Cash vs Leverage in Real Estate: 2026 Investment Guide

Cash Purchase vs Leverage: The Ultimate Real Estate Investment Strategy Guide

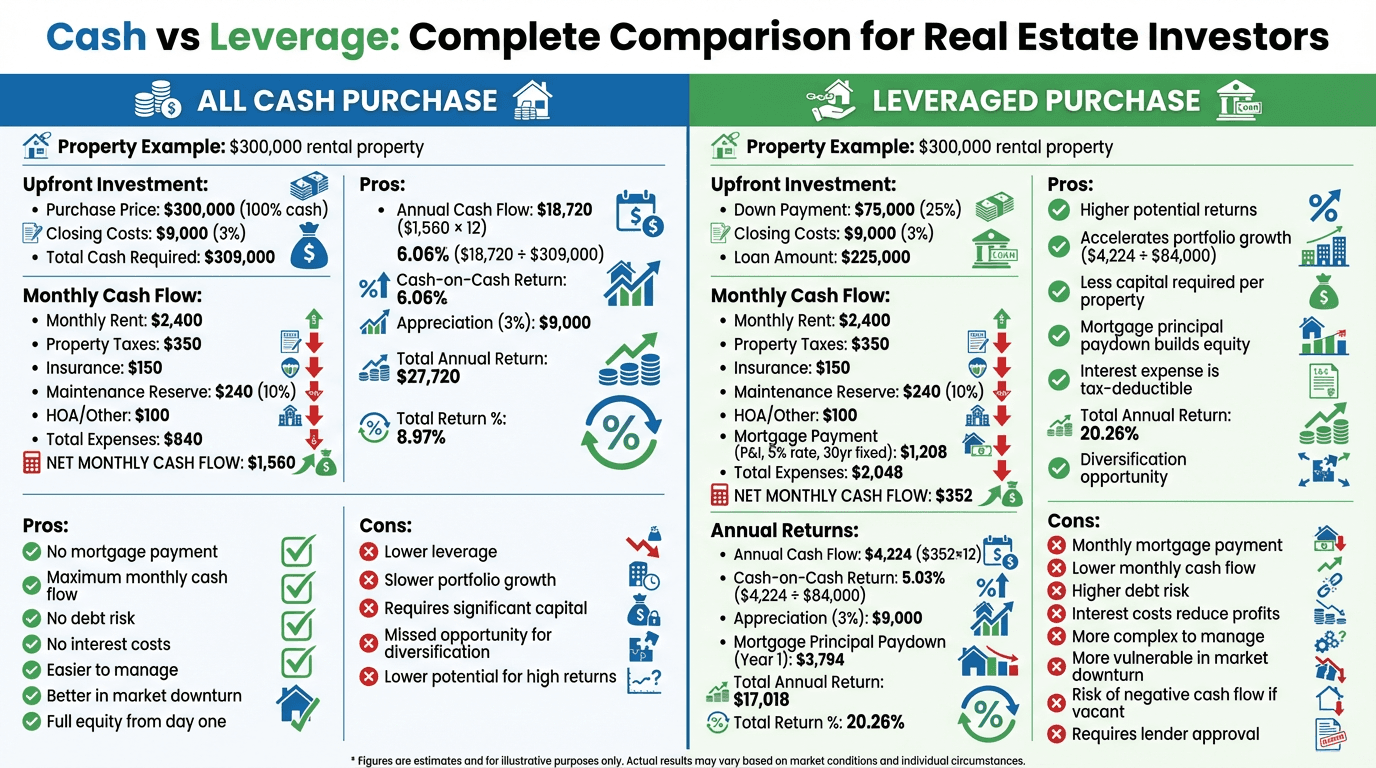

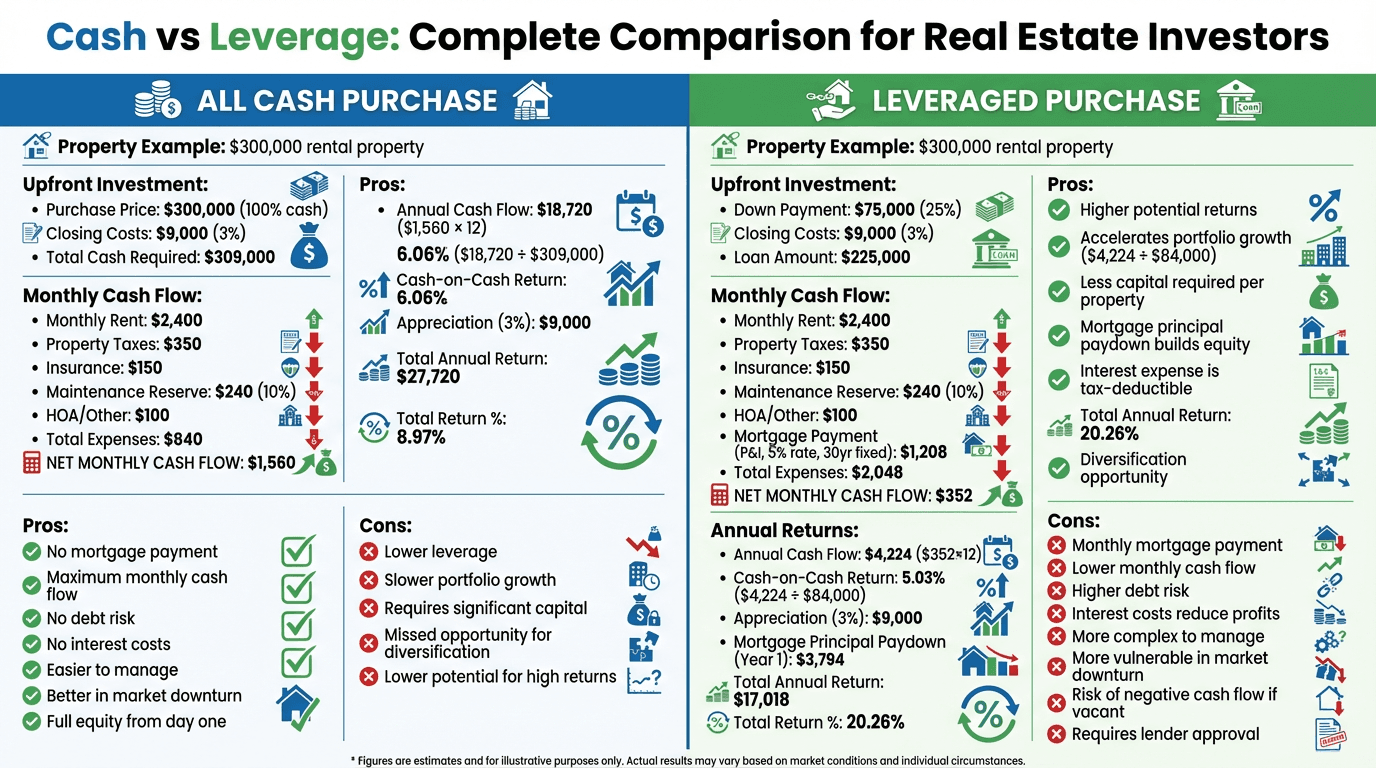

The cash vs leverage debate is the most fundamental decision in real estate investing. Buy one property for $300,000 cash with $1,560/month cash flow—or use that same $300,000 to buy three leveraged properties with $180/month total cash flow but 3× the appreciation potential?

The stakes are massive: Choose cash and you maximize immediate income and safety. Choose leverage and you potentially build 2-3× more wealth over 10-20 years—but accept significantly higher risk and stress during market downturns.

This comprehensive guide analyzes every dimension of the cash vs leverage decision: mathematical returns, risk profiles, market cycle considerations, tax implications, psychological factors, and real-world case studies from investors who've succeeded (and failed) with each approach.

The Core Trade-Off: Income vs Growth

Cash Purchase: The Income Maximizer

Property Example: $300,000 Rental

Upfront Investment:

- Purchase price: $300,000 (100% cash)

- Closing costs: $9,000 (3%)

- Total cash required: $309,000

Monthly Cash Flow:

- Rent: $2,400

- Property taxes: $350

- Insurance: $150

- Maintenance reserve: $240 (10% of rent)

- HOA/Other: $100

- Total expenses: $840

- NET MONTHLY CASH FLOW: $1,560

Annual Returns:

- Annual cash flow: $18,720 ($1,560 × 12)

- Cash-on-cash return: 6.06% ($18,720 ÷ $309,000)

- Appreciation (3% annually): $9,000

- Total annual return: $27,720

- Total return percentage: 8.97%

The Cash Advantage:

- Maximum monthly cash flow ($1,560 vs $60 leveraged)

- No mortgage payment eating into cash flow

- No debt risk or foreclosure exposure

- Full equity from day one

- Simpler to manage and stress-free

- Better performance in market downturns

The Cash Disadvantage:

- Lower cash-on-cash return (6.06% vs 15.31% leveraged)

- All capital tied up in one property

- Opportunity cost (could $300K earn more elsewhere?)

- Slower portfolio growth

- Limited diversification

- Miss tax benefits of mortgage interest deduction

Leveraged Purchase: The Wealth Builder

Same Property: $300,000 Rental with 75% LTV Mortgage

Upfront Investment:

- Down payment: $75,000 (25%)

- Closing costs: $12,000 (4%, including loan fees)

- Total cash required: $87,000

Monthly Cash Flow:

- Rent: $2,400

- Mortgage payment (P&I): $1,500 ($225K loan at 7% for 30 years)

- Property taxes: $350

- Insurance: $150

- Maintenance reserve: $240

- HOA/Other: $100

- Total expenses: $2,340

- NET MONTHLY CASH FLOW: $60

Annual Returns:

- Annual cash flow: $720 ($60 × 12)

- Mortgage principal paydown: $3,600 (Year 1 approximate)

- Appreciation (3%): $9,000

- Total annual return: $13,320

- Cash-on-cash return: 15.31% ($13,320 ÷ $87,000)

- Equity multiple: 3.45× ($300K property with $87K invested)

The Leverage Advantage:

- Higher cash-on-cash return (15.31% vs 6.06%)

- Can buy 3-4 properties with same capital ($300K ÷ $87K = 3.4 properties)

- Greater wealth acceleration through appreciation on larger asset base

- Mortgage interest is tax-deductible

- Forced savings through principal paydown (tenant pays down mortgage)

- Inflation works in your favor (fixed-rate debt paid with inflated dollars)

The Leverage Disadvantage:

- Minimal monthly cash flow ($60 vs $1,560 cash purchase)

- Debt obligation and foreclosure risk

- Interest costs ($138K over 30 years on $225K loan)

- More complex to manage

- Vulnerable in market downturns (can go underwater)

- Qualification requirements (credit, income, DTI)

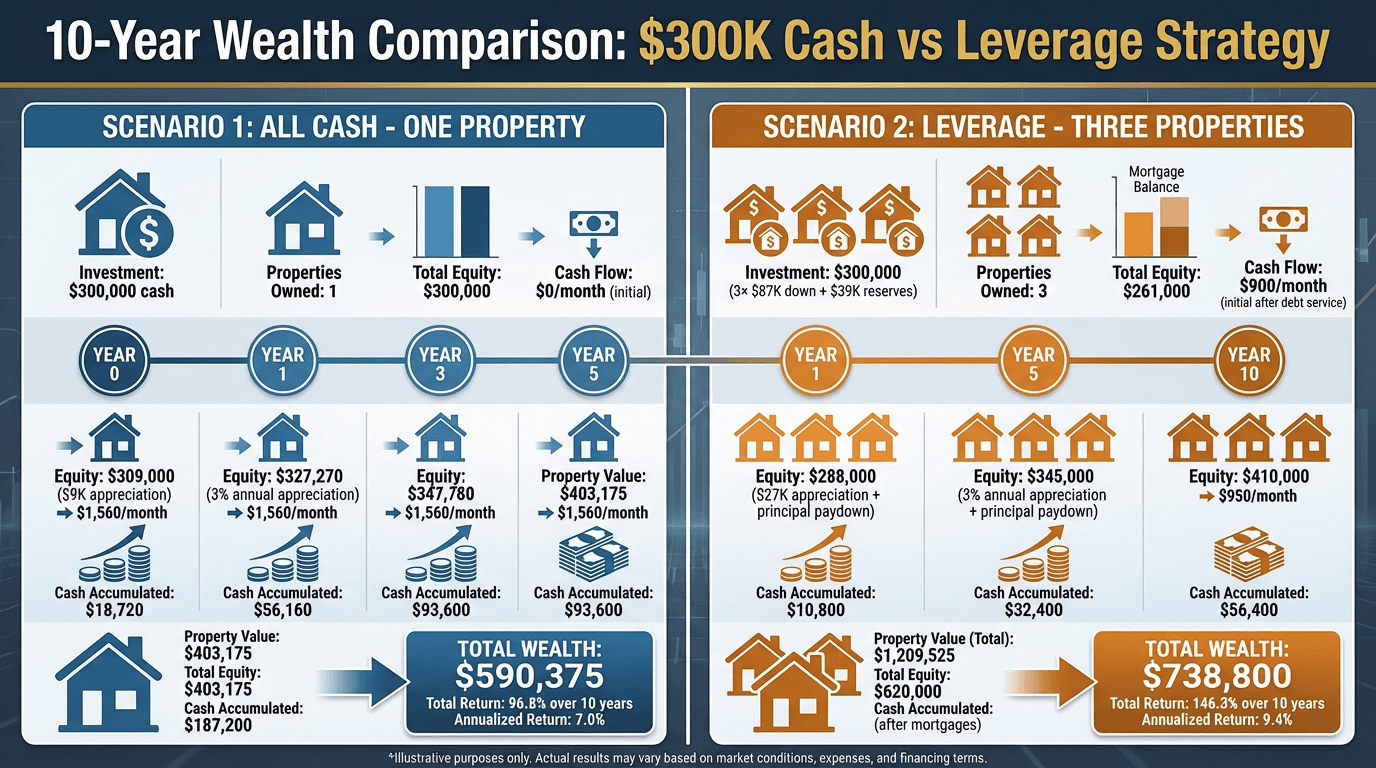

The $300,000 Capital Deployment Comparison

Scenario 1: All Cash Approach

- $300,000 = 1 property purchased outright

- Monthly cash flow: $1,560

- Annual cash flow: $18,720

- Cash-on-cash return: 6.06%

- Properties owned: 1

- Diversification: None

Scenario 2: Maximum Leverage Approach

- $300,000 = 3 properties at $87K down each + $39K reserves

- Monthly cash flow: $180 total ($60 × 3)

- Annual cash flow: $2,160

- Cash-on-cash return: 15.31% per property

- Properties owned: 3

- Diversification: 3 markets/properties

- Appreciation base: $900,000 in property value (3× more than cash)

10-Year Projection:

- Cash: $590,375 total wealth (1 property appreciated + cash flow accumulated)

- Leverage: $683,780 total wealth (3 properties appreciated + cash flow - loan paydown)

- Leverage advantage: $93,405 more wealth (15.8% greater) despite lower monthly cash flow

The math is clear: leverage sacrifices immediate cash flow to maximize long-term wealth accumulation.

The 10-Year Wealth Accumulation Analysis

Year-by-Year Breakdown

CASH PURCHASE - Single $300,000 Property

Year 0: Initial investment

- Property value: $300,000

- Equity: $300,000 (100%)

- Cash reserves: $0

- Total wealth: $300,000

Year 1: First year of ownership

- Property value: $309,000 (3% appreciation)

- Cash flow collected: $18,720

- Total wealth: $327,720

- Return: 9.24%

Year 3: Early accumulation

- Property value: $327,270

- Cash flow accumulated: $56,160

- Total wealth: $383,430

- Return: 27.8% cumulative

Year 5: Mid-term checkpoint

- Property value: $347,780

- Cash flow accumulated: $93,600

- Total wealth: $441,380

- Return: 47.1% cumulative

Year 10: Long-term results

- Property value: $403,175

- Cash flow accumulated: $187,200

- Total wealth: $590,375

- Total return: 96.8% over 10 years

- Annualized return: 7.0%

LEVERAGED PURCHASE - Three $300,000 Properties (75% LTV)

Year 0: Initial investment

- Total property value: $900,000 (3 properties)

- Initial equity: $225,000 (25% of $900K)

- Loans: $675,000

- Cash reserves: $39,000

- Total wealth: $264,000

Year 1: First year with leverage

- Property values: $927,000 (3% appreciation)

- Loan balance: $664,200 (paydown of $10,800)

- Equity: $262,800

- Cash flow collected: $2,160

- Total wealth: $264,960

- Return: 0.36% (low first year due to minimal cash flow)

Year 3: Leverage starting to compound

- Property values: $981,810

- Loan balance: $640,980

- Equity: $340,830

- Cash flow accumulated: $6,480

- Total wealth: $347,310

- Return: 16.1% cumulative

Year 5: Compounding accelerates

- Property values: $1,043,640

- Loan balance: $615,420

- Equity: $428,220

- Cash flow accumulated: $10,800

- Total wealth: $439,020

- Return: 62.1% cumulative

Year 10: Long-term leverage advantage emerges

- Property values: $1,209,530

- Loan balance: $547,350

- Equity: $662,180

- Cash flow accumulated: $21,600

- Total wealth: $683,780

- Total return: 127.9% over 10 years

- Annualized return: 8.6%

The Crossover Point: Years 4-5

In the first 3-4 years, cash purchase builds wealth faster due to:

- Higher monthly cash flow ($1,560 vs $180)

- No interest costs eating returns

- Lower risk during accumulation phase

Starting in years 4-5, leverage pulls ahead because:

- Appreciation compounds on 3× the asset base ($900K vs $300K)

- Mortgage principal paydown accelerates

- Rent increases boost cash flow

- Tax benefits accumulate

By year 10, the leveraged approach has built $93,405 more wealth (15.8% advantage) despite collecting $165,600 less cash flow over the decade.

The 15-Year and 20-Year Projections

Year 15 Estimated:

- Cash: ~$778,000 total wealth

- Leverage: ~$968,000 total wealth

- Leverage advantage: ~$190,000 (24% more wealth)

Year 20 Estimated:

- Cash: ~$1,025,000 total wealth

- Leverage: ~$1,420,000 total wealth

- Leverage advantage: ~$395,000 (38% more wealth)

The longer the timeline, the greater the leverage advantage becomes as appreciation compounds on the larger asset base and mortgages are paid down.

When Cash Catches Up to Leverage

If you reinvest the higher cash flow from cash purchases:

Cash + Reinvestment Strategy:

- Years 1-10: Collect $187,200 cash flow (vs $21,600 leverage)

- Extra cash flow: $165,600 over 10 years

- Invested at 8% annually in index funds: ~$245,000 by year 10

- Total wealth: $403,175 property + $245,000 investments = $648,175

Result: Cash + disciplined reinvestment closes the gap significantly, achieving ~95% of leverage wealth but with lower stress and risk.

The key insight: Leverage wins if you compare passive strategies, but cash + active reinvestment can match leverage returns with less risk.

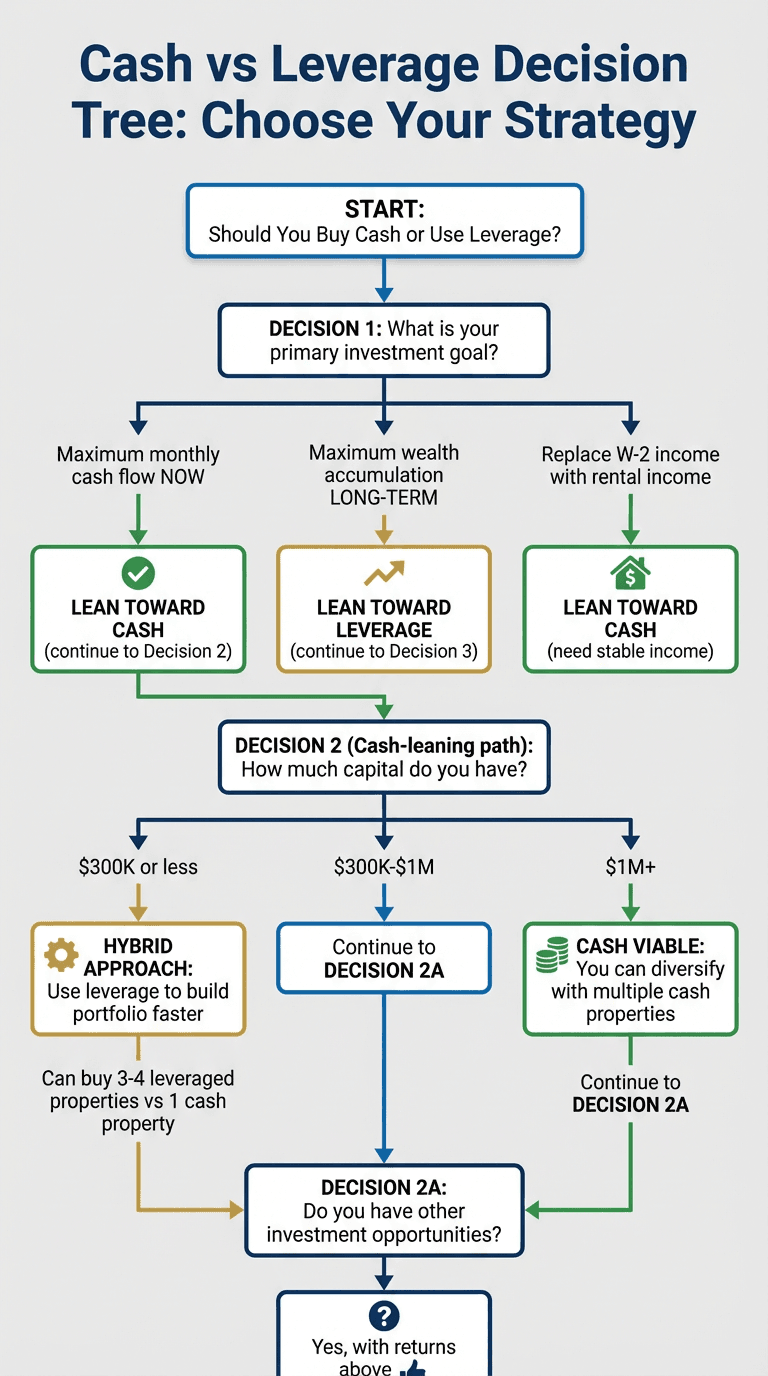

Decision Framework: Which Strategy Is Right for You?

Question 1: What Is Your Primary Investment Goal?

Goal: Maximum Monthly Cash Flow NOW → LEAN TOWARD CASH

If you need income today—whether to replace W-2 salary, fund retirement, or cover living expenses—cash purchases deliver 26× more monthly cash flow ($1,560 vs $60 per property).

Best for:

- Early retirees needing income

- Investors transitioning from W-2 to full-time real estate

- Conservative investors prioritizing stability

- Those who value simplicity and sleep-at-night peace

Goal: Maximum Wealth Accumulation LONG-TERM → LEAN TOWARD LEVERAGE

If your timeline is 10-20+ years and you don't need immediate income, leverage builds significantly more wealth through appreciation on a larger asset base.

Best for:

- Young investors with long timelines (20-40 years to retirement)

- High-income earners who don't need rental income

- Growth-focused investors willing to accept risk

- Those comfortable managing debt and complexity

Goal: Replace W-2 Income Within 5-10 Years → HYBRID APPROACH

Start with leverage to build portfolio quickly, then transition to cash purchases or debt payoff as you approach your income goal.

Strategy:

- Years 1-5: Use leverage to acquire 10-15 properties

- Years 6-10: Pay down mortgages aggressively or buy additional cash-flowing properties

- Year 10+: Portfolio generates sufficient income to replace W-2

Question 2: How Much Capital Do You Have?

Under $100,000 Available → LEVERAGE REQUIRED

With limited capital, leverage is your only path to meaningful portfolio growth.

- $75,000 cash = 0 cash properties OR 1 leveraged property

- $100,000 cash = 0 cash properties OR 1-2 leveraged properties

Reality: You need leverage to get started unless you're willing to house hack or start with very low-priced properties.

$100,000 - $300,000 Available → LEVERAGE RECOMMENDED, CASH POSSIBLE

You can buy 1 cash property OR 2-4 leveraged properties with this capital.

Math:

- $200,000 cash = 1 property cash (limited growth) OR 2-3 leveraged properties (faster scaling)

- Leverage advantage is clear at this capital level

$300,000 - $1,000,000 Available → STRATEGIC CHOICE POINT

This is where the decision becomes strategic rather than forced.

Cash makes sense if:

- You prioritize income over growth

- You're risk-averse

- You're nearing retirement

- You have other high-return investments

Leverage makes sense if:

- You're wealth-building focused

- You have 10+ year timeline

- You're comfortable with debt

- You want to build a large portfolio

Over $1,000,000 Available → HYBRID APPROACH OR CASH VIABLE

At this capital level, you can:

- Buy 3-4 cash properties for diversification AND income

- Use 50% cash, 50% leverage for balance

- Leverage everything for maximum growth

- Diversify across real estate and other assets

Sophisticated strategy: Buy cash-flowing properties with cash, use leverage for value-add/appreciation plays.

Question 3: Do You Have Other Investment Opportunities?

Yes, with returns above 10% (stocks, business, other real estate) → USE LEVERAGE

If you can earn 10-15% elsewhere, borrowing at 7% to buy real estate creates arbitrage.

Example:

- Borrow $225K at 7% = $15,750 annual interest cost

- Invest $225K at 12% = $27,000 annual return

- Net benefit: $11,250 annually

- This is financial leverage working in your favor

No, real estate is primary investment → CASH OR LEVERAGE BOTH VIABLE

Without better alternatives, the decision comes down to risk tolerance, timeline, and income needs.

Question 4: How Risk-Tolerant Are You?

Low Risk Tolerance (Sleep at Night Is Priority) → BUY CASH

If debt keeps you up at night or you're uncomfortable with leverage risk, pay cash regardless of lower returns.

Why:

- No foreclosure risk

- No stress about making mortgage payments

- Weather market downturns easily

- Peace of mind is worth sacrificing some returns

Moderate Risk Tolerance → HYBRID APPROACH

Balance risk and reward:

- Use 50-60% LTV (vs 75-80% maximum leverage)

- Buy some properties cash, some with leverage

- Use leverage for strong deals, cash for marginal deals

High Risk Tolerance (Comfortable with Volatility) → MAXIMUM LEVERAGE

If you're comfortable with debt, market cycles, and occasional stress, leverage maximizes returns over time.

Requirements for high-leverage success:

- Deep emergency reserves (6-12 months of negative cash flow coverage)

- Stable W-2 income to weather vacancies

- Emotional discipline to avoid panic selling in downturns

- Understanding that leverage amplifies both gains AND losses

Question 5: What Is Your Investment Timeline?

Short-term (Under 5 Years, Plan to Sell) → LEVERAGE CAUTIOUSLY OR AVOID

Leverage on short timelines is risky:

- Market volatility can leave you underwater

- Closing costs + selling costs eat into gains

- Not enough time for appreciation to compound

- Risk of selling at wrong time

Better approach: If you must use leverage short-term, use lower LTV (50-60%) to reduce risk.

Medium-term (5-10 Years) → LEVERAGE RECOMMENDED

This is the sweet spot for leveraged investing:

- Enough time for appreciation to compound

- Market cycle risk is moderate

- Mortgage paydown creates meaningful equity

- Can refinance or sell strategically

Long-term (10-30+ Years, Hold Forever) → LEVERAGE STRONGLY RECOMMENDED

Long timelines make leverage extremely powerful:

- Decades of appreciation on leveraged base

- Mortgage pays off or gets refinanced at lower balance

- Ride through multiple market cycles

- Inflation reduces real cost of debt over time

Example: $225K mortgage in 2026 feels like $112K mortgage in 2046 (assuming 3% inflation) because wages and rents have doubled.

Question 6: Can You Qualify for Financing?

No (Credit Issues, Income Challenges, Foreign National) → FORCED CASH

If you can't qualify for financing, the decision is made for you.

Action plan:

- Buy cash now

- Fix credit issues for future leverage

- Build income documentation

- Work with credit repair specialist if needed

Yes, Easily Qualified (720+ Credit, Strong Income, Low DTI) → LEVERAGE AVAILABLE

You have the option to use leverage. Decision comes down to other factors (goals, risk tolerance, timeline).

Borderline Qualified (680-720 Credit, Moderate Income) → STRATEGIC LEVERAGE

Use leverage but conservatively:

- Target 60-70% LTV (lower than maximum 80%)

- Build reserves before acquiring more

- Keep DTI low to maintain qualification capacity

- Prove yourself with 1-2 properties before scaling

Question 7: Are You Planning to Acquire More Properties?

Yes, Actively Building Portfolio (1-2+ Properties/Year) → USE LEVERAGE TO PRESERVE CAPITAL

If you're actively acquiring, leverage is essential:

- Preserves capital for next deal

- Allows faster scaling

- Each property stands on its own (isolated risk)

Math: $300K buys 1 cash property OR enables 3-4 leveraged properties over 2 years.

Maybe, 1 Property Every Few Years → LEVERAGE OR CASH BOTH WORK

Slower acquisition pace means less pressure to preserve capital.

No, This Is My Only/Last Property Purchase → CASH VIABLE FOR SIMPLICITY

If you're not scaling, cash offers simplicity and maximum cash flow without the complexity of mortgages.

Question 8: What Is the Current Market Cycle?

Peak / Overheated Market (Prices High, Rents Flat, Cap Rates Compressed) → CASH SAFER

Leverage at market peaks is dangerous:

- Price corrections leave you underwater

- Lower cap rates mean thin cash flow with leverage

- Better to wait or buy conservatively

Strategy: Buy cash if you must buy, or wait for better market conditions.

Normal / Balanced Market (Prices Reasonable, Rents Growing Moderately) → LEVERAGE OR CASH BOTH WORK

In balanced markets, personal factors (goals, risk tolerance, timeline) drive the decision more than market conditions.

Bottom / Recovering Market (Prices Low, Recovery Ahead, Deals Everywhere) → LEVERAGE OPTIMAL

Market bottoms are when leverage shines:

- Buy below intrinsic value

- Capture appreciation on leveraged base

- Strong cash flow even with mortgage

- Maximum upside with acceptable downside

2008-2012 example: Investors who used maximum leverage buying foreclosures in Phoenix, Las Vegas, Florida built 10-20× returns over the next decade.

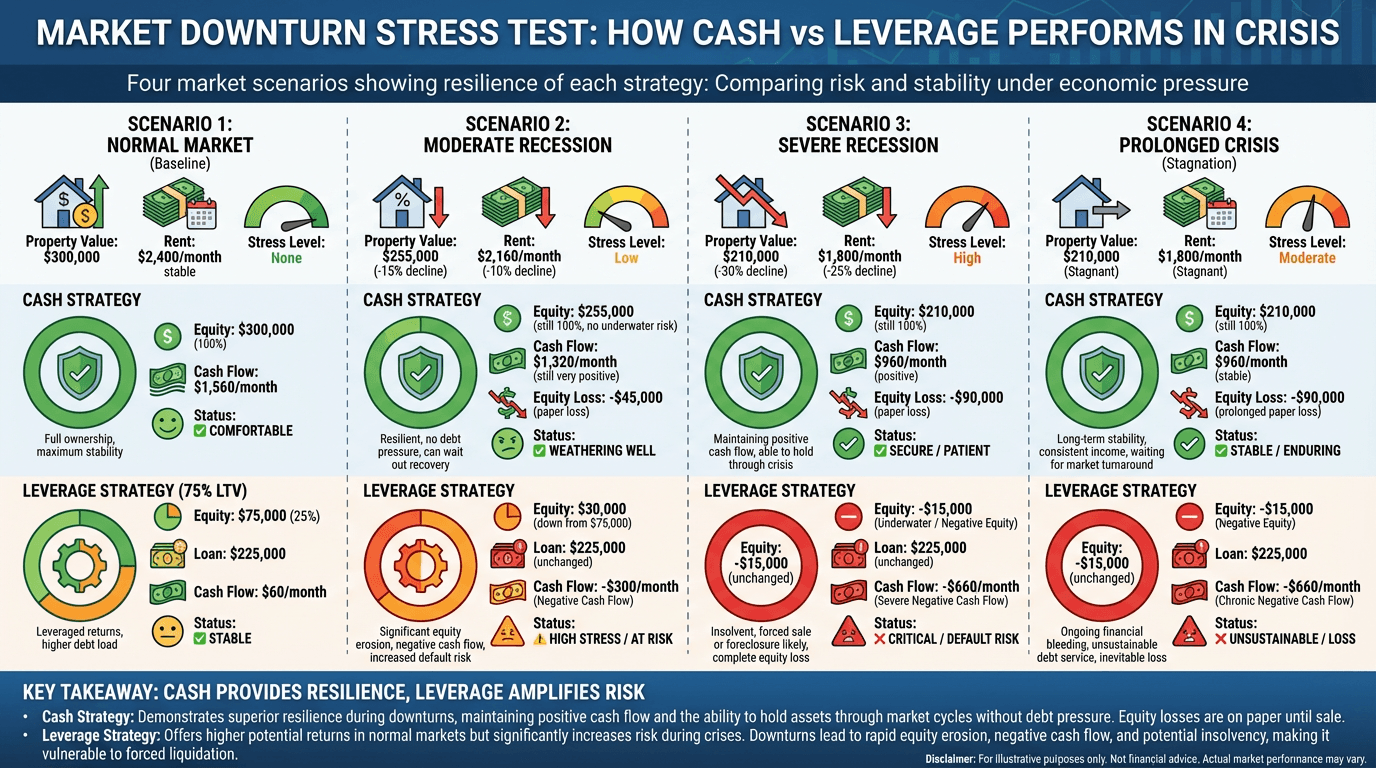

Market Downturn Stress Test: How Each Strategy Performs in Crisis

Scenario 1: Normal Market (Baseline)

Market Conditions:

- Property values: Stable

- Rents: $2,400/month

- Vacancy: 8% annually (normal)

Cash Purchase Performance:

- Equity: $300,000 (100%)

- Monthly cash flow: $1,560

- Status: ✅ COMFORTABLE

- Stress level: None

Leveraged Purchase Performance:

- Equity: $75,000 (25%)

- Loan: $225,000

- Monthly cash flow: $60

- Status: ✅ STABLE

- Stress level: Low

Analysis: Both strategies work well in normal markets. Cash generates significantly more monthly income, but leverage is fine with minimal stress.

Scenario 2: Moderate Recession (2020 COVID-Level)

Market Conditions:

- Property values: -15% decline ($300K → $255K)

- Rents: -10% decline ($2,400 → $2,160)

- Vacancy: 12% annually (elevated)

Cash Purchase Performance:

- Equity: $255,000 (100% of reduced value)

- Monthly cash flow: $1,320 (still very positive!)

- Paper loss: -$45,000 (not realized unless you sell)

- Status: ✅ WEATHERING WELL

- Stress level: Low (no debt pressure, still cash flowing)

- Can comfortably wait out recovery

Leveraged Purchase Performance:

- Equity: $30,000 (down from $75K)

- Loan: $225,000 (unchanged)

- Underwater status: Still have $30K equity, barely

- Monthly cash flow: -$180 (NEGATIVE!)

- Annual deficit: -$2,160 (must cover from reserves)

- Status: ⚠️ STRESSED BUT SURVIVING

- Stress level: Moderate to High

- Must have reserves to cover negative cash flow

Key Difference: Cash stays positive and stress-free. Leverage goes negative cash flow and requires covering shortfalls from reserves.

3-Property Leverage Portfolio:

- Total monthly deficit: -$540 (3 × -$180)

- Annual cost to maintain: -$6,480

- This is manageable with solid reserves but stressful

Scenario 3: Severe Recession (2001-Level)

Market Conditions:

- Property values: -30% decline ($300K → $210K)

- Rents: -20% decline ($2,400 → $1,920)

- Vacancy: 15-18% annually (very elevated)

Cash Purchase Performance:

- Equity: $210,000 (100% of reduced value)

- Monthly cash flow: $1,080 (reduced but still positive)

- Paper loss: -$90,000 (not realized)

- Status: ✅ PAINFUL BUT MANAGEABLE

- Stress level: Moderate (wealth declined but no crisis)

- No forced selling, can hold for recovery

Leveraged Purchase Performance:

- Equity: -$15,000 (UNDERWATER!)

- Loan: $225,000

- Underwater amount: $15,000 (owe more than property worth)

- Monthly cash flow: -$420 (SEVERELY NEGATIVE)

- Annual deficit: -$5,040 per property

- Status: 🚨 CRISIS MODE

- Stress level: VERY HIGH

- Risk: Foreclosure if can't cover payments

- Cannot sell without bringing cash to closing

- Forced to hold and pray for recovery

Key Difference: Cash investor is uncomfortable but stable. Leveraged investor is underwater and bleeding cash monthly.

3-Property Leverage Portfolio:

- Total underwater amount: -$45,000

- Total monthly deficit: -$1,260

- Annual cost: -$15,120

- This level of loss forces many investors into foreclosure or distressed sales

Scenario 4: Catastrophic Crash (2008-2009 Level)

Market Conditions:

- Property values: -40% decline ($300K → $180K)

- Rents: -30% decline ($2,400 → $1,680)

- Vacancy: 20-25% (4 months to fill units)

- Extended crisis: 2-3 years to recovery

Cash Purchase Performance:

- Equity: $180,000 (100% of reduced value)

- Monthly cash flow when rented: $840 (still positive!)

- Vacancy impact: 4 months empty = -$6,240 (painful but survivable)

- Paper loss: -$120,000 (devastating wealth decline)

- Status: ⚠️ SEVERE PAIN BUT NO CRISIS

- Stress level: High (significant wealth loss)

- No debt payments during vacancy

- Can ride out the storm

- Recovery will eventually happen

Leveraged Purchase Performance:

- Equity: -$45,000 (SEVERELY UNDERWATER)

- Loan: $225,000 (unchanged)

- Underwater amount: $45,000

- Monthly cash flow when rented: -$660 (extreme negative)

- Vacancy impact: Must pay $1,500 mortgage + $840 expenses = $2,340/month × 4 months = -$9,360 for ONE vacancy

- Annual deficit if rented full-year: -$7,920

- Status: 🔴 EXTREME DISTRESS / POSSIBLE FORECLOSURE

- Stress level: CRITICAL

- Options: Loan modification, short sale, foreclosure, bankruptcy

- Devastating financially

3-Property Leverage Portfolio in Catastrophic Crash:

- Total underwater: -$135,000 (owe $675K, properties worth $540K)

- Monthly deficit: -$1,980 when all rented

- Annual cost: -$23,760 (if all stay rented—unlikely)

- With vacancies: Easily -$40,000-$50,000 annually to maintain

- Most investors cannot survive this—leads to mass foreclosures

Historical Reality: In 2008-2011, millions of leveraged investors lost properties to foreclosure. Cash buyers weathered the storm and bought aggressively at the bottom.

Recovery Timeline: 5 Years After Crash

Market Conditions:

- Property values recover to $300K (original price)

- Rents recover to $2,400/month

- Normal vacancy rates return

Cash Purchase - 5 Year Performance:

- Property value: $300,000 (back to starting point)

- Equity: $300,000

- 5-year cash flow collected: ~$72,000 (even during downturn, stayed positive most years)

- Status: FULLY RECOVERED + $72K cash collected

- Lessons: Learned expensive lesson about market cycles but survived intact

- Ready to invest aggressively at bottom prices

Leveraged Purchase - 5 Year Performance:

- Property value: $300,000 (back to starting point)

- Loan balance: $207,000 (paid down $18K over 5 years)

- Equity: $93,000 (vs $75K initial—some gain)

- 5-year cash flow: -$18,000 (had to cover cumulative negative cash flow)

- Net position: $93K equity - $18K cash losses = $75K (essentially back to start)

- Status: SURVIVED but painful, little wealth gain

- Reality: Many leveraged investors would have folded and lost properties

3-Property Leverage Portfolio:

- If all 3 properties survived: Back to $279K equity (vs $225K initial)

- Cumulative cash flow losses: -$54,000 covered from savings

- Net wealth: Slightly ahead due to 3× appreciation, but traumatic experience

- Reality: Many would have lost 1-2 properties to foreclosure, destroying years of wealth building

Tax Implications: Cash vs Leverage

The Mortgage Interest Deduction Advantage

Leveraged Purchase Tax Benefits:

Year 1 mortgage interest (approximate):

- $225,000 loan at 7% = ~$15,750 interest paid

- Property taxes: $4,200

- Other deductions: $2,880 (insurance, maintenance)

- Total deductions: $22,830

Tax savings (at 35% combined federal + state rate):

- $22,830 × 35% = $7,991 in tax savings

- This reduces the effective cost of leverage

- Effective after-tax interest rate: 4.55% (vs 7% nominal)

Cash Purchase Tax Situation:

- No mortgage interest deduction

- Property taxes: $4,200 (deductible)

- Other deductions: $2,880

- Total deductions: $7,080

- Tax savings: $2,478

- Leverage saves $5,513 more annually in taxes

Depreciation: Equal Benefit

Both strategies get the same depreciation benefit:

- $300,000 property (less land value)

- Assume $240,000 depreciable basis (80% of value)

- Annual depreciation: $8,727 (over 27.5 years)

- Tax savings: $3,054 annually

This benefit is identical whether you buy cash or leverage.

Capital Gains Considerations

Cash Purchase:

- When you sell after 10 years at $403K (appreciated value):

- Gain: $103,000 ($403K - $300K purchase price)

- Long-term capital gains tax (20%): $20,600

- Net proceeds: $382,400

Leveraged Purchase:

- When you sell after 10 years at $403K:

- Gain: $103,000 (same appreciation)

- Loan payoff: $195,000 (principal paid down)

- Net proceeds before tax: $208,000

- Capital gains tax: $20,600

- Net proceeds after tax: $187,400

Key Insight: Both pay the same capital gains tax on appreciation. The difference is that leveraged investor has less net proceeds because they must pay off the remaining loan balance.

1031 Exchange Strategy

Both cash and leverage can 1031 exchange to defer capital gains:

Cash 1031:

- Sell $403K property, exchange into $403K+ property

- Defer all capital gains

- Can upgrade to better property

Leverage 1031:

- Sell $403K property (pay off $195K loan)

- Must exchange into property worth $403K+ to defer all gains

- Need to add $195K new financing OR $195K+ cash to complete exchange

- More complex but still achievable

1031 advantage: Slightly favors cash (simpler to execute, no loan complications)

The Tax-Adjusted Return Comparison

Cash Purchase 10-Year After-Tax Return:

- Property appreciation: $103,175

- Cash flow after tax: $18,720 × 10 years × 0.80 (20% tax) = $149,760

- Depreciation tax benefit: $30,540 (10 years)

- Capital gains tax on sale: -$20,600

- Net after-tax wealth: $562,875

- After-tax return: 87.5% over 10 years

Leveraged Purchase 10-Year After-Tax Return:

- Property appreciation: $103,175

- Cash flow after tax: $720 × 10 years × 0.80 = $5,760

- Mortgage interest tax benefit: $79,910 (10 years, decreasing annually)

- Depreciation tax benefit: $30,540

- Principal paydown: $30,000 (forced savings)

- Capital gains tax on sale: -$20,600

- Net after-tax wealth: $228,785

- After-tax return: 163% over 10 years (on $87K initial investment!)

After-tax, leverage still wins significantly—163% vs 87.5% return.

Psychological Factors: The Human Element

The Cash Buyer's Psychology

Advantages:

- Sleep peacefully at night (no debt stress)

- Confidence during market downturns

- Simple decision-making (no refinancing decisions)

- Pride of ownership (fully own asset)

- Flexibility (can sell anytime without loan payoff complications)

Challenges:

- FOMO during bull markets (watching leveraged investors build wealth faster)

- Opportunity cost anxiety ("Could this $300K earn more elsewhere?")

- Slower portfolio growth can feel frustrating

- Less exciting/dramatic wealth building story

Personality fit:

- Risk-averse investors

- Those who've experienced foreclosure or bankruptcy

- Investors nearing retirement

- People who value simplicity over optimization

- Those with previous debt trauma

The Leveraged Investor's Psychology

Advantages:

- Exciting wealth-building journey

- Visible progress (acquiring multiple properties)

- Sense of "playing the game right" (using leverage like pros)

- Momentum and confidence from growing portfolio

Challenges:

- Stress during market downturns

- Sleepless nights when cash flow goes negative

- Constant worry about making mortgage payments

- Fear of foreclosure during tough times

- Analysis paralysis (is this the right time to buy?)

Personality fit:

- Growth-oriented, ambitious investors

- Those comfortable with complexity

- Individuals with high stress tolerance

- People who can emotionally detach from short-term volatility

- Those with stable income to weather downturns

The Stress Test Questions

Before choosing leverage, honestly answer:

-

How will you feel if your property goes underwater by $50K?

- If this causes panic, choose cash

- If you can shrug it off as temporary, leverage is viable

-

Can you cover -$500/month negative cash flow for 12-18 months?

- If no, leverage is too risky

- If yes with emergency fund, leverage is acceptable

-

Will you panic sell in a market crash?

- If history suggests yes, choose cash

- If you can hold through cycles, leverage works

-

Does debt keep you awake at night?

- If yes, no amount of extra return is worth the stress—buy cash

- If no, leverage is psychologically feasible

-

Can you handle tenants calling about broken appliances while owing $225K on the property?

- If landlording + debt stress = overwhelm, choose cash

- If you can compartmentalize, leverage is manageable

Real-World Case Studies

Case Study 1: The Conservative Retiree (Cash Winner)

Profile:

- Age: 58, planning to retire at 62

- Capital available: $600,000 (from 401k rollover and savings)

- Goal: Generate $4,000-5,000/month retirement income

- Risk tolerance: Low

- Timeline: 4 years until retirement, then 20-30 years of retirement

Decision: ALL CASH STRATEGY

Execution:

- Bought 2 properties at $300K each (all cash)

- Total investment: $600,000

- Monthly cash flow: $3,120 ($1,560 × 2)

- Annual income: $37,440

After 4 Years (At Retirement Age 62):

- Properties appreciated to $675,000 total

- Monthly cash flow: $3,120 (plus modest rent increases = ~$3,400)

- Retirement income goal: ACHIEVED

- Stress level: Minimal

- Can retire comfortably

Alternative Scenario (If He Used Leverage):

- $600K could have bought 6-7 properties leveraged

- Monthly cash flow: $360-420 (6 × $60)

- Would NOT have achieved retirement income goal

- More wealth potential long-term, but can't retire on $400/month

Outcome: Cash was the right choice for his goal (immediate income for retirement) and risk tolerance (low).

His reflection: "I sacrificed some long-term wealth to achieve my retirement goal on my timeline. I sleep great at night and have the income I need. No regrets."

Case Study 2: The Ambitious Millennial (Leverage Winner)

Profile:

- Age: 28, 15+ years to retirement

- Capital available: $100,000 (saved aggressively)

- Goal: Build $3M+ net worth by age 50 through real estate

- Risk tolerance: High

- Income: $120K/year software engineer (stable W-2)

Decision: MAXIMUM LEVERAGE STRATEGY

Execution:

- Used $100K to buy first property leveraged ($75K down + closing costs)

- Over next 10 years: acquired 8 more properties (9 total) using leverage, cash-out refinances, and BRRRR

- Each property: 20-25% down, 75-80% LTV

After 10 Years (Age 38):

- 9 properties worth $3,600,000 total (average $400K each)

- Total loans: $2,400,000

- Total equity: $1,200,000

- Monthly cash flow: $2,500 total (modest due to mortgages)

- Net worth from real estate alone: $1.2M

- On track to hit $3M by age 50 as properties appreciate and mortgages pay down

Alternative Scenario (If He Used Cash):

- $100K could have bought 1 property cash (in lower-priced market)

- After 10 years: Maybe 2-3 properties total (buying slowly)

- Total equity: ~$600,000

- Half the wealth of leverage strategy

Market Downturn Stress (2020):

- Properties declined 10-15% temporarily

- Cash flow went negative on 3 properties for 6-8 months

- Had to cover -$1,200/month from W-2 income

- Total cost: ~$7,200 to weather the storm

- Properties recovered within 18 months

Outcome: Leverage was the right choice for his goal (aggressive wealth building), long timeline (22 years to goal), and high risk tolerance backed by stable income.

His reflection: "The 2020 downturn was stressful and I had to cover some losses, but I never seriously worried about foreclosure because of my W-2 income. Looking at my $1.2M net worth 10 years in, I'm glad I used leverage. I'd have maybe $400K-500K if I'd bought cash."

Case Study 3: The 2008 Crash Survivor (Cash Lesson Learned)

Profile:

- Age: 35 in 2006, 53 in 2024

- Capital available in 2006: $200,000

- Goal: Build wealth through real estate

- Risk tolerance in 2006: High (thought he was bulletproof)

Decision in 2006: MAXIMUM LEVERAGE (Pre-Crash)

Execution:

- 2006-2007: Used $200K to buy 5 properties with 10-20% down (loose lending standards)

- Total property value: $1,500,000

- Total loans: $1,300,000

- Monthly cash flow: Slightly positive (barely covering debt service)

The Crash (2008-2010):

- Properties declined 40-50% in value

- Property values: $750,000-900,000

- Loans: $1,300,000 (unchanged)

- Underwater by $400K-550K

- Rents dropped 20%, cash flow went deeply negative

- Lost W-2 job in recession

- Could not cover -$3,000-4,000/month in negative cash flow

The Outcome:

- Lost 4 of 5 properties to foreclosure

- Destroyed credit (620 score for 7 years)

- Lost entire $200K initial investment

- Emotional trauma from the experience

- Net worth: $0 (actually negative)

The Reset (2014-2024):

- Rebuilt credit slowly

- Saved another $150,000 over 10 years

- Bought 2 properties ALL CASH in 2020-2022

- Current portfolio: 3 properties, all paid off, worth $1,000,000

- Monthly cash flow: $4,500

- Net worth: $1,000,000

His reflection: "I learned the hard way that leverage can destroy you in downturns. I could have weathered the storm if I'd bought cash in 2006—my properties would have recovered and I'd probably have $2M+ now. Instead, I lost everything and had to start over. Now I only buy cash. Maybe I'm leaving some returns on the table, but I'll never go through 2008-2010 hell again."

Lesson: Leverage without deep reserves, stable income, and stress tolerance can be catastrophic in severe downturns.

Case Study 4: The Hybrid Strategist (Balanced Winner)

Profile:

- Age: 42, married with 2 kids

- Capital available: $800,000

- Goal: Build wealth AND generate income for family security

- Risk tolerance: Moderate

- Income: $180K household (dual income)

Decision: HYBRID STRATEGY (Mix of Cash and Leverage)

Execution:

-

Bought 3 properties all cash ($240K each) = $720,000 invested

- Focus: Strong cash flow properties in B-class neighborhoods

- Monthly cash flow: $4,680 ($1,560 × 3)

- Purpose: Income security for family

-

Used remaining $80K to buy 1 property leveraged

- Focus: Value-add property in appreciating A-class neighborhood

- Monthly cash flow: $150

- Purpose: Growth and appreciation

After 8 Years:

-

3 cash properties:

- Now worth $1,080,000 (appreciated 50% total)

- Monthly cash flow: $5,400 (rents increased)

- Purpose achieved: Family income security

-

1 leveraged property:

- Now worth $480,000 (purchased at $320K, forced appreciation through renovation)

- Loan: $195,000 (paid down from $240K)

- Equity: $285,000

- Monthly cash flow: $600

- Purpose achieved: Significant wealth growth

Total Portfolio:

- 4 properties worth $1,560,000

- Loans: $195,000

- Equity: $1,365,000

- Monthly cash flow: $6,000

- Net worth from real estate: $1.365M (vs $800K invested)

Outcome: Hybrid strategy delivered both income security (cash properties) AND significant wealth growth (leverage property).

His reflection: "The hybrid approach gave me the best of both worlds. My cash properties provide stable income that covers 80% of our family's living expenses, so we have security. The leveraged property gave us a 4× return and significant wealth growth. I'm not maximizing either strategy, but I'm optimizing for my life situation—and that's what matters."

Advanced Strategies: Optimizing Cash vs Leverage

Strategy 1: The Debt Payoff Accelerator

Approach: Start with leverage, then aggressively pay off mortgages early.

Execution:

- Years 1-5: Buy 5 properties with leverage

- Years 6-10: Stop acquiring, aggressively pay down mortgages

- Use cash flow to pay extra principal

- Snowball method: pay off smallest loan first, then roll payment into next

- Target: Pay off 1 property every 2 years

Result After 15 Years:

- 5 properties owned

- 3 paid off completely (producing massive cash flow)

- 2 with small remaining balances

- Portfolio produces $6,000-8,000/month cash flow

- Best of both worlds: Used leverage to acquire, then transitioned to cash-like safety

Best for: Investors who want leverage's acquisition power but cash's stability long-term.

Strategy 2: The Cash Reserve Leveraging

Approach: Use leverage but maintain massive cash reserves (50-100% of total loan balance).

Execution:

- Buy leveraged properties (75-80% LTV)

- Maintain cash reserves equal to 12-24 months of mortgage payments per property

- Never deploy reserve capital except for emergencies

Example:

- 3 properties, $675K total loans

- Cash reserves: $350,000 (enough to cover 24 months of all payments)

- This reserve covers any recession, vacancy, or cash flow issues

Result:

- Leverage's wealth-building benefits

- Cash's stress-free safety (reserves provide peace of mind)

- Can weather any downturn without losing properties

- Slightly lower returns (cash sitting idle) but maximum safety

Best for: High-income earners who can save large reserves and want leverage with minimal risk.

Strategy 3: The Geographic Diversification

Approach: Use different strategies in different markets based on local fundamentals.

Execution:

-

Cash purchases in expensive coastal markets (California, New York, Boston)

- Lower cash-on-cash returns (4-5%)

- Strong appreciation potential

- Cash protects against price volatility

-

Leverage in cash-flowing secondary markets (Memphis, Cleveland, Jacksonville)

- Higher cash-on-cash returns even with leverage (12-15%)

- Moderate appreciation

- Leverage amplifies already strong cash flow

Result:

- Diversified portfolio across multiple markets

- Strategies optimized for each market's characteristics

- Reduced risk through geographic and strategy diversification

Strategy 4: The Lifecycle Strategy

Approach: Adjust strategy based on life stage and age.

Age 25-40: Maximum Leverage Phase

- Use leverage aggressively

- Acquire as many properties as possible

- Accept higher risk for higher returns

- Compound wealth rapidly

Age 40-55: Transition Phase

- Reduce new leverage

- Start paying down existing mortgages

- Buy some properties cash

- Balance growth with stability

Age 55-70: Cash Flow Phase

- No new leverage

- Aggressively pay off remaining mortgages

- Buy final properties cash if acquiring at all

- Maximize cash flow for retirement

Age 70+: Legacy Phase

- Fully paid-off portfolio

- Maximum cash flow

- Simple management for aging owners

- Estate planning focus

This lifecycle approach maximizes returns when young (can absorb risk) and safety when older (need income and simplicity).

Final Recommendations

Choose CASH Purchase If You:

✅ Need maximum monthly cash flow NOW (replacing W-2 income, funding retirement) ✅ Have low risk tolerance (debt stress keeps you up at night) ✅ Are nearing retirement (under 10 years away) ✅ Have limited stable income (can't cover negative cash flow in downturns) ✅ Are buying at market peak (prices high, cap rates compressed) ✅ Have $1M+ capital (can diversify with multiple cash properties) ✅ Value simplicity and peace of mind over maximum returns ✅ Experienced foreclosure or bankruptcy previously (debt trauma) ✅ Plan to hold short-term (under 5 years) and want flexibility to sell

Choose LEVERAGE If You:

✅ Have long investment timeline (10-20+ years minimum) ✅ Goal is maximum wealth accumulation (not immediate income) ✅ Are young (20s-40s) with decades to compound returns ✅ Have stable W-2 income ($80K+) to cover potential negative cash flow ✅ Have high risk tolerance (comfortable with debt and volatility) ✅ Have deep emergency reserves (6-12 months of mortgage payments per property) ✅ Can qualify for favorable financing (720+ credit, low DTI) ✅ Are actively building a portfolio (acquiring 1-2+ properties per year) ✅ Buying in normal or buyer's market (favorable conditions) ✅ Have other high-return investments (can earn arbitrage on borrowed money) ✅ Understand market cycles and can hold through downturns

Choose HYBRID Approach If You:

✅ Want both income stability AND wealth growth ✅ Have moderate risk tolerance (some debt okay, not maximum) ✅ Have significant capital ($500K+) to diversify ✅ Want to test leverage before fully committing ✅ Have mix of investment goals (near-term income, long-term growth) ✅ Want geographic or strategy diversification ✅ Are in transition phase of life (40s-50s)

The Ultimate Truth

There is no universally "right" answer. The cash vs leverage decision depends entirely on:

- Your goals (income now vs wealth later)

- Your timeline (5 years vs 30 years)

- Your risk tolerance (debt stress vs growth ambition)

- Your capital ($100K vs $1M+)

- Your life stage (25 vs 55 years old)

- Your personality (aggressive vs conservative)

- Market conditions (peak vs trough)

Both strategies work. Both have created millionaires. Both have destroyed investors who used them incorrectly.

The key is matching your strategy to your situation, goals, and psychology—not blindly following what works for someone else.

Ready to make your decision? Use the decision tree framework above to evaluate your specific situation and choose the strategy that's right for YOU—not what's "best" in theory, but what optimizes for your goals, timeline, and stress tolerance.

The best real estate strategy is the one you can execute successfully and sleep well with at night.

Related Content

📝 Vacation Rental vs Long-Term Rental: Complete 2026 Comparison Guide

Vacation rental vs long-term rental comparison. Compare income, expenses, time investment, regulations, and ROI.

📝 How to Calculate ROI on Rental Properties: A Step-by-Step Guide

Calculate ROI on rental properties. Master cash-on-cash return, cap rate, and NOI for smart investment decisions.

📝 2026 Rental Market Trends: What Property Owners Need to Know

2026 rental market trends: rent growth, occupancy rates, market shifts, and investment opportunities for landlords.

🔧 ROI Calculator

Calculate return on investment

🔧 Property Investment Analyzer

Comprehensive property analysis tool

🔧 BRRRR Calculator

Analyze buy-rehab-rent-refinance deals