DIY vs Professional Property Management: 2026 Guide

DIY vs Hiring Professional Property Management: The Ultimate 2026 Decision Guide

Property management is either a 10-20 hour per week job that steals your time and freedom—or a 10% fee that seems expensive until you calculate the opportunity cost. The decision to self-manage or hire professional property management is one of the most impactful choices in real estate investing, affecting your cash flow, scalability, stress levels, and ultimate success.

The Core Question: Should you save 10% of rent by managing properties yourself, or invest that 10% to free up your time for acquisitions and portfolio growth?

This comprehensive guide analyzes every aspect of the DIY vs professional management decision: true costs (including time value), portfolio size thresholds, decision frameworks, red flags to avoid, and real-world case studies from investors who've done both.

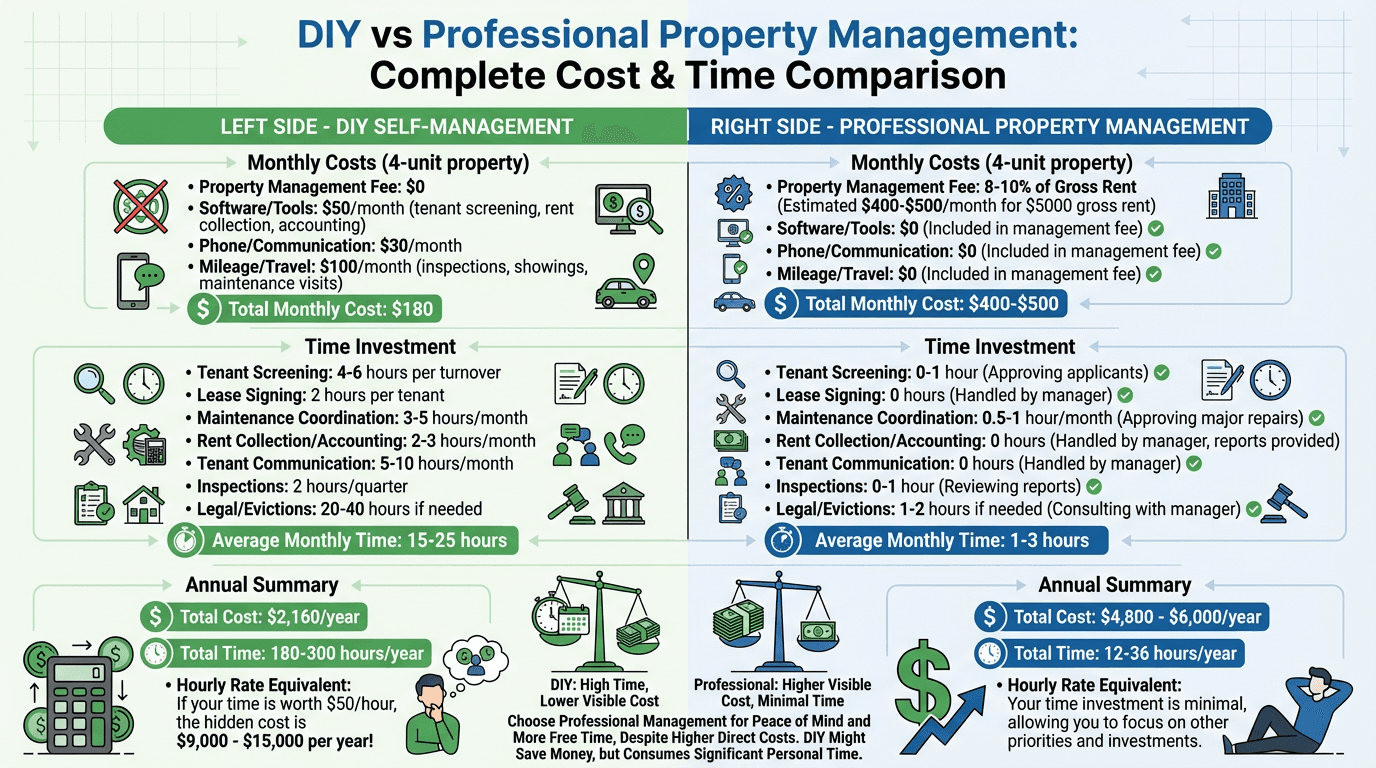

The True Cost Comparison: Beyond the 10% Fee

DIY Self-Management: The Hidden Costs

Most investors see the 10% management fee and think "I'll save thousands by doing it myself." But DIY management has real costs that extend far beyond saved fees:

Direct Cash Costs (4-Unit Property Example):

- Property management software/tools: $50-100/month

- Tenant screening services: $30-50 per applicant

- Phone/communication systems: $30-50/month

- Mileage/travel for inspections, showings, maintenance: $100-200/month

- Legal consultation (occasional): $200-500/month averaged

- Total Monthly Direct Cost: $410-900

- Annual Direct Cost: $4,920-10,800

Time Investment (Monthly Average):

- Tenant screening and applications: 4-6 hours per turnover (16-24 hours annually for 25% turnover)

- Lease signings and move-ins: 2-3 hours per tenant

- Maintenance coordination: 3-5 hours/month minimum

- Rent collection and accounting: 2-4 hours/month

- Tenant communication (calls, texts, emails): 5-10 hours/month

- Property inspections: 2-4 hours/quarter (8-16 hours annually)

- Legal issues/evictions: 20-40 hours when needed (devastating time sink)

- Average Monthly Time: 15-25 hours

- Annual Time: 180-300 hours

The Opportunity Cost Calculation:

If your time is worth $100/hour (reasonable for a working professional or active investor):

- 180-300 hours/year × $100/hour = $18,000-30,000 in opportunity cost

- Add direct costs: $4,920-10,800

- True Annual Cost of DIY: $22,920-40,800

Professional Property Management: The Real Numbers

Direct Costs (4-Unit Property, $4,800 Monthly Rent):

- Monthly management fee (10%): $480/month

- Leasing fee (typically 50% of one month's rent per placement): ~$100/month averaged across tenancy length

- Maintenance coordination markup (varies by company): $50-150/month

- Total Monthly Cost: $630-730

- Annual Cost: $7,560-8,760

Time Investment:

- Initial setup and orientation: 4-6 hours (one-time)

- Monthly financial review: 1-2 hours/month

- Quarterly property visits: 2-3 hours/quarter

- Annual strategy and performance review: 3-4 hours

- Average Monthly Time: 2-3 hours

- Annual Time: 24-36 hours

The True Cost with Opportunity:

If your time is worth $100/hour:

- 24-36 hours/year × $100/hour = $2,400-3,600 in opportunity cost

- Add management fees: $7,560-8,760

- True Annual Cost: $9,960-12,360

The Shocking Math

DIY appears cheaper by $2,640-5,280 annually ($7,560 management fee minus $4,920 direct DIY costs).

But when you include opportunity cost:

- DIY True Cost: $22,920-40,800

- Professional True Cost: $9,960-12,360

- Professional Management Actually SAVES You: $12,960-28,440 Annually!

This is why sophisticated investors hire property managers despite the "high" 10% fee—it's actually the more cost-effective option when time value is considered.

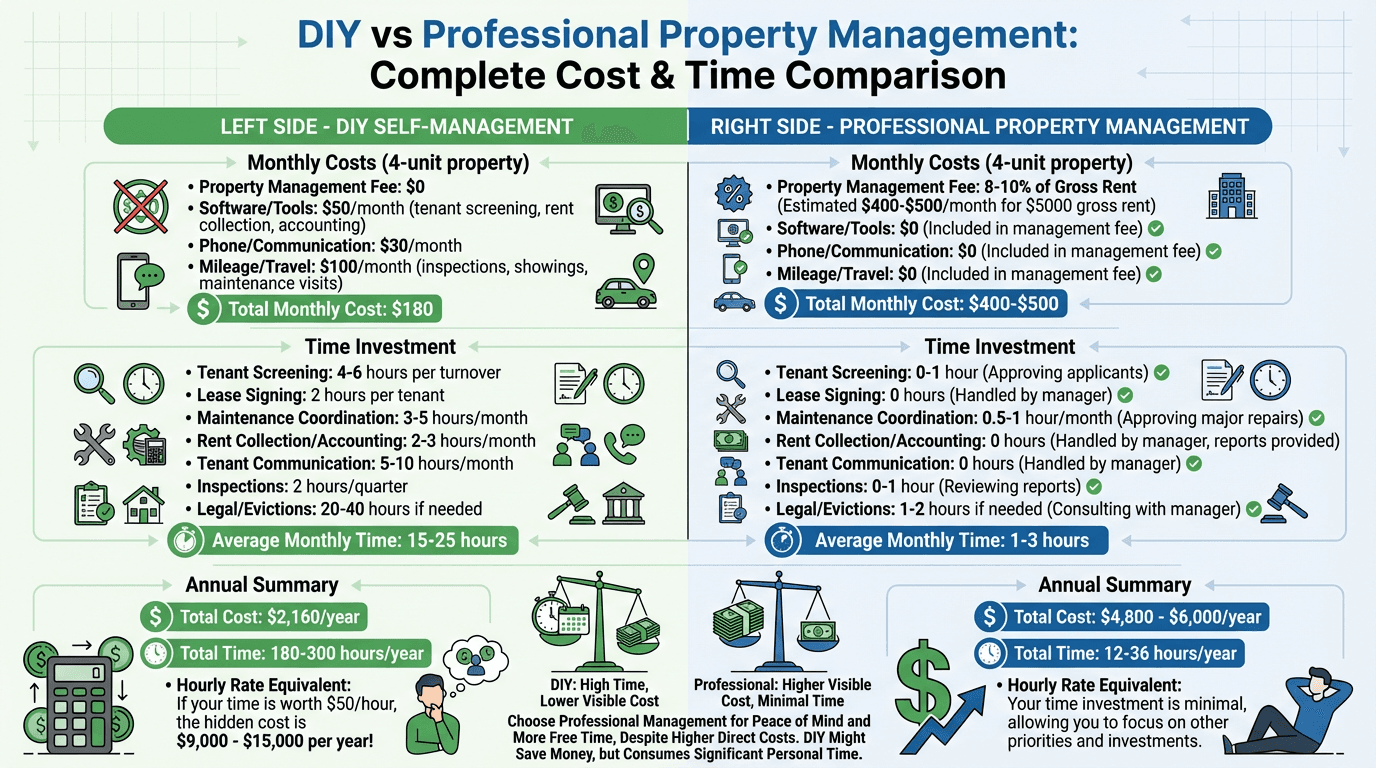

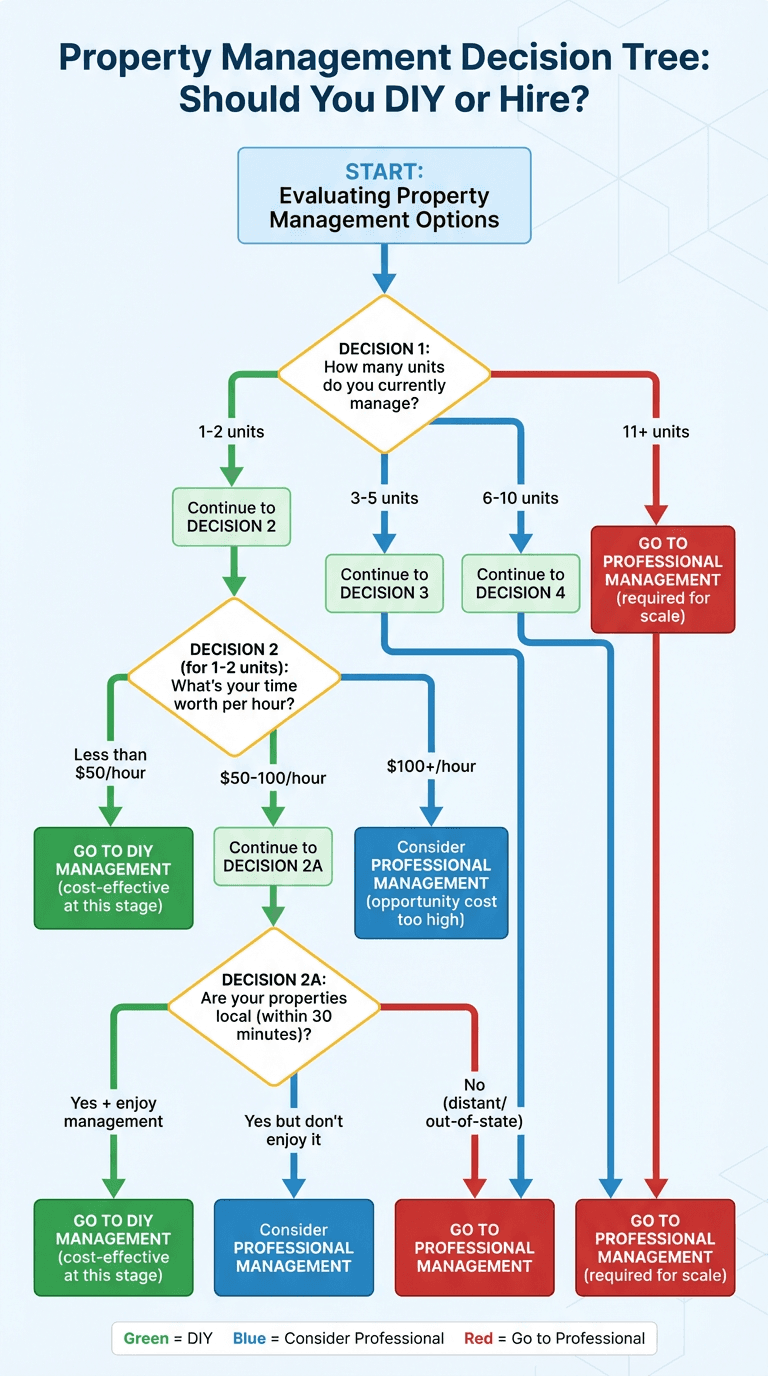

Portfolio Size Decision Matrix: When to Make the Transition

1-2 Units: DIY Usually Makes Sense

Time Commitment: 10-15 hours/month Annual DIY Cost: $1,500-3,000 (minimal tools, occasional screening) Annual Professional Cost: $5,000-10,000 (10% of $3,500-7,000 monthly rent)

DIY Recommended If:

- You're learning the property management business

- Properties are local (within 30 minutes)

- You have 10-15 hours/month available

- Your time is worth less than $50/hour

- You enjoy or don't mind tenant interactions

Professional Recommended If:

- Properties are distant or out-of-state

- Your time is worth $100+/hour (high-income professional)

- You're actively seeking acquisitions (need time for deal flow)

- You travel frequently for work

Break-Even Analysis:

Professional management costs $5,000-10,000 annually vs $1,500-3,000 DIY direct costs = $3,500-7,000 premium.

If you value your time at $50/hour: 180 hours DIY time × $50 = $9,000 opportunity cost.

Even at 1-2 units, professional management makes financial sense if your time is worth $50+/hour.

3-5 Units: Transition Zone

Time Commitment: 20-30 hours/month DIY Annual DIY Cost: $3,000-5,000 Annual Professional Cost: $15,000-25,000 (10% of $10,000-18,000 monthly rent)

Hybrid Approach Often Best:

- Manage local, easy properties yourself

- Hire professional for distant or problem properties

- Test professional management before full transition

DIY Still Works If:

- All properties are local and similar

- You have systems and processes in place

- You genuinely enjoy property management

- You're not actively acquiring more properties

- Your time value is below $75/hour

Professional Makes Sense If:

- Actively acquiring (1+ properties per year)

- Properties in multiple locations

- High-income earner ($100K+) where time is valuable

- Want work-life balance and scalability

Decision Framework Questions:

- Are you acquiring more properties? → Yes = Hire professional now

- Is management taking 25+ hours/month? → Yes = Professional

- Do you have solid systems? → No = Hybrid or professional

- Are you stressed by management tasks? → Yes = Professional immediately

6-10 Units: Professional Strongly Recommended

Time Commitment DIY: 30-45 hours/month (essentially a second full-time job) Annual DIY Cost: $5,000-8,000 direct + $30,000-45,000 opportunity (at $75/hour) Annual Professional Cost: $30,000-50,000

Why Professional Makes Sense:

At 6-10 units, DIY management becomes a full-time job (30-45 hours/month). Even with systems, you're spending one entire business week per month on property management.

The Scalability Problem:

DIY at 6-10 units means you have no time for:

- Finding and analyzing new deals

- Negotiating purchases

- Building lender relationships

- Networking with other investors

- Improving your real estate business

You've built a property management job, not a real estate investment business.

Break-Even Reality:

If your time is worth just $50/hour:

- 360-540 hours/year × $50 = $18,000-27,000 opportunity cost

- Plus $5,000-8,000 direct costs = $23,000-35,000 true DIY cost

- Professional costs $30,000-50,000, but saves you 320-500 hours

- Net cost difference: Only $7,000-15,000 to buy back 320-500 hours

That's $20-30/hour to eliminate property management from your life and focus on portfolio growth.

11-20 Units: Professional Management Essential

Time Commitment DIY: 50-80 hours/month (more than a full-time job!) Annual DIY Cost: Unsustainable without hiring staff Annual Professional Cost: $60,000-100,000

Why You Cannot DIY at This Scale:

Managing 11-20 units alone requires 50-80 hours/month minimum. You physically cannot do this while:

- Working a full-time job

- Finding new deals

- Managing renovations

- Handling financing

- Having any personal life

Your Only Options:

- Hire professional property management company ($60-100K/year)

- Hire in-house property manager ($45-65K salary + $15-25K benefits = $60-90K total)

- Burn out and quit real estate (worst option)

In-House vs Professional Management Company:

In-House Property Manager:

- Pros: More control, dedicated to your portfolio only, potential cost savings at scale

- Cons: You're now managing an employee, HR issues, vacation coverage, benefits costs

- Best for: 20-50 units where you want tight control

Professional Management Company:

- Pros: Team approach, vacation coverage built-in, expertise across many properties, scalable

- Cons: Less control, 10% fee vs fixed salary, variable quality

- Best for: 11-30 units where you want hands-off approach

21+ Units: Professional or In-House Team Required

Professional Management: $90,000-200,000+ annually In-House Team: $100,000-150,000 (property manager + assistant)

Negotiation Opportunity:

At 21+ units, you have leverage to negotiate:

- Reduced management fee (8-9% instead of 10%)

- Waived leasing fees

- Reduced maintenance markup

- Volume discounts

Strategic Considerations:

Stay with Professional If:

- You want maximum scalability (grow to 50-100+ units)

- You prefer hands-off approach

- You don't want to manage employees

- You're focused on acquisitions, not operations

Build In-House Team If:

- You want maximum control and cost efficiency

- You're comfortable managing employees

- You have 30-50+ units to justify the overhead

- You plan to hold long-term (10+ years)

Hybrid Approach (Best of Both Worlds):

- In-house property manager for day-to-day operations

- Professional company for leasing and tenant placement

- Third-party contractor for major maintenance coordination

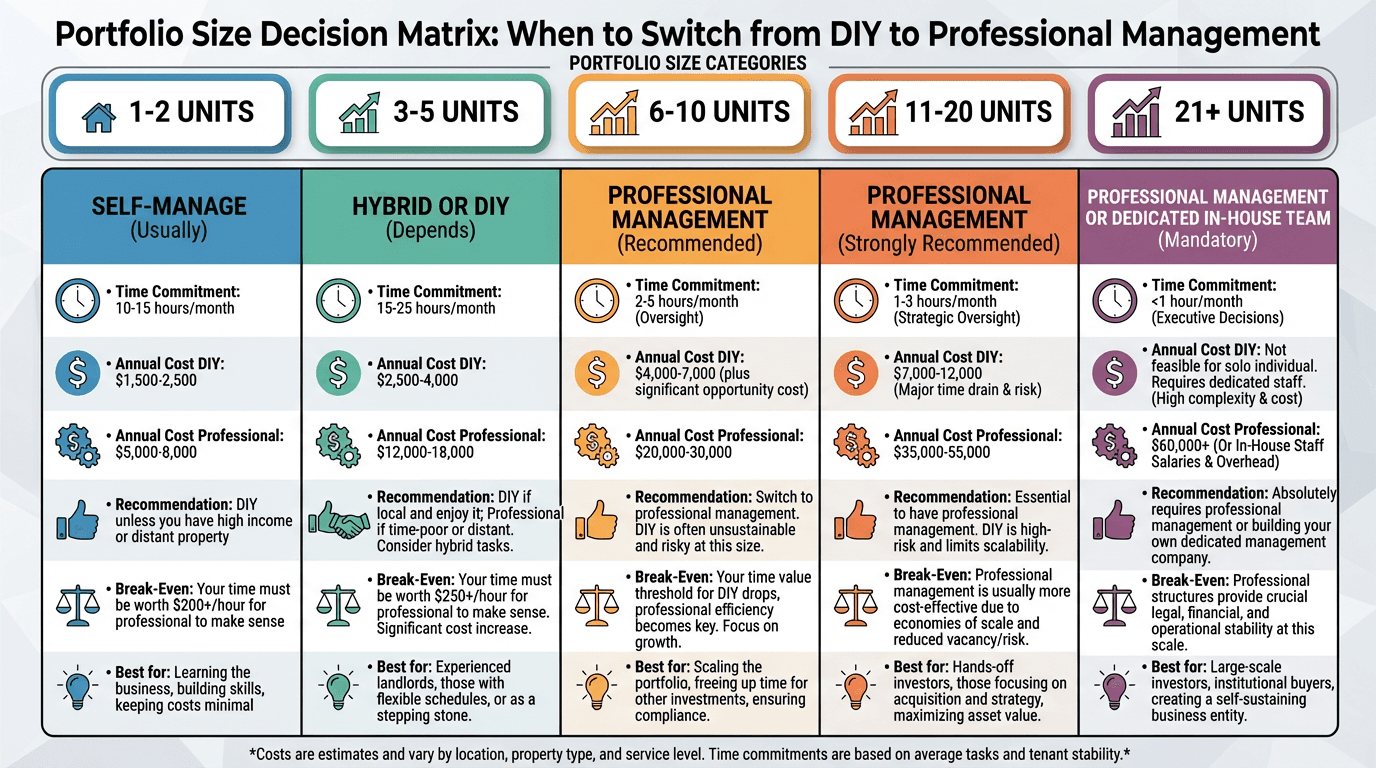

Decision Framework: Should You DIY or Hire?

The 10 Critical Questions

Question 1: How many rental units do you own or manage?

- 1-2 units → DIY viable (consider Q2-Q4)

- 3-5 units → Hybrid or transition to professional (consider Q2-Q5)

- 6-10 units → Professional strongly recommended (consider Q6-Q8)

- 11+ units → Professional or in-house required

Question 2: What is your hourly rate or time value?

Calculate your time value honestly:

- Current job salary ÷ 2,080 hours = base hourly rate

- Add value of your personal time (family, health, hobbies)

- Consider opportunity cost of not pursuing deals

Time Value Guidelines:

- Below $50/hour → DIY viable for 1-5 units

- $50-100/hour → Professional makes sense at 3+ units

- $100-200/hour → Professional essential at 2+ units

- $200+/hour → Hire immediately, even for single property

Question 3: Are your properties local or distant?

Local (within 30 minutes):

- DIY viable for 1-5 units

- Can handle showings, inspections, emergencies quickly

- Lower travel costs

Distant (30+ minutes to 2+ hours):

- Professional recommended at 2+ units

- Travel time kills efficiency

- Harder to respond to emergencies

Out-of-State:

- Professional management mandatory

- You cannot effectively manage remotely without local expertise

- Trying to DIY from afar is recipe for disaster

Question 4: How much do you enjoy property management tasks?

Love it (it's part of your investment strategy):

- DIY can work long-term up to 5-10 units

- You're building a property management business intentionally

- Consider starting your own PM company

Neutral (it's okay, just part of the job):

- DIY for 1-3 units while learning

- Transition to professional at 4-6 units as you scale

- Focus on what you do best (acquisitions or operations, not both)

Hate it (causes stress and unhappiness):

- Hire immediately, even at 1 property

- Life is too short to do work you despise

- Your stress will show to tenants and hurt performance

Question 5: Are you actively acquiring more properties?

Yes, acquiring 1+ properties per year:

- Hire professional management NOW

- Your time is better spent finding deals

- Professional management enables faster growth

Yes, but slowly (1 property every 2-3 years):

- DIY viable for 1-4 units

- Transition to professional as portfolio grows

No, staying at current portfolio size:

- DIY more viable if you have time and interest

- Consider professional for quality of life improvement

Question 6: Do you have systems and processes in place?

Yes, fully systemized:

- Documented procedures for all tasks

- Template leases, applications, letters

- Software for rent collection, maintenance tracking, accounting

- Vendor network established

- DIY viable up to 5-10 units with solid systems

Partially systemized:

- You have some processes but not comprehensive

- Hybrid approach recommended (professional for complex tasks)

- Continue building systems

No, winging it:

- Professional management essential

- Lack of systems leads to mistakes, legal issues, burnout

- Let professionals handle it while you build systems for future

Question 7: What's your long-term real estate investment goal?

Build small, stable portfolio (5-10 properties):

- DIY viable if you enjoy it and are systematic

- Professional viable if you prefer hands-off

Scale aggressively (20-50+ properties):

- Hire professional immediately

- Free up your time for acquisitions

- Build team and systems for scale

Replace W-2 income with real estate:

- Professional management for existing properties

- Spend your time growing the portfolio, not managing it

- Focus on acquisitions until you hit your income target

Question 8: Can you handle difficult tenant situations calmly?

Yes, I'm patient and professional under pressure:

- DIY viable (essential trait for self-management)

- Can de-escalate conflicts

- Understand fair housing laws and stay compliant

Sometimes, but it stresses me out:

- Hybrid approach (professional handles difficult tenants)

- You manage good tenants only

No, I get emotional or aggressive:

- Hire professional immediately

- You WILL get sued or make costly mistakes

- Your temperament is not suited for property management

Question 9: Do you have 15-30 hours/month for management?

Yes, consistently:

- DIY viable for your current portfolio size

- Track actual hours to ensure this remains true

Sometimes, but it's inconsistent:

- Professional recommended

- Inconsistent management leads to problems

- Tenants need reliable, responsive management

No, I'm too busy:

- Hire professional immediately

- Trying to squeeze in management leads to burnout and mistakes

Question 10: Have you calculated your true total cost (including opportunity cost)?

If not, use this formula:

DIY True Cost:

- Direct costs (software, screening, travel): $___________

- Hours per month: _______ × hourly rate $_______ = $_______ monthly opportunity

- Monthly opportunity × 12 = $_______ annual opportunity cost

- Total DIY Cost: $_______ annually

Professional Management Cost:

- Monthly rent × 10% × 12 = $_______ annual management fee

- Leasing fees: $_______ (typically 50% of one month's rent per year of tenancy)

- Maintenance markup: $_______ (estimate $50-150/month)

- Total Professional Cost: $_______ annually

Net Difference: $_______ to hire professional

If the net difference is less than $10,000-15,000 annually, hiring professional management is almost always the smarter choice for the stress reduction and time savings alone.

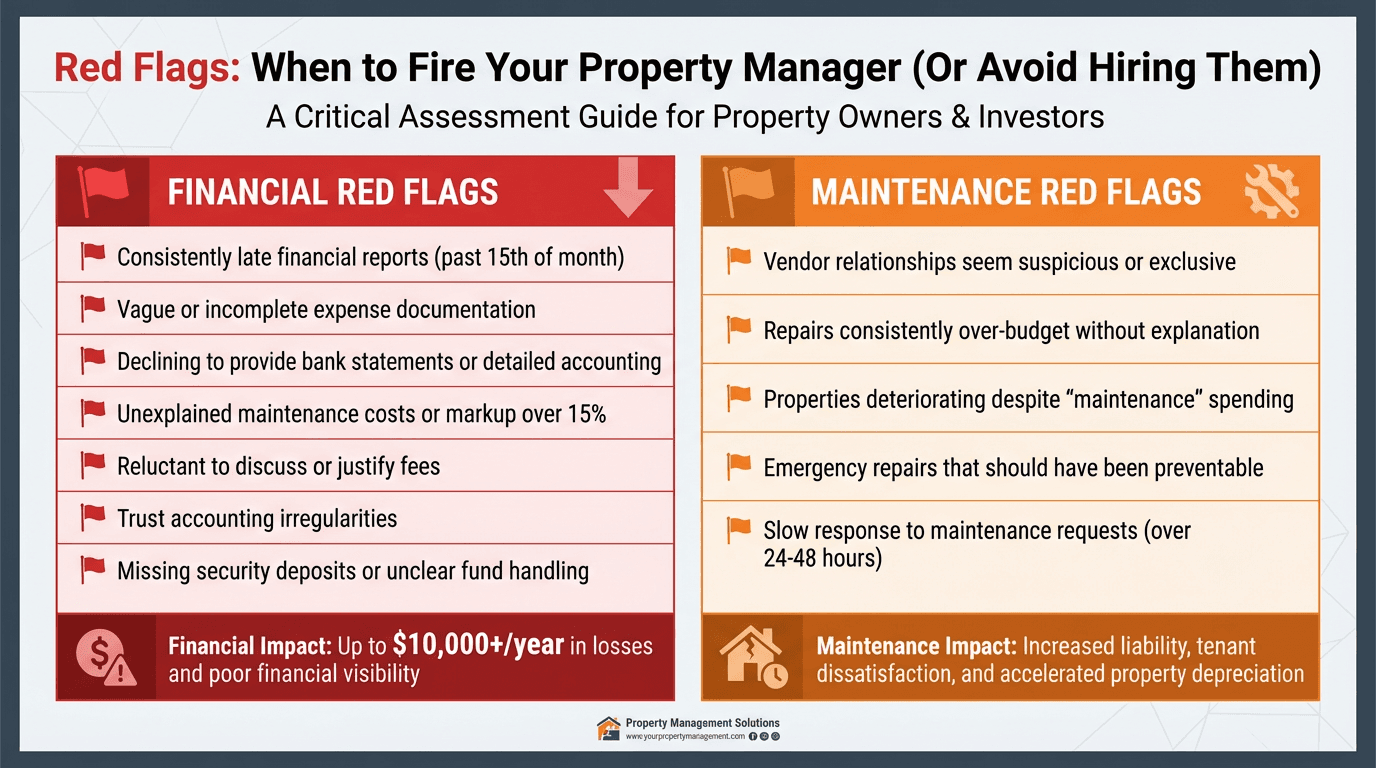

Red Flags: When to Fire Your Property Manager (or Avoid Hiring Them)

Not all property management companies are created equal. A bad property manager can cost you far more than their 10% fee through neglect, incompetence, or even fraud. Here are the warning signs:

Financial Red Flags (Critical)

🚩 Consistently late financial reports (past 15th of the month)

- Professional managers have automated systems

- Late reports indicate disorganization or intentional hiding

- Action: Demand immediate compliance; switch if not resolved

🚩 Vague or incomplete expense documentation

- Every expense should have a receipt and vendor invoice

- "Miscellaneous maintenance $450" is unacceptable

- Red flag severity: High - could indicate embezzlement

🚩 Declining to provide bank statements or detailed accounting

- You have a legal right to detailed accounting

- Resistance to transparency is a massive red flag

- Action: Terminate immediately; consult attorney

🚩 Unexplained maintenance costs or markup above 15%

- Standard markup is 5-15% to coordinate contractors

- Above 15% or unexplained charges suggest kickbacks or fraud

- Cost impact: $5,000-$15,000/year in excess charges

🚩 Reluctant to discuss or justify fees

- Professional managers happily explain their fee structure

- Defensiveness indicates problems

- Action: Request detailed fee breakdown; compare to industry standards

🚩 Trust accounting irregularities

- Security deposits must be in separate trust accounts

- Mixing operating and trust funds is illegal in most states

- Legal risk: $10,000-$50,000+ in fines and lawsuits

Maintenance Red Flags (Serious)

🚩 Vendor relationships seem suspicious or too cozy

- Always using the same contractor regardless of cost or quality

- Contractor prices are 50-100% above market rate

- Likely cause: Kickback arrangement

🚩 Repairs consistently over-budget without explanation

- $500 estimate becomes $1,200 actual cost repeatedly

- No updated quotes or approval sought for overages

- Cost impact: 15-30% higher maintenance costs

🚩 Properties deteriorating despite "maintenance" spending

- You're spending $8,000/year but property looks worse

- Deferred maintenance piling up

- Long-term impact: $20,000-$50,000 in property value decline

🚩 Emergency repairs that should have been preventable

- Burst pipes because manager ignored tenant's report of leak

- HVAC failure because no preventative maintenance

- Cost impact: $3,000-$10,000 per emergency

🚩 Slow response to maintenance requests (3+ days for urgent issues)

- Professional managers respond within 24 hours to urgent issues

- 3-7 day response indicates understaffing or negligence

- Tenant impact: Increased turnover, negative reviews

🚩 No preventative maintenance program

- Good managers schedule annual HVAC service, gutter cleaning, etc.

- Reactive-only maintenance is far more expensive long-term

- Cost difference: 30-50% higher lifetime maintenance costs

Tenant Management Red Flags (Concerning)

🚩 High tenant turnover (above 30% annually)

- Healthy portfolios have 15-20% annual turnover

- Above 30% indicates poor tenant screening or management

- Cost impact: $5,000-$10,000 per turnover

🚩 Frequent evictions

- One eviction per year in a 10-unit portfolio is concerning

- Multiple evictions suggest poor tenant screening

- Cost impact: $3,000-$7,000 per eviction

🚩 Consistent late rent collection

- Professional managers collect 95%+ of rent by 5th of month

- Consistent late rent indicates poor enforcement

- Cash flow impact: Unpredictable income, can't plan expenses

🚩 Vacancy periods longer than market average

- Check your market average days on market for rentals

- 30+ days beyond market average indicates poor marketing

- Cost impact: $1,000-$2,500 per extra month vacant

🚩 Poor communication with tenants (verified by tenant complaints)

- Check online reviews and speak directly with tenants

- Unresponsive managers cause tenant frustration and turnover

- Impact: 20-30% higher turnover rates

🚩 Lease agreement errors or legal compliance issues

- Leases missing required clauses

- Not following state/local landlord-tenant laws

- Legal risk: $10,000-$100,000+ in lawsuits

Communication Red Flags (Warning Signs)

🚩 Difficult to reach or unresponsive (24+ hours for callbacks)

- Professional managers return calls within 4-8 business hours

- 24-48 hour delays indicate problems

- Impact: Missed opportunities, crisis escalation

🚩 Defensive when questioned about decisions

- Good managers welcome questions and explain reasoning

- Defensiveness indicates insecurity or hiding something

- Action: Demand transparency or switch

🚩 Won't share access to owner portal or reports

- Modern PM companies provide 24/7 portal access

- Restricting access is a major red flag

- Likely hiding: Poor performance, financial irregularities

🚩 Inconsistent communication or missing updates

- Professional managers provide monthly owner reports

- Quarterly property inspections with photos

- Impact: You're blind to property conditions

🚩 Dismissive of owner concerns or questions

- You own the property; your concerns are valid

- Dismissive attitude indicates they don't value you

- Action: Find a manager who respects you

🚩 No regular property inspections or inspection reports

- Good managers inspect every 3-6 months

- Provide detailed photo reports

- Risk: Property damage going undetected

Legal & Compliance Red Flags (Critical)

🚩 Unfamiliar with landlord-tenant laws in your state

- Ask specific questions about notice periods, security deposits, eviction process

- A PM should know these cold

- Legal risk: Lawsuits, fines, voided leases

🚩 Poor lease agreements (missing clauses, unclear terms)

- Lease should be state-specific and comprehensive

- Missing clauses create legal vulnerabilities

- Action: Have attorney review; demand better lease

🚩 Fair housing complaints or discrimination issues

- Any fair housing complaints are extremely serious

- Check BBB, court records, state licensing board

- Legal risk: $25,000-$100,000+ in fines and lawsuits

🚩 No insurance or inadequate liability coverage

- PM companies should carry errors & omissions insurance

- $1-2 million liability coverage minimum

- Risk: You're personally exposed if something happens

🚩 Unlicensed property managers where license is required

- Many states require PM licensing

- Operating without license is illegal

- Action: Verify licensing immediately

🚩 Security deposit handling violations

- Deposits must be in separate trust accounts

- Interest requirements (in some states)

- Itemized deductions with receipts

- Legal risk: 2-3× security deposit penalties in many states

Action Guide: How Many Red Flags Before You Act?

1-2 Red Flags:

- Address immediately with property manager

- Document your concerns in writing

- Set 30-day deadline for improvement

- Monitor closely

3-4 Red Flags:

- Serious concern requiring immediate action

- Begin interviewing replacement managers

- Prepare for transition

- Document all issues for potential legal action

5+ Red Flags:

- Terminate relationship immediately (with proper notice per contract)

- Protect yourself legally (consult attorney if money missing)

- Transition to new manager ASAP

- Leave negative review to warn other investors

Financial or Legal Red Flags (any of them):

- These are immediate termination triggers

- Consult attorney before acting

- Secure all documents and evidence

- File complaints with state licensing board if appropriate

How to Interview and Hire the Right Property Manager

The Interview Process

Phase 1: Initial Screening (Phone/Email)

Ask these filter questions:

- How many properties/units do you currently manage in [your area]?

- What is your average tenant turnover rate?

- What is your average vacancy period?

- Can you provide references from current clients?

- Are you licensed (in states requiring it)?

Red flags at this stage:

- Evasive answers or reluctance to provide data

- Turnover above 30% or vacancy above 45 days (unless tough market)

- No references available

- Not licensed where required

Phase 2: In-Person Interview

Financial & Fee Questions:

- What is your exact fee structure (management %, leasing fees, other charges)?

- What maintenance markup do you charge?

- Are there any hidden fees (inspections, lease renewal, etc.)?

- When do I receive owner statements?

- How do you handle trust accounting?

Look for:

- Clear, transparent fee structure

- Detailed written management agreement

- Markup of 10-15% or less

- Monthly statements by 15th of month

- Separate trust accounts

Tenant Management Questions:

- Walk me through your tenant screening process.

- What are your minimum credit score and income requirements?

- How do you market vacant properties?

- What's your average time to lease?

- How do you handle maintenance requests?

- What's your eviction process and success rate?

Look for:

- Comprehensive screening (credit, criminal, eviction, employment, landlord references)

- Clear written criteria

- Multi-channel marketing (MLS, Zillow, Facebook, etc.)

- 15-30 day average lease-up in normal market

- 24-48 hour response to maintenance requests

- Documented eviction process and attorney relationships

Property Care Questions:

- How often do you inspect properties?

- Do you have a preventative maintenance program?

- How do you handle emergency repairs?

- Do you have preferred vendors or use my contractors?

- What approval threshold requires my authorization for repairs?

Look for:

- Quarterly inspections minimum

- Annual preventative maintenance (HVAC, gutters, etc.)

- 24/7 emergency hotline

- Network of licensed, insured contractors

- Clear approval thresholds ($500-1,000 typical)

Technology Questions:

- What property management software do you use?

- Do you provide an owner portal with 24/7 access?

- How do tenants pay rent?

- Can I see a sample owner report?

Look for:

- Professional PM software (AppFolio, Buildium, Propertyware, etc.)

- Owner portal with financial reports, documents, maintenance requests

- Online rent payment (ACH, credit card)

- Detailed monthly statements

Phase 3: Reference Checks

Call at least 3 current clients:

- How long have you worked with [PM company]?

- How responsive are they to your questions?

- How is their financial reporting?

- Have you had any issues? How were they handled?

- What's your tenant turnover and vacancy rate with them?

- Would you recommend them? Any reservations?

Warning signs:

- Reluctance to speak freely (may be coached)

- Vague answers without specifics

- Repeated issues mentioned

- "They're okay, but..." (lukewarm recommendations)

Phase 4: Contract Review

Have an attorney review the property management agreement before signing. Watch for:

Red flags in contracts:

- Auto-renewal clauses (should be month-to-month after initial term)

- Excessive termination penalties

- Vague fee structures

- Exclusive rights to sell the property

- No clear termination clause

- Limitation of liability clauses that are too broad

Good contract elements:

- Clear 30-90 day termination notice

- Detailed fee schedule

- Defined scope of authority and approval requirements

- Insurance requirements

- Monthly accounting schedule

- Performance standards (vacancy rates, response times)

Negotiation Tactics

For 1-5 Units:

- Limited negotiation power

- Focus on service quality over fee reduction

- Ask for waived leasing fee for first placement

For 6-15 Units:

- Negotiate down to 9% management fee

- Request reduced or waived leasing fees

- Ask for quarterly property inspections (vs annual)

For 16-30 Units:

- Negotiate 8-9% management fee

- Waive or reduce leasing fees significantly

- Demand monthly property visits/inspections

- Request dedicated property manager (not shared)

For 31+ Units:

- Negotiate 7-8% management fee

- Waive leasing fees entirely or cap at $500/unit

- Reduced maintenance markup (5% instead of 10-15%)

- Dedicated account manager

- Quarterly in-person portfolio review meetings

The Hybrid Approach: Best of Both Worlds

Strategy: Manage some properties yourself, hire professionals for others

DIY These Properties:

- Local properties (under 30 minutes away)

- Newer construction with fewer maintenance issues

- Great tenants who rarely need attention

- Single-family homes (simpler than multi-unit)

Hire Professional For:

- Distant properties (over 30 minutes or out-of-state)

- Multi-family (more complex management)

- Problem properties or difficult tenants

- Properties in landlord-unfriendly states (California, New York, New Jersey)

Benefits:

- Learn property management while keeping some control

- Test professional managers with lower risk

- Optimize cost/benefit for your specific situation

- Transition gradually as portfolio grows

Drawbacks:

- Split attention between DIY and professional

- Can't achieve full economies of scale with PM company

- Risk of inconsistent quality across portfolio

Best for: 3-8 units in transition phase from DIY to full professional management

Real-World Case Studies

Case Study 1: The Burnout Engineer

Profile:

- Software engineer earning $150K/year ($72/hour)

- Owns 4 single-family rentals

- Self-managing for 3 years

- Properties within 45-minute drive

The Problem:

Mark was spending 20-25 hours/month managing his 4 properties:

- Fielding tenant calls during work meetings

- Rushing to properties after work for maintenance issues

- Spending weekends showing vacant units

- Stressed about legal compliance

Financial Analysis:

- Time spent: 20-25 hours/month × $72/hour = $1,440-1,800/month opportunity cost

- Direct DIY costs: $300/month (software, screening, travel)

- Total DIY cost: $1,740-2,100/month ($20,880-25,200 annually)

Professional management quote:

- 10% of $6,000 monthly rent = $600/month

- Leasing fees: ~$150/month averaged

- Total professional cost: $750/month ($9,000 annually)

Decision:

Mark hired professional management and immediately saw:

- Time savings: 20-25 hours/month (240-300 hours annually)

- Actual cost: $9,000 professional minus $3,600 direct DIY costs = $5,400 net increase

- But real savings: $20,880 true DIY cost minus $9,000 professional = $11,880 annually

Outcome After 1 Year:

With his time freed up, Mark:

- Found and closed on 2 additional rental properties (wouldn't have had time while self-managing)

- Added $350/month cash flow from each new property = $700/month = $8,400/year

- New properties professionally managed from day one

- Reduced stress, improved work performance (got promotion worth $15K raise)

Net impact: Spending $5,400 more on management enabled $8,400 in new cash flow plus $15,000 raise = $18,000 total benefit

Mark's reflection: "I thought I was saving $600/month by self-managing. I was actually losing $1,500/month in opportunity cost and burning myself out. Best decision I ever made."

Case Study 2: The Retiree Landlord

Profile:

- Retired teacher, age 63

- Owns 2 duplexes (4 units) in same neighborhood

- Self-managing for 15 years

- Properties 10 minutes away

- Enjoys tenant relationships

The Problem:

Janet's adult children suggested she hire professional management so she could travel and enjoy retirement without being tied to properties.

Financial Analysis:

- Time spent: 12-15 hours/month (comfortable for her)

- Direct DIY costs: $200/month

- Total DIY cost: $2,400 annually (doesn't calculate opportunity cost since retired)

Professional management quote:

- 10% of $4,500 monthly rent = $450/month

- Leasing fees: ~$100/month averaged

- Total professional cost: $550/month ($6,600 annually)

Decision:

Janet decided to KEEP self-managing because:

- She enjoys the tenant interactions (social aspect)

- Properties are close and easy to manage

- She has the time and energy

- $6,600 annual professional cost is significant on fixed retirement income

- Management gives her purpose and structure

Hybrid Compromise:

Janet hired a property manager to be "on call" for:

- When she travels (3-4 weeks per year)

- Emergency situations she can't handle

- Showings and leasing when she's unavailable

Cost: $150/month retainer plus hourly as needed = ~$2,500 annually

Outcome:

Janet continues self-managing but has professional backup, allowing her to:

- Travel guilt-free

- Have emergency support

- Transition gradually toward full professional management as she ages

Janet's reflection: "I'm not ready to give up property management yet—it's part of my identity and keeps me active. But knowing I have professional help available gives me peace of mind."

Lesson: Not every decision is purely financial. Quality of life, enjoyment, and personal preference matter too.

Case Study 3: The Aggressive Scaler

Profile:

- Real estate agent/investor, age 38

- Owns 6 properties (13 units total)

- Self-managing while working full-time

- Goal: 50 units in 5 years

The Problem:

Lisa was spending 35-40 hours/month managing 13 units:

- Properties scattered across 3 cities (30-90 minute drives)

- Mix of single-family, duplex, and small multi-family

- Finding deals and managing properties was overwhelming

- Acquisitions slowing down due to lack of time

Financial Analysis:

- Time spent: 35-40 hours/month × $75/hour (realtor income) = $2,625-3,000/month opportunity cost

- Direct DIY costs: $500/month

- Total DIY cost: $3,125-3,500/month ($37,500-42,000 annually)

Professional management quote:

- 10% of $11,000 monthly rent = $1,100/month

- Leasing fees: ~$250/month averaged

- Total professional cost: $1,350/month ($16,200 annually)

Decision:

Lisa hired professional management for all 13 units immediately.

Outcome After 18 Months:

With 35-40 hours/month freed up, Lisa:

- Acquired 7 additional properties (18 units) in 18 months

- Added $2,800/month cash flow from new properties

- Professional managed all properties from acquisition

- Reduced stress, improved quality of life

- On track to hit 50-unit goal in 3 years instead of 5

Financial Impact:

- Spending $16,200/year on professional management

- New properties generating $33,600/year ($2,800/month × 12)

- Net benefit: $17,400/year plus equity growth on 7 properties

Lisa's reflection: "I was trying to save $1,100/month on management fees and it was costing me my growth. I couldn't find deals because I was too busy managing properties. Hiring management was the unlock that let me scale."

Lesson: For growth-focused investors, professional management isn't a cost—it's an investment that enables acquisitions.

Case Study 4: The Bad Property Manager Story

Profile:

- Small business owner, age 45

- Owns 3 rental properties (5 units)

- Hired budget property management company

- Distant properties (out-of-state)

The Disaster:

Tom hired a discount property management company charging 7% (instead of typical 10%) to manage his out-of-state properties.

Problems discovered over 18 months:

- Financial reports consistently 2-3 weeks late

- Maintenance costs 40% above previous DIY costs

- Tenant turnover increased from 20% to 60%

- Properties deteriorating despite high maintenance spending

- No detailed accounting or receipts

The Discovery:

Tom visited his properties unannounced and found:

- One property had been vacant for 4 months (manager claimed "only 6 weeks")

- Repairs he'd paid for hadn't been completed

- Property condition was poor (dirty, poorly maintained)

- Tenants complained manager never responded to issues

Financial Damage:

- Lost rent from excess vacancy: $8,000

- Excess maintenance charges (kickbacks suspected): $5,000

- Turnover costs from poor management: $6,000

- Attorney fees to terminate contract and transition: $2,000

- Total cost: $21,000 over 18 months

Resolution:

Tom fired the property manager (had to give 90-day notice and pay early termination fee of $1,500) and hired a reputable company at 10%.

New company (6 months in):

- On-time detailed financial reports

- Transparent maintenance with receipts

- Vacancy dropped back to 15%

- Properties improving in condition

- Tom has peace of mind

Tom's reflection: "I tried to save 3% on management fees and it cost me $21,000 plus immense stress. Cheap property managers are expensive. Now I pay 10% happily and my properties are thriving."

Lesson: Don't choose property managers based solely on price. Quality, transparency, and track record matter far more than saving 2-3% on fees.

Actionable Next Steps

For Investors Currently DIY Managing

Step 1: Calculate your true total cost

Use this worksheet:

- Monthly hours spent managing: ______ hours

- Your hourly rate (salary ÷ 2,080): $______

- Opportunity cost (hours × rate): $______

- Direct costs (software, screening, travel): $______

- Total monthly DIY cost: $______

- Annual DIY cost: $______ × 12

Step 2: Get 3 professional management quotes

- Interview at least 3 companies

- Compare fees, services, references

- Check online reviews and licensing

Step 3: Calculate break-even time value

- Professional management cost: $______/year

- Minus direct DIY costs: $______/year

- Net additional cost: $______/year

- Divided by annual hours (180-300): = $______/hour

- This is your break-even hourly rate

If your time is worth more than your break-even rate, hire professional management immediately.

Step 4: Decide your timeline

- Hire immediately (recommended if above break-even)

- Transition at next vacancy

- Test with one property first (hybrid approach)

- Continue DIY with a specific re-evaluation date (6-12 months)

For Investors Currently Using Professional Management

Step 1: Evaluate your current property manager

Review the red flags checklist:

- Financial red flags: _____ (number present)

- Maintenance red flags: _____ (number present)

- Tenant management red flags: _____ (number present)

- Communication red flags: _____ (number present)

- Legal/compliance red flags: _____ (number present)

- Total red flags: _____

Action based on red flags:

- 0-1: Great manager, keep them

- 2-3: Address concerns, set improvement timeline

- 4-5: Begin interviewing replacements

- 6+: Terminate immediately (with proper notice)

Step 2: Negotiate better terms (if satisfied with service)

For 6+ units:

- Request fee reduction to 9% (from 10%)

- Ask for reduced leasing fees

- Negotiate maintenance markup cap

For 15+ units:

- Request 8-9% management fee

- Significantly reduced leasing fees

- Quarterly property visits included

- Dedicated property manager

Step 3: Request performance improvements

Even with good managers, ask for:

- More frequent property inspections

- Enhanced owner portal access

- Detailed monthly reports with photos

- Quarterly performance review calls

For Investors Planning First Rental Purchase

Step 1: Decide management approach before buying

DIY if:

- Buying local property (under 30 minutes)

- You have 10-15 hours/month available

- You want to learn property management

- Your time value is below $50/hour

Professional if:

- Buying distant or out-of-state property

- You have limited time available

- Your time value is $75+/hour

- You plan to scale to 5+ properties quickly

Step 2: Factor management cost into your analysis

When analyzing deals, include:

- 10% property management fee (even if DIY initially)

- This ensures deal works with professional management

- Allows easy transition later

Common mistake: Analyzing with no management cost, then discovering deal doesn't work once you hire professional management.

Step 3: Interview property managers BEFORE buying

If planning to hire professional management:

- Interview 3 companies before purchase

- Understand their criteria for taking on properties

- Some PM companies have minimum rent thresholds

- Know your costs before closing

Final Recommendations

The General Rule: When to DIY vs Hire Professional

DIY Self-Management Works Best For:

- 1-4 units that are local and manageable

- Investors who genuinely enjoy property management

- Learning phase (first 1-2 properties)

- Time-rich, cash-poor investors in early accumulation phase

- Retirees with time and interest in management

Professional Management Makes Sense For:

- 5+ units where time commitment becomes unsustainable

- Distant or out-of-state properties (mandatory)

- High-income earners where time value exceeds 10% fee

- Growth-focused investors who need time for acquisitions

- Investors who find property management stressful or unenjoyable

Hybrid Approach Works For:

- 3-8 units in transition from DIY to professional

- Mix of local and distant properties

- Testing professional management before full commitment

- Cost-conscious investors who want some control

In-House Property Manager Makes Sense For:

- 25-75 units where dedicated staff is economical

- Investors who want control but need help

- Long-term holders who can justify employee overhead

- Operators building property management as a business

The Sophistication Curve

Level 1: New Investor (1-2 properties)

- DIY to learn the business

- Build systems and understand operations

- Transition to professional once you know what good management looks like

Level 2: Growing Portfolio (3-10 properties)

- Shift to professional management

- Free up time for acquisitions

- Focus on your highest-value activity (finding deals, not managing tenants)

Level 3: Established Investor (10-30 properties)

- Professional management for all properties

- Negotiate better terms with volume

- Build systems for portfolio oversight

- Focus on strategy and growth

Level 4: Sophisticated Operator (30-100+ properties)

- Professional management OR in-house team

- Institutional-quality operations

- Technology-driven oversight

- Strategic focus on portfolio optimization and expansion

The Ultimate Insight

Property management is not a binary choice between DIY or professional—it's a strategic decision that should evolve with your portfolio, goals, and life stage.

The key is understanding your true costs (including time value), your personal strengths and preferences, and your long-term goals.

Most successful investors start with DIY management to learn the business, transition to professional management to scale, and then build in-house teams or negotiate volume discounts as they grow to 30-50+ units.

The investors who struggle are those who:

- DIY too long, burning out and limiting growth

- Never learn property management basics before hiring (can't evaluate managers effectively)

- Choose managers based on price instead of quality

- Ignore red flags until significant damage is done

The sweet spot: Learn by doing (DIY) for 1-3 properties, hire professional management once you understand good management, and focus your time on what you do best—building your real estate portfolio.

Ready to hire professional property management? Use our Property Manager Interview Questionnaire (coming soon) to evaluate and select the right management company for your portfolio.

Related Content

📝 Cash vs Leverage in Real Estate: 2026 Investment Guide

Read more about this topic

📝 Best Property Management Software 2026: Complete Comparison Guide

Read more about this topic

📝 Vacation Rental vs Long-Term Rental: Complete 2026 Comparison Guide

Vacation rental vs long-term rental comparison. Compare income, expenses, time investment, regulations, and ROI.

🔧 ROI Calculator

Calculate return on investment

🔧 Property Investment Analyzer

Comprehensive property analysis tool

🔧 BRRRR Calculator

Analyze buy-rehab-rent-refinance deals