]

The Mistake: Skipping the operating agreement to save money.

The Risk:

- State default rules govern your LLC (may not match your intentions)

- Disputes between members

- Difficulty raising capital or adding partners

- Courts may question LLC validity

The Fix: Create an operating agreement even for single-member LLCs. Use free templates if needed, but have one.

7. [object Object]

The Mistake: S-Corp owner takes $10K salary on $200K profit to minimize payroll taxes.

The IRS Response: Audit, reclassify distributions as salary, assess back payroll taxes + penalties + interest.

The Fix: Pay yourself a reasonable salary (30-50% of profit). Document why your salary is reasonable (industry data, comparable roles).

Action Plan: What to Do Right Now

If You Own 0 Properties (Just Starting):

✅ Stay as sole proprietor for now

- No need to form LLC until you own property

- Save LLC formation costs

✅ Plan ahead:

- Research your state's LLC formation process

- Budget $500-1,000 for LLC formation

- Find a good real estate CPA

✅ Form LLC when:

- You're under contract on property #1

- Or after closing on property #1

If You Own 1-3 Rental Properties:

✅ Form Single-Member LLC immediately (if you haven't)

- Cost: $500-1,000 Year 1

- Protection: Priceless

- Tax Treatment: Same as now (pass-through, Schedule E)

✅ Transfer properties to LLC:

- Quitclaim deed (DIY or attorney)

- Notify lender (some require consent)

- Update insurance (landlord policy in LLC name)

- Update leases for new properties

✅ Do NOT elect S-Corp status

- No tax benefit for rental income

- Adds $2K-5K/year in costs

- Unnecessary complexity

If You Own 4+ Rental Properties:

✅ Verify LLC is properly formed and maintained

- Annual reports filed on time?

- Registered agent current?

- Operating agreement in place?

- Separate bank account?

✅ Consider one LLC per 3-5 properties (liability compartmentalization)

- Limits exposure if one property is sued

- Trade-off: More annual fees

✅ Still no S-Corp for rentals

- Rental income = no SE tax = no S-Corp benefit

If You Run an Active Real Estate Business (Flipping, PM, Wholesaling):

✅ Form LLC immediately

✅ Calculate if S-Corp makes sense:

- Is annual profit > $60,000? → Consider S-Corp

- Will tax savings ($5K-20K/year) exceed compliance costs ($2-5K/year)? → Elect S-Corp

- Can you handle payroll complexity? → If no, hire CPA

✅ File Form 2553 by deadline (2.5 months into tax year)

✅ Set up payroll (Gusto recommended)

✅ Pay yourself reasonable salary (30-50% of profit)

If You Have Both Rentals and Active Business:

✅ Form two LLCs:

- LLC #1: Rental properties (default taxation)

- LLC #2: Active business (S-Corp election)

✅ Separate everything:

- Separate bank accounts

- Separate bookkeeping

- Separate tax returns

- Clear division between passive and active income

✅ Management fees:

- LLC #2 (property management company) charges LLC #1 (rental LLC) management fees

- Deductible expense for LLC #1

- Active income for LLC #2 (subject to SE tax, hence S-Corp saves money)

Frequently Asked Questions

Q: Can I have multiple rental properties in one LLC?

A: Yes, and this is common for smaller portfolios (1-10 properties). However, consider:

- Pro: Lower costs (one annual report vs multiple)

- Con: If one property is sued, ALL properties in that LLC are at risk

Advanced Strategy: Create separate LLCs for every 3-5 properties to limit liability exposure.

Q: Should I form an LLC in Delaware or Wyoming for "better asset protection"?

A: Probably not. Here's why:

- Most states now have strong LLC laws similar to Delaware

- You still must register as "foreign LLC" in property states (extra $200-800 per state)

- Some lenders won't finance out-of-state LLC-owned properties

- More complex compliance

Exception: If you own properties in many states, a Delaware or Wyoming "holding LLC" owning individual state LLCs might make sense. Consult a CPA/attorney.

Q: Will my mortgage have a "due on sale" clause if I transfer property to LLC?

A: Most residential mortgages have a due-on-sale clause allowing the lender to demand full payment if you transfer the property. However:

- Reality: Lenders rarely enforce this if you're current on payments

- Best Practice: Notify lender and request consent (many will approve)

- Workaround: Some investors transfer property to LLC after closing, then update insurance

Important: Commercial loans typically require the LLC to be the borrower from the start.

Q: How much does it cost to maintain an LLC per year?

A: Varies significantly by state:

- Cheap states: $100-300/year (Missouri, Kentucky, Pennsylvania)

- Moderate states: $300-600/year (Texas, Florida, Illinois)

- Expensive states: $800-1,500/year (California, Massachusetts)

Additional Costs:

- Registered Agent: $100-300/year (optional if you serve as your own)

- CPA: $300-1,000/year for tax preparation

- Business bank account: $0-180/year

Q: Can I convert my sole proprietorship to an LLC?

A: Yes, but technically you don't "convert"—you:

- Form a new LLC

- Transfer assets (properties) to the LLC

- Update contracts, leases, insurance

Most investors form LLC, then transfer properties via quitclaim deed.

Q: Do I need a lawyer to form an LLC?

A: Not required, but depends on complexity:

DIY (Online Filings):

- Cost: $100-500

- Time: 1-2 hours

- Best For: Single-member LLC, simple situation

- Resources: Your state's Secretary of State website

LLC Formation Services:

- Northwest Registered Agent: $39 + state fees (highly recommended)

- Incfile: $0 + state fees (upsells)

- LegalZoom: $79-399 + state fees

- Includes registered agent service (first year free typically)

Attorney:

- Cost: $500-2,000

- Best For: Multi-member LLCs, complex operating agreements, multiple properties

- Value: Customized operating agreement, personalized advice

Q: Can I form an LLC if I have bad credit or past bankruptcies?

A: Yes. LLC formation does not require a credit check. Your personal credit history doesn't affect your ability to form an LLC.

However: Bad credit may affect:

- Ability to get business bank account (some banks may decline)

- Ability to get financing (lenders will still check personal credit for real estate loans)

Q: Can my LLC own properties in multiple states?

A: Yes, but you'll need to register as a "foreign LLC" in each state where you own property.

Example:

- Form LLC in Missouri ($50)

- Own properties in Missouri, Kansas, and Arkansas

- Register as foreign LLC in Kansas ($160) and Arkansas ($300)

- File annual reports in all 3 states

- Total annual cost: $510

Alternative: Some investors form a separate LLC in each state (simpler compliance, but more entities to manage).

Conclusion: Which Entity Structure Should You Choose?

The answer depends on your specific situation:

✅ [object Object]

- You own zero properties and are just learning

- You plan to form LLC very soon

- You're testing real estate investing with minimal risk

But move to LLC quickly (within 1-2 properties).

✅ [object Object]

- You own 1+ rental properties

- You're a buy-and-hold investor

- You want liability protection with simple taxes

- You're building a rental property portfolio

This is the right choice for 90%+ of rental property investors.

✅ [object Object]

- You run an active real estate business (property management, flipping, wholesaling)

- Annual profit > $60,000

- You can handle payroll complexity (or hire CPA)

- Tax savings ($5K-20K/year) exceed compliance costs

Do NOT elect S-Corp for rental properties (no tax benefit).

✅ [object Object]

- You own rentals AND run active business

- You want maximum tax efficiency

- You can manage multiple entities

- LLC #1: Rentals (pass-through)

- LLC #2: Active business (S-Corp)

Next Steps

-

Talk to a CPA: Every investor's situation is unique. A good real estate CPA can model tax scenarios and recommend the optimal structure.

-

Talk to a Real Estate Attorney: Especially important for multi-member LLCs, complex ownership structures, or high-value portfolios.

-

Form Your LLC: Don't wait. The sooner you form your LLC, the sooner you're protected.

-

Maintain Compliance: Set up systems to never miss annual reports or tax deadlines.

-

Review Annually: Your optimal structure may change as your portfolio grows. Review with CPA annually.

Ready to form your LLC?

Use our Property Entity Structure Calculator to estimate costs and determine the best structure for your portfolio.

Have questions?

Join our Real Estate Investor Community to get personalized advice from experienced investors and professionals.

Related Content

📝 Cash vs Leverage in Real Estate: 2026 Investment Guide

Read more about this topic

📝 1031 Exchange Calculator: Complete Tax-Deferred Real Estate Guide

Read more about this topic

📝 DIY vs Professional Property Management: 2026 Guide

Read more about this topic

🔧 ROI Calculator

Calculate return on investment

🔧 Property Investment Analyzer

Comprehensive property analysis tool

🔧 BRRRR Calculator

Analyze buy-rehab-rent-refinance deals