1031 Exchange Calculator: Complete Tax-Deferred Real Estate Guide

1031 Exchange Calculator: Complete Tax-Deferred Real Estate Guide

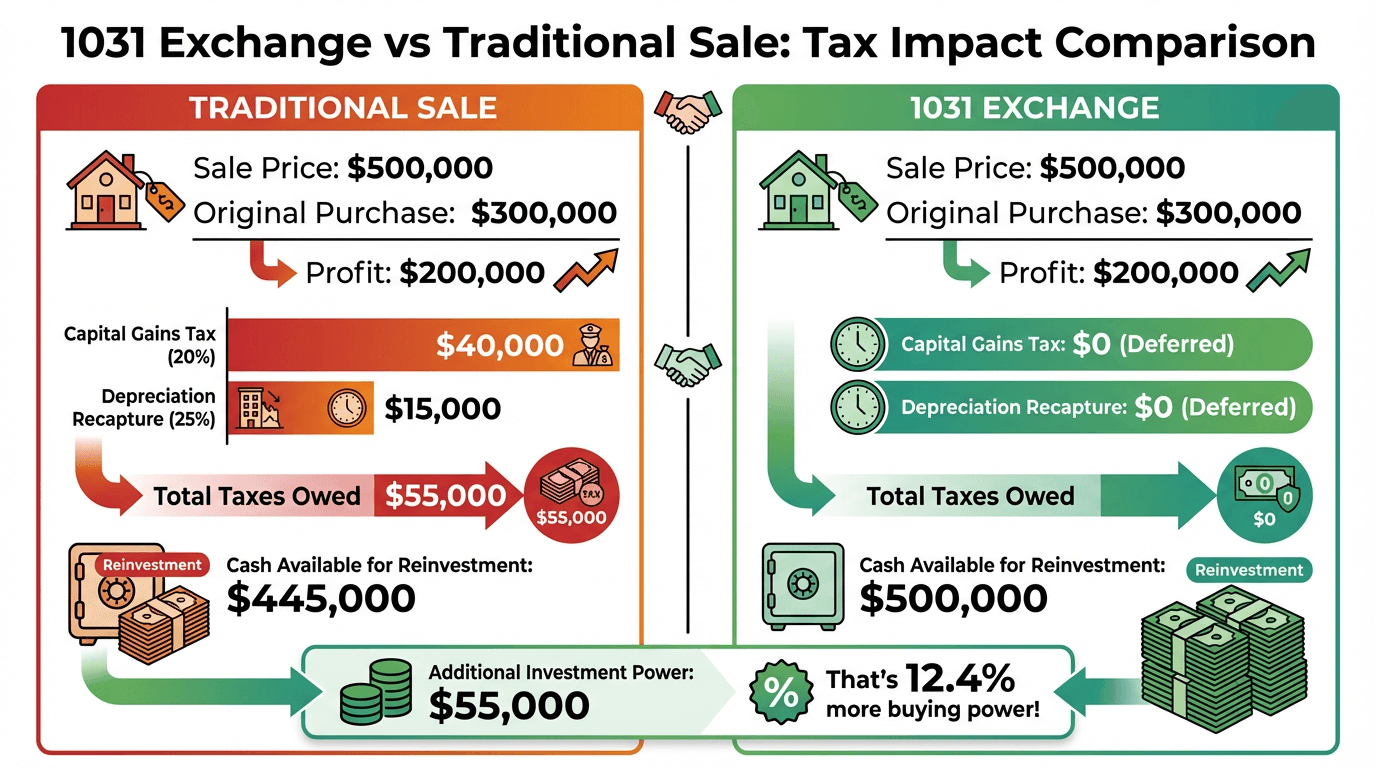

Imagine selling a $500,000 rental property and keeping all $500,000 to reinvest—instead of paying $55,000 in taxes. That's the power of a 1031 exchange.

The 1031 Exchange Formula:

Tax Deferred = Capital Gains Tax + Depreciation Recapture Tax

Buying Power Preserved = Sale Price - 0 (instead of Sale Price - Taxes)

Most investors pay 20 to 37% in combined taxes when selling investment property. With a 1031 exchange, you defer 100% of those taxes and reinvest your full proceeds into larger, better-performing properties.

What is a 1031 Exchange?

A 1031 exchange (named after Internal Revenue Code Section 1031) allows you to defer capital gains taxes and depreciation recapture taxes when you sell an investment property—as long as you reinvest the proceeds into a "like-kind" replacement property.

The Basic Concept

Traditional Sale:

- Sell property for $500,000

- Pay $55,000 in taxes

- Reinvest only $445,000

1031 Exchange:

- Sell property for $500,000

- Pay $0 in taxes (deferred)

- Reinvest full $500,000

That extra $55,000 in buying power allows you to purchase a more valuable property, which generates more income and appreciates more over time.

Why Use a 1031 Exchange?

1. Defer Capital Gains Taxes

When you sell investment real estate, you typically owe:

Federal Capital Gains Tax:

- Short-term (held less than 1 year): 10 to 37% (ordinary income rates)

- Long-term (held 1+ years): 0%, 15%, or 20% (depending on income)

State Capital Gains Tax:

- 0 to 13.3% (varies by state—California is highest)

Net Investment Income Tax (NIIT):

- Additional 3.8% for high earners (over $200,000 single, $250,000 married)

Example:

- Purchase Price: $300,000

- Sale Price: $500,000

- Capital Gain: $200,000

- Federal Tax (20%): $40,000

- NIIT (3.8%): $7,600

- State Tax (CA 13.3%): $26,600

- Total Tax: $74,200

With a 1031 exchange: $0 tax immediately

2. Defer Depreciation Recapture Tax

Depreciation recapture is taxed at 25% (up to the amount of depreciation claimed).

Example:

- Original Purchase: $300,000 (building value: $250,000)

- Depreciation Claimed: $60,000 (over ~7 years)

- Depreciation Recapture Tax: $60,000 × 25% = $15,000

A 1031 exchange defers this tax as well.

3. Build Wealth Faster

By deferring taxes and reinvesting your full proceeds, you can:

- Purchase larger properties

- Increase cash flow

- Diversify into multiple properties

- Move to better markets

- Trade up repeatedly throughout your investing career

Wealth-Building Example:

Without 1031 Exchange:

- Sell Property A: $500,000 → Pay $55,000 taxes → Reinvest $445,000

- Property B appreciates 5%/year → After 10 years: $724,841

With 1031 Exchange:

- Sell Property A: $500,000 → Pay $0 taxes → Reinvest $500,000

- Property B appreciates 5%/year → After 10 years: $814,447

Difference: $89,606 more wealth in 10 years

And you can keep deferring taxes by doing multiple 1031 exchanges throughout your life!

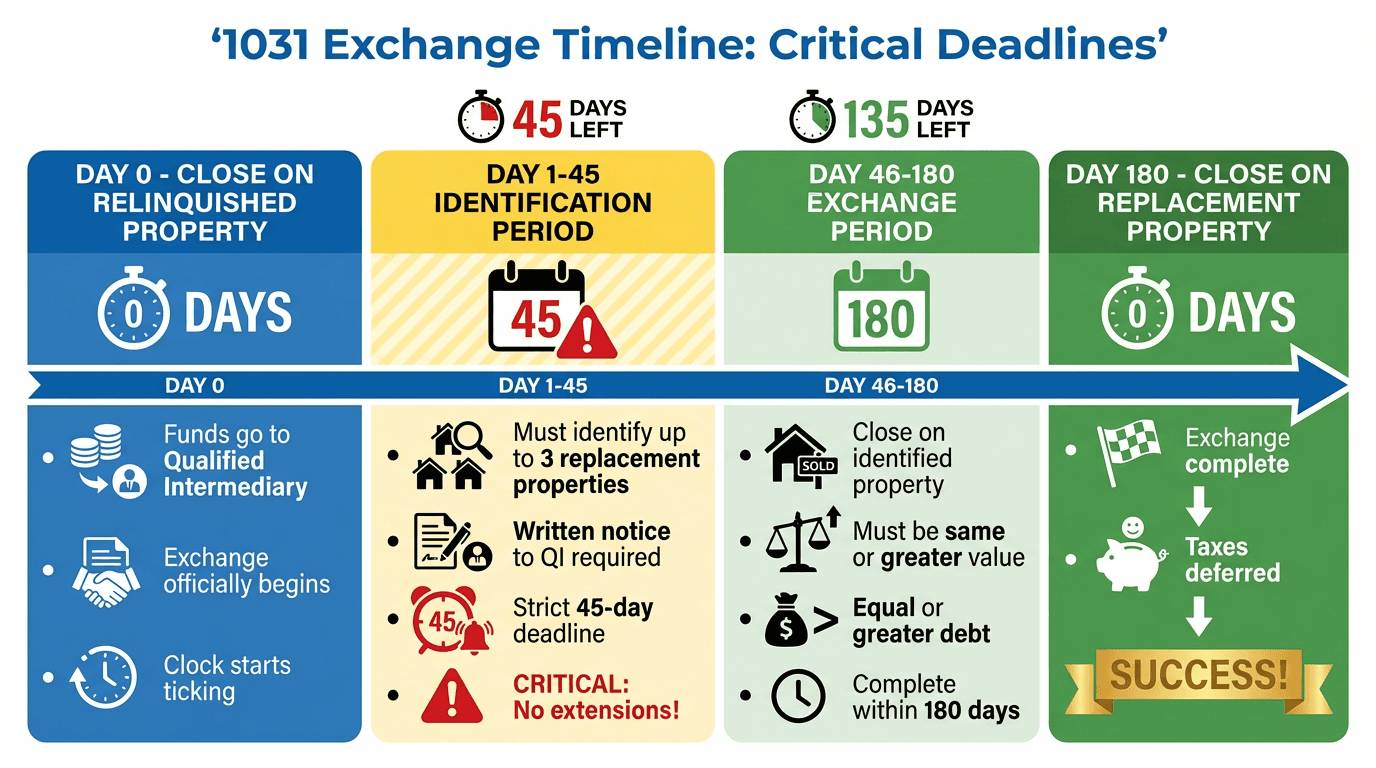

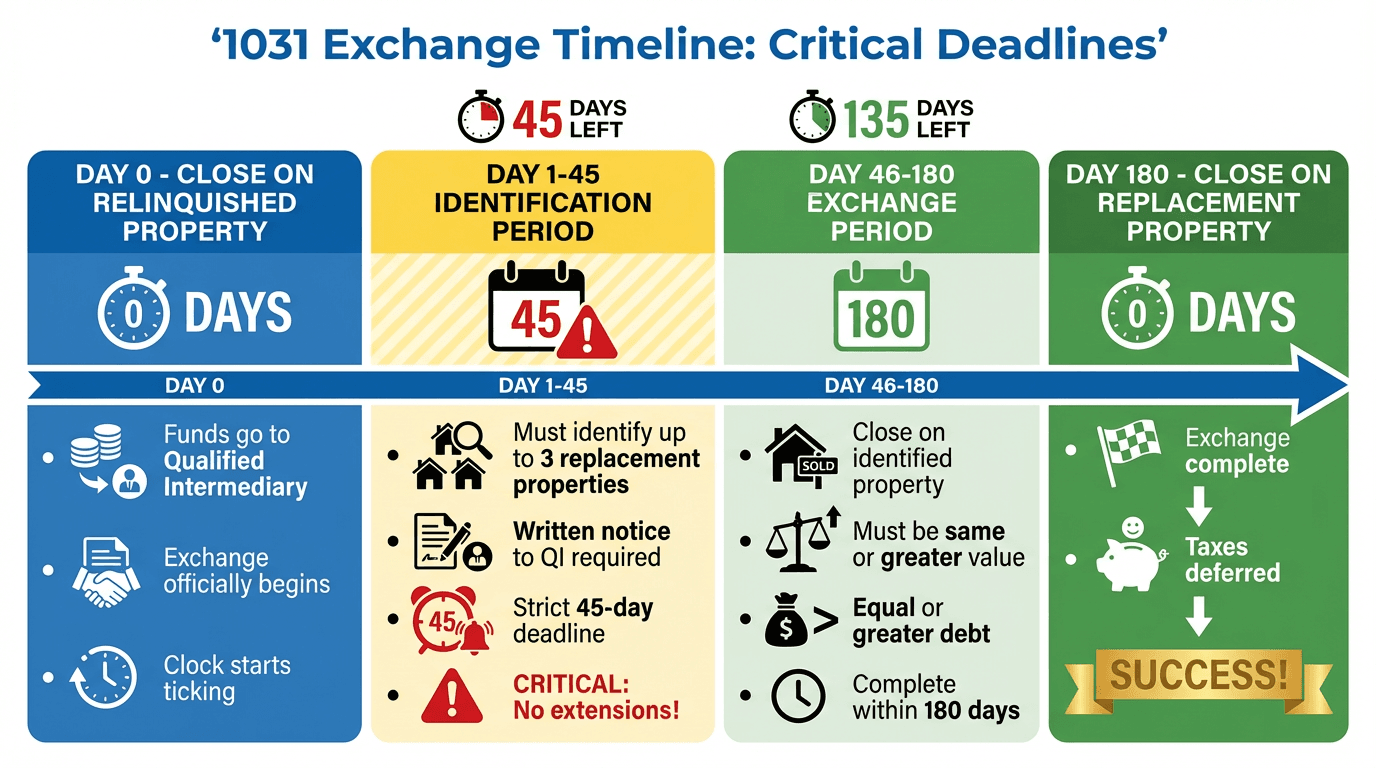

The Critical 1031 Exchange Timeline

The IRS has strict deadlines for 1031 exchanges. Miss them and you lose the tax deferral.

Day 0: Relinquished Property Closes

The day your original property sale closes is Day 0. The clock starts ticking immediately.

Action Items:

- Funds go directly to Qualified Intermediary (QI)

- You never touch the money

- Begin searching for replacement property

Day 1 to 45: Identification Period

You have 45 calendar days from closing to formally identify potential replacement properties in writing to your QI.

Identification Rules (choose one):

-

Three-Property Rule (Most Common)

- Identify up to 3 properties of any value

- Must close on at least one

-

200% Rule

- Identify any number of properties

- Combined value cannot exceed 200% of relinquished property value

-

95% Rule

- Identify any number of properties of any value

- Must close on 95% of identified value

Best Practice: Identify 3 properties to give yourself options.

Day 46 to 180: Closing Period

You have 180 calendar days from the relinquished property closing (or your tax return due date, whichever is earlier) to close on your replacement property.

Critical Notes:

- The 180 days run concurrently with the 45-day identification period (not in addition to)

- You can only purchase properties you identified in writing during the first 45 days

- Extensions are not allowed (except in disaster declarations)

Timeline Example:

- Day 0: Sell property (June 1)

- Day 45: Identify replacements (July 16)

- Day 180: Close on replacement (November 28)

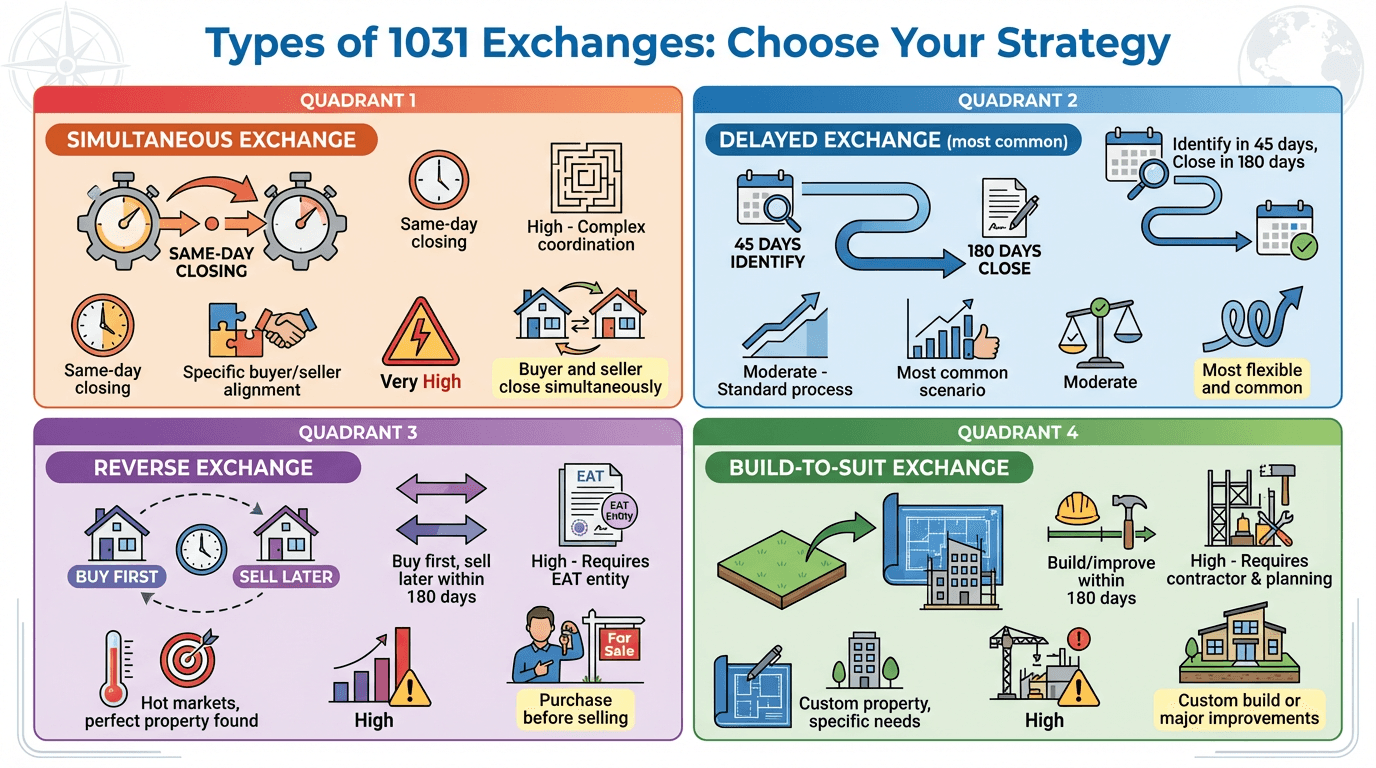

Types of 1031 Exchanges

There are four main types of 1031 exchanges, each suited to different situations:

1. Delayed Exchange (Most Common)

What it is: Sell your property first, then buy the replacement property within 180 days.

Timeline:

- Day 0: Close on relinquished property

- Day 1 to 45: Identify replacement properties

- Day 46 to 180: Close on replacement property

Best for: 95% of all exchanges. This is the standard structure.

Pros:

- Most flexible

- Qualified Intermediaries handle it routinely

- Established legal precedent

Cons:

- Must find and close on replacement within 180 days

- Market conditions might change

2. Simultaneous Exchange

What it is: Close on both properties on the same day.

Timeline:

- Both closings happen simultaneously (same day)

Best for: Rare situations where you've already found the perfect replacement and both parties are ready to close on the same day.

Pros:

- Immediate completion

- No holding period

Cons:

- Extremely difficult to coordinate

- Very rare in practice

- High failure risk if either closing falls through

3. Reverse Exchange

What it is: Purchase the replacement property first, then sell your relinquished property within 180 days.

Timeline:

- Day 0: Close on replacement property (held by Exchange Accommodation Titleholder)

- Day 1 to 180: Sell your relinquished property

Best for:

- Hot markets where you must act fast on the replacement

- You found the perfect property but haven't sold yet

Pros:

- Secure replacement property first

- No risk of losing the replacement

Cons:

- Much more complex and expensive

- Requires Exchange Accommodation Titleholder (EAT) entity

- Higher QI fees ($3,000 to $10,000+)

- You need financing to purchase before selling

4. Build-to-Suit (Improvement) Exchange

What it is: Use exchange proceeds to purchase land and construct improvements, or purchase property and make improvements during the 180-day exchange period.

Timeline:

- Day 0: Relinquished property closes

- Day 1 to 45: Identify replacement property

- Day 46 to 180: Purchase property + complete improvements

Best for:

- Developers and active investors

- You want to build or substantially improve the replacement property

Pros:

- Customize the replacement property

- Add value immediately

Cons:

- Complex structure

- Improvements must be complete by day 180 (you can't defer incomplete work)

- High coordination requirements

- Requires EAT entity

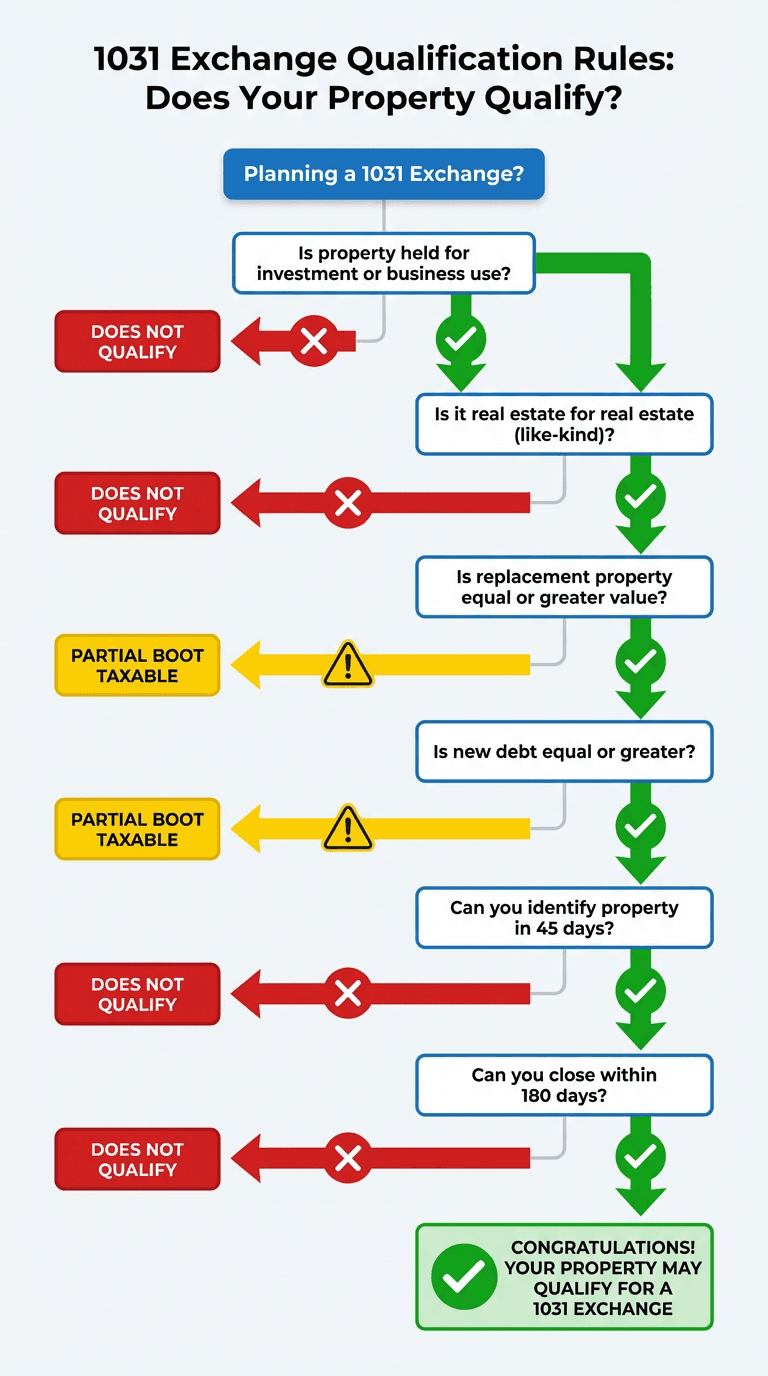

1031 Exchange Qualification Rules

Not every property or transaction qualifies. Here are the requirements:

Rule 1: Investment or Business Use (Both Properties)

Qualifies:

- Rental properties (residential or commercial)

- Commercial buildings

- Industrial properties

- Land held for investment

- Vacation rentals (with proper documentation)

Does NOT Qualify:

- Primary residences

- Second homes used personally

- Fix-and-flip properties (held for sale, not investment)

- Properties held primarily for resale

The IRS Test: Intent matters. Hold property for at least 1 to 2 years and rent it out to demonstrate investment intent.

Rule 2: Like-Kind Property

After the Tax Cuts and Jobs Act (2017), only real estate qualifies for 1031 exchanges.

Like-Kind Means:

- Any U.S. real estate can be exchanged for any other U.S. real estate

- Residential rental → Commercial building ✓

- Apartment building → Raw land ✓

- Single-family rental → Office building ✓

- Retail → Industrial ✓

Does NOT Qualify:

- U.S. property for foreign property

- Real estate for personal property (vehicles, equipment, etc.)

- Real estate for stocks, bonds, or crypto

Rule 3: Equal or Greater Value

To defer 100% of capital gains taxes, your replacement property must be:

- Equal or greater in value than the relinquished property

- Equal or greater debt (or add cash to offset debt reduction)

What is "Boot"?

Boot = any value you receive that is not like-kind property. Boot is taxable.

Types of Boot:

- Cash Boot: You receive cash from the exchange

- Mortgage Boot: You reduce debt without replacing it

- Personal Property Boot: Non-real estate items included in sale

Example:

- Sell property for $500,000 (with $300,000 mortgage)

- Buy replacement for $450,000 (with $250,000 mortgage)

- Cash boot: $50,000 (taxable)

- Mortgage boot: $50,000 (taxable)

To avoid boot: Purchase replacement property worth $500,000 or more with debt of $300,000 or more.

Rule 4: Use a Qualified Intermediary (QI)

You cannot touch the sale proceeds. Doing so disqualifies the exchange.

Qualified Intermediary:

- A third-party facilitator (not your agent, attorney, or family member)

- Holds the proceeds in escrow

- Handles all documentation

- Coordinates the exchange

How it Works:

- You hire a QI before closing on the relinquished property

- The QI is written into the purchase agreement

- Sale proceeds go directly to the QI

- QI holds funds until you close on the replacement property

- QI transfers funds directly to the replacement property seller

QI Fees: Typically $800 to $1,500 for a standard delayed exchange.

Rule 5: Same Taxpayer

The taxpayer who sells the relinquished property must be the same taxpayer who buys the replacement property.

Examples:

✓ John Doe sells → John Doe buys

✓ ABC LLC sells → ABC LLC buys

✗ John Doe sells → Jane Doe buys

✗ John Doe sells → John Doe LLC buys

Exception: You can convert from individual to LLC (or vice versa) if structured properly with legal counsel (disregarded entity rules).

How to Use the 1031 Exchange Calculator

Our calculator helps you estimate:

- Capital gains taxes owed (traditional sale)

- Depreciation recapture taxes owed

- Total tax deferred through 1031 exchange

- Additional buying power from tax deferral

Step 1: Enter Property Sale Information

Original Purchase Price: What you paid for the property (including closing costs)

Current Sale Price: What you're selling the property for

Years Owned: How long you've held the property

Example:

- Original Purchase: $300,000

- Sale Price: $500,000

- Years Owned: 7 years

Step 2: Enter Tax Information

Federal Capital Gains Rate: Based on your income

- 0%, 15%, or 20% (most investors pay 15% or 20%)

State Tax Rate: Your state's capital gains rate

- California: 13.3% (highest)

- Texas, Florida: 0% (no state income tax)

Net Investment Income Tax (NIIT): 3.8% if you earn over $200,000 (single) or $250,000 (married)

Step 3: Enter Depreciation Information

Accumulated Depreciation: Total depreciation claimed

- Residential rental: Building value ÷ 27.5 years × years owned

- Commercial: Building value ÷ 39 years × years owned

Example:

- Purchase Price: $300,000

- Land Value: $50,000

- Building Value: $250,000

- Years Owned: 7

- Depreciation: $250,000 ÷ 27.5 × 7 = $63,636

Depreciation Recapture Rate: 25% federal

Step 4: Review Your Results

The calculator shows:

Traditional Sale:

- Capital Gains Tax

- Depreciation Recapture Tax

- State Tax

- Net Investment Income Tax

- Total Taxes Owed

- Net Proceeds After Tax

1031 Exchange:

- Taxes Deferred: $0

- Full Proceeds Available: 100% of sale price

- Additional Buying Power: The tax savings amount

Real-World 1031 Exchange Examples

Example 1: The Upgrade Exchange (Success)

Situation:

- Sarah owns a duplex in Austin, TX

- Purchase Price: $280,000 (5 years ago)

- Current Value: $420,000

- Monthly Cash Flow: $800

- She wants to scale up

Without 1031 Exchange:

- Sale Price: $420,000

- Capital Gain: $140,000

- Depreciation Claimed: $45,000

- Federal Capital Gains Tax (20%): $28,000

- Depreciation Recapture (25%): $11,250

- NIIT (3.8%): $5,320

- Total Tax: $44,570

- Net Proceeds: $375,430

With 1031 Exchange:

- Sale Price: $420,000

- Tax Deferred: $44,570

- Full Proceeds Available: $420,000

- Purchased: Small apartment building (8 units) for $850,000

- Down Payment: $420,000 (full proceeds)

- New Cash Flow: $3,200/month (4× higher!)

Result: Sarah quadrupled her cash flow and deferred $44,570 in taxes.

Example 2: The Portfolio Diversification Exchange (Success)

Situation:

- Mike owns a $600,000 single-family rental in San Jose, CA (high-cost market)

- Cash flow: $500/month (2% cash-on-cash return)

- He wants better returns

1031 Exchange Strategy:

- Sold San Jose property: $600,000

- Deferred taxes: $95,000

- Purchased 3 properties in Phoenix, AZ (lower-cost market):

- Duplex 1: $220,000

- Duplex 2: $210,000

- Duplex 3: $215,000

- Total: $645,000

- Combined Cash Flow: $2,800/month (8% cash-on-cash return)

Result: Mike increased his cash flow by 5.6× and diversified into 3 properties across 3 neighborhoods.

Example 3: The Vacation Home Conversion (Partial Success)

Situation:

- Linda owns a mountain cabin she rents out occasionally

- Purchase Price: $350,000

- Sale Price: $500,000

- Personal use: 30 days/year

- Rental use: 100 days/year

The Problem: Mixed-use properties have partial tax deferral.

IRS Rules for Vacation Rentals:

- Must rent at fair market value

- Must hold for investment (not primarily personal use)

- Safe harbor: Rent 14+ days AND personal use less than 14 days or 10% of rental days

Linda's Approach:

- Stopped personal use for 2 years before selling (to demonstrate investment intent)

- Rented property full-time

- Documented rental income on Schedule E

Result:

- Successfully completed 1031 exchange

- Deferred $38,000 in taxes

- Purchased 2 long-term rental properties

Lesson: Plan ahead. If you use a property personally, convert it to 100% rental at least 1 to 2 years before selling.

Common 1031 Exchange Mistakes to Avoid

Mistake 1: Missing the 45-Day Identification Deadline

The Problem: The 45-day identification period is strict—no exceptions. Investors often:

- Wait too long to start searching

- Don't put identification in writing

- Fail to send identification to the QI

The Solution:

- Start searching for replacement properties immediately after closing

- Identify 3 properties to give yourself options

- Submit written identification to your QI by day 40 (5-day buffer)

Mistake 2: Touching the Money

The Problem: If you receive any proceeds (even temporarily), the exchange is disqualified.

Examples of Disqualification:

- Asking the QI to send funds to your account

- Using funds to pay off personal debt

- Taking a distribution before closing on replacement

The Solution:

- Never touch the money

- All proceeds go directly from relinquished sale → QI → replacement purchase

- Your QI handles all fund transfers

Mistake 3: Buying a Lower-Value Property (Boot)

The Problem: If you purchase a replacement property worth less than your relinquished property, the difference is taxable boot.

Example:

- Sell property: $500,000

- Buy replacement: $450,000

- Taxable boot: $50,000

The Solution:

- Purchase equal or greater value: $500,000+

- Maintain equal or greater debt

- Add cash if reducing debt

Mistake 4: Not Planning for Mortgage Debt

The Problem: Debt reduction creates mortgage boot (taxable).

Example:

- Relinquished property debt: $300,000

- Replacement property debt: $250,000

- Mortgage boot: $50,000 (taxable)

The Solution:

- Maintain equal or greater debt on replacement

- Or add cash to offset debt reduction ($50,000 cash in this example)

Mistake 5: Using the Wrong Property Type

The Problem: Primary residences, fix-and-flips, and properties held for resale don't qualify.

The Solution:

- Use only investment or business-use properties

- Hold property at least 1 to 2 years before selling

- Document rental income (Schedule E)

Advanced 1031 Exchange Strategies

Strategy 1: The Infinite Exchange Chain

You can do multiple 1031 exchanges throughout your investing career, deferring taxes indefinitely.

Example:

- Age 30: Buy duplex for $200,000

- Age 35: 1031 into fourplex for $400,000

- Age 40: 1031 into small apartment (12 units) for $1,000,000

- Age 50: 1031 into large apartment (50 units) for $3,500,000

- Age 65: 1031 into triple-net lease commercial for $5,000,000 (passive income)

Result: Never paid capital gains taxes. Built a $5M portfolio from $200,000 starting point.

Strategy 2: The Step-Up Basis at Death

When you die, your heirs receive a step-up in basis to current market value—eliminating all deferred capital gains taxes.

Example:

- You bought property for $300,000

- Exchanged multiple times, now worth $2,000,000

- You die

- Heirs inherit at $2,000,000 basis

- All deferred taxes eliminated

This is the ultimate 1031 exit strategy: never pay the taxes.

Strategy 3: The 721 UPREIT Exchange

Convert 1031 property into a Real Estate Investment Trust (REIT) for liquidity without triggering taxes.

How it Works:

- Complete a 1031 exchange into a property held by a REIT

- Contribute property to the REIT

- Receive Operating Partnership (OP) units

- OP units can eventually be converted to REIT shares (liquid)

Benefits:

- Defer taxes indefinitely

- Gain liquidity over time

- Diversify into institutional-quality real estate

- Professional management

Drawbacks:

- Complex structure

- Limited REIT options

- Less control

Strategy 4: Delaware Statutory Trust (DST)

A DST allows you to invest in fractional ownership of institutional-quality real estate.

How it Works:

- Sell your property via 1031 exchange

- Purchase fractional interests in a DST (pre-packaged institutional property)

- DST owns and manages the property

- You receive passive income

Benefits:

- 100% passive (no management)

- Institutional-quality properties (Class A apartments, medical buildings, etc.)

- Low minimums ($100,000 typical)

- Can diversify into multiple DSTs

Best For:

- Investors tired of management

- Investors who can't find suitable replacement properties

- Estate planning (easier to divide among heirs)

Drawbacks:

- No control

- Illiquid (7 to 10 year hold)

- Fees (1 to 2%)

1031 Exchange Costs and Fees

Qualified Intermediary Fees

- Standard delayed exchange: $800 to $1,500

- Reverse exchange: $3,000 to $10,000+

- Build-to-suit exchange: $5,000 to $15,000+

Professional Fees

- CPA/Tax Advisor: $500 to $2,000

- Real Estate Attorney: $1,000 to $3,000 (for complex exchanges)

- Title and Escrow: Standard closing costs

Total Cost: $2,000 to $5,000 for a standard delayed exchange

Return on Investment: If you're deferring $40,000 to $100,000 in taxes, a $3,000 investment in a 1031 exchange is well worth it.

Frequently Asked Questions

Can I do a 1031 exchange on my primary residence?

No. Primary residences don't qualify for 1031 exchanges because they're not held for investment or business use.

However, you may qualify for the primary residence capital gains exclusion: up to $250,000 (single) or $500,000 (married) tax-free if you lived in the home 2 of the last 5 years.

Can I convert a primary residence into a rental and then do a 1031 exchange?

Yes, but you must hold it as a rental for at least 1 to 2 years before selling to demonstrate investment intent.

Best Practice:

- Convert to rental

- Rent it out for 2+ years

- Document all rental income (Schedule E)

- Then sell via 1031 exchange

Can I do a 1031 exchange with a fix-and-flip property?

Generally no. Fix-and-flip properties are considered "held for sale" (inventory), not investment properties.

The IRS looks at:

- Holding period (flips are usually less than 1 year)

- Intent (purchased to resell quickly)

- Number of transactions (frequent flipping indicates dealer status)

If you flip properties regularly, you're considered a dealer and don't qualify for 1031 exchanges.

What happens if I can't find a replacement property in 180 days?

If you don't close on a replacement property by day 180, the exchange fails and you owe all taxes immediately.

Backup Option: Delaware Statutory Trust (DST)

- If you can't find a suitable property by day 170, consider a DST

- DSTs close quickly (within days)

- Allows you to complete the exchange and defer taxes

Can I take some cash out and still do a partial 1031 exchange?

Yes, but the cash you receive is taxable boot.

Example:

- Sell property for $500,000

- Take $50,000 cash

- Reinvest $450,000 into replacement property

- Tax owed on $50,000 boot

If you need cash, consider refinancing the replacement property after the exchange instead of taking boot.

Can I exchange one property for multiple properties?

Yes! This is common.

Example:

- Sell one $800,000 property

- Buy four $200,000 properties

- Must meet equal-or-greater-value rule ($800,000 total)

Can I exchange multiple properties for one property?

Yes!

Example:

- Sell three $200,000 properties ($600,000 total)

- Buy one $650,000 property

- Defer all taxes

Do I have to pay taxes eventually?

Only if you:

- Sell without doing another 1031 exchange

- Take cash boot

- Reduce debt without offsetting with cash

The Infinite Deferral Strategy:

- Keep doing 1031 exchanges throughout your life

- When you die, your heirs receive a step-up in basis

- All deferred taxes are eliminated

Can I use a 1031 exchange for property outside the U.S.?

No. After 2017, only U.S. real estate qualifies. You cannot exchange:

- U.S. property for foreign property

- Foreign property for U.S. property

- Foreign property for foreign property (for U.S. taxpayers)

Can I live in the replacement property after the exchange?

Not immediately. The replacement property must be held for investment or business use.

Safe Harbor Rule:

- Hold as rental for at least 2 years (some advisors recommend 3 to 5 years)

- Rent to a third party at fair market value

- Then you can convert to personal use

Final Thoughts: Is a 1031 Exchange Right for You?

A 1031 exchange is one of the most powerful wealth-building tools for real estate investors. It allows you to:

- Defer 100% of capital gains and depreciation recapture taxes

- Reinvest your full proceeds into larger, better properties

- Build wealth faster through tax-deferred compounding

- Create an infinite chain of exchanges throughout your investing career

You should consider a 1031 exchange if:

- You're selling an investment property

- You owe significant taxes ($20,000+)

- You want to reinvest in more real estate

- You have time to find a suitable replacement (180 days)

You should NOT do a 1031 exchange if:

- You want to cash out and exit real estate

- You're selling a primary residence (use the $250,000/$500,000 exclusion instead)

- You're a fix-and-flip dealer

- You need the cash for non-real estate purposes

Next Steps:

- Use our 1031 Exchange Calculator to estimate your tax savings

- Consult with a CPA or tax advisor

- Find a Qualified Intermediary before listing your property

- Start identifying replacement properties early

- Follow the 45-day and 180-day deadlines strictly

With proper planning and execution, a 1031 exchange can save you tens of thousands (or even hundreds of thousands) in taxes—and help you build generational wealth through real estate.

Step-by-Step: How to Execute a 1031 Exchange

Phase 1: Pre-Sale Planning (30 to 60 Days Before Listing)

Action 1: Consult with a Tax Advisor

Before listing your property, meet with a CPA or tax advisor to:

- Calculate your potential tax liability

- Confirm your property qualifies for 1031 exchange

- Understand your investment goals

- Discuss replacement property criteria

Cost: $500 to $1,500

Action 2: Select a Qualified Intermediary

Research and hire a QI before you list your property.

How to Choose a QI:

- Check credentials (look for membership in Federation of Exchange Accommodators)

- Verify they maintain separate escrow accounts (not commingled funds)

- Ask about insurance and bonding (errors and omissions insurance)

- Check references from other investors

- Understand fee structure

Questions to Ask:

- How long have you been facilitating exchanges?

- How many exchanges do you complete annually?

- What happens to my funds? (Should be in separate escrow account)

- What insurance protections do you have?

- What are your fees for different exchange types?

Cost: $800 to $1,500 for delayed exchange

Action 3: Notify Your Real Estate Agent

Tell your agent you're doing a 1031 exchange BEFORE listing. They need to:

- Include 1031 language in the listing

- Notify potential buyers

- Coordinate with your QI

- Understand the timeline constraints

Phase 2: Marketing and Sale (30 to 90 Days)

Action 4: Add 1031 Exchange Language to Purchase Agreement

Your purchase agreement must include cooperation and assignment language allowing your QI to step into the transaction.

Standard 1031 Language: "Seller is completing this sale as part of an IRC Section 1031 tax-deferred exchange. Buyer agrees to cooperate with Seller's exchange and hold Seller harmless for any delays. Seller has the right to assign this contract to a Qualified Intermediary."

Action 5: Coordinate with QI Before Closing

2 to 3 weeks before closing:

- Notify your QI of the pending sale

- Provide purchase agreement and property details

- Sign exchange agreement with QI

- Confirm closing date

Action 6: Start Searching for Replacement Properties

Don't wait until after closing. Begin identifying potential replacements immediately.

Where to Search:

- MLS listings (work with local agents in target markets)

- LoopNet (commercial properties)

- Zillow, Redfin (residential rentals)

- Networking with other investors

- Direct mail campaigns

- Wholesalers and turnkey providers

Phase 3: Closing on Relinquished Property (Day 0)

What Happens at Closing:

-

QI is Named in Closing Documents

- QI becomes the "seller" on closing documents

- You assign your rights to the QI

-

Proceeds Go Directly to QI

- Buyer pays QI (not you)

- QI deposits funds into exchange escrow account

- You never touch the money

-

Clock Starts Ticking

- Day 0 = closing date

- 45-day identification deadline begins

- 180-day closing deadline begins

-

You Receive Closing Statement

- Shows sale price, closing costs, net proceeds

- Confirms funds transferred to QI

Critical: Do NOT take any proceeds. This disqualifies the exchange.

Phase 4: Identification Period (Day 1 to Day 45)

You have 45 calendar days to identify potential replacement properties in writing.

Action 7: Identify Replacement Properties (By Day 40)

Identification Requirements:

- Must be in writing

- Must be signed by you (the taxpayer)

- Must be delivered to QI (email, fax, or certified mail)

- Must clearly identify each property (address and legal description)

Choose Your Identification Rule:

Three-Property Rule (Most Common):

- Identify up to 3 properties of any value

- Must close on at least 1 of the 3

- Recommended: Identify all 3 to give yourself options

200% Rule:

- Identify any number of properties

- Combined fair market value cannot exceed 200% of relinquished property value

- Must close on one or more

Example:

- Sold property for $500,000

- Can identify properties totaling up to $1,000,000 (200%)

- Example: Four $250,000 properties = $1,000,000 total

95% Rule:

- Identify any number of properties of any value

- Must close on 95% of total identified value

Example:

- Identify 10 properties totaling $2,000,000

- Must close on $1,900,000 worth (95%)

Best Practice: Use the three-property rule. Identify three solid options to give yourself flexibility.

Sample Identification Letter:

[Date]

To: [Qualified Intermediary Name]

[QI Address]

RE: Identification of Replacement Property

Taxpayer: [Your Name]

Relinquished Property: [Address]

Sale Date: [Date]

Pursuant to IRC Section 1031 and Treasury Regulation 1.1031(k)-1(c), I hereby identify the following replacement properties:

Property 1:

Address: 123 Main Street, Austin, TX 78701

Legal Description: Lot 5, Block 12, ABC Addition

Property 2:

Address: 456 Oak Avenue, Austin, TX 78702

Legal Description: Lot 8, Block 3, XYZ Subdivision

Property 3:

Address: 789 Elm Drive, Austin, TX 78703

Legal Description: Lot 2, Block 7, DEF Addition

Signed: ________________________

Date: __________________________

Action 8: Submit Identification by Day 40

Don't wait until the last minute. Submit your identification by day 40 to account for:

- Weekends and holidays

- Delivery delays

- Corrections if needed

Confirmation: Get written confirmation from your QI that they received your identification.

Phase 5: Acquisition Period (Day 46 to Day 180)

Action 9: Make Offers on Identified Properties

As soon as you identify properties (even before day 45), start making offers.

Tips:

- Don't mention you're in a 1031 exchange during negotiations (reduces your leverage)

- Work with experienced agents who understand investment properties

- Have financing pre-approved

- Be ready to move quickly

Action 10: Conduct Due Diligence

Even under time pressure, don't skip due diligence:

Property Inspection:

- Professional home inspection

- Roof inspection

- HVAC inspection

- Pest inspection

- Sewer scope (if older property)

Financial Analysis:

- Review rent rolls (if tenants in place)

- Verify rental comps

- Review property tax history

- Confirm insurance costs

- Analyze cash flow

Legal Review:

- Title search

- Survey

- Zoning confirmation

- HOA documents (if applicable)

- Environmental assessment (if commercial)

Typical Due Diligence Period: 7 to 14 days

Action 11: Coordinate Closing with QI

2 to 3 weeks before closing:

- Notify QI of pending purchase

- Provide purchase agreement

- Confirm closing date

- Ensure QI is included in closing documents

What Happens at Closing:

-

QI is Named as Buyer

- QI becomes the "buyer" on closing documents

- QI immediately assigns the property to you

-

QI Pays for Property

- QI transfers exchange funds directly to seller

- Any additional funds needed come from you (new financing or cash)

-

Title Transfers to You

- Property is deeded directly to you

- Exchange is complete

-

Congratulations!

- You've successfully deferred your capital gains taxes

- You own a new investment property

State-Specific 1031 Exchange Considerations

California

State Tax Rate: 13.3% (highest in the nation)

Special Considerations:

- California taxes capital gains as ordinary income

- High combined federal + state + NIIT tax can exceed 37%

- 1031 exchanges provide massive tax savings for CA investors

Popular Strategy: Many CA investors sell high-priced CA properties and exchange into multiple lower-priced properties in TX, FL, TN, or AZ (states with no income tax and better cash flow).

Withholding: CA may require withholding on sales over $100,000. Your QI and escrow will coordinate.

New York

State Tax Rate: 10.9% (NYC residents pay additional city tax)

Special Considerations:

- NY has complex transfer taxes (especially NYC)

- Co-op apartments generally don't qualify for 1031 (not real property)

- Condos qualify

Mansion Tax: NYC properties over $1 million have additional transfer taxes (1% to 3.9%).

Texas, Florida, Nevada, Washington (No State Income Tax)

Advantage: No state capital gains tax means lower total tax burden.

Federal Only:

- Federal capital gains: 15% to 20%

- NIIT: 3.8% (if applicable)

- Depreciation recapture: 25%

Strategy: Still beneficial to do 1031 exchanges to defer federal taxes and reinvest full proceeds.

Multi-State Exchanges

You can exchange property in one state for property in another state.

Example:

- Sell property in California

- Buy property in Texas

- Defer all federal and CA state taxes

Best For: Moving to lower-tax states or better cash flow markets.

1031 Exchange vs. Other Tax Strategies

1031 Exchange vs. Installment Sale

Installment Sale:

- Seller finances the sale

- Taxes paid over time as payments are received

- Interest income is taxable

1031 Exchange:

- Defer 100% of taxes immediately

- Reinvest full proceeds

- Build wealth faster

Winner: 1031 exchange for active investors who want to reinvest.

1031 Exchange vs. Opportunity Zone Investment

Opportunity Zone:

- Invest capital gains into Qualified Opportunity Fund

- Defer taxes until 2026 (or sale of OZ investment)

- Potential for tax-free appreciation after 10 years

1031 Exchange:

- Defer taxes indefinitely

- Full control over property selection

- Can do infinite exchanges

Winner: Depends on goals. OZ is good for long-term holds (10+ years). 1031 is more flexible.

1031 Exchange vs. Primary Residence Exclusion

Primary Residence Exclusion:

- $250,000 (single) or $500,000 (married) tax-free gain

- Must live in home 2 of last 5 years

- Can use once every 2 years

1031 Exchange:

- Unlimited tax deferral

- Only for investment properties

Strategy: Use both!

- Convert rental to primary residence

- Live in it 2 years

- Sell and claim $250,000 to $500,000 exclusion

- Remaining gain: do 1031 exchange

When NOT to Do a 1031 Exchange

Situation 1: You're in the 0% Capital Gains Bracket

If your taxable income is under $44,625 (single) or $89,250 (married) in 2024, you pay 0% federal capital gains tax.

In this case: You might be better off selling, paying $0 federal tax, and cashing out.

Situation 2: You Need Cash for Non-Real Estate Purposes

If you need the cash to:

- Pay off debt

- Start a business

- Retire and live off the proceeds

In this case: A 1031 exchange doesn't help. Pay the taxes and move on.

Situation 3: You're Selling at a Loss

If you're selling a property for less than you paid, you have a capital loss (not a gain). No taxes to defer, so no benefit to a 1031 exchange.

Better Strategy: Sell normally and use the capital loss to offset other gains.

Situation 4: You're a Fix-and-Flip Dealer

Dealers (frequent flippers) don't qualify for 1031 exchanges. Their properties are considered inventory (held for resale), not investment properties.

Situation 5: You Want to Cash Out and Exit Real Estate

If you're done with real estate investing and want liquidity, pay the taxes and exit.

Alternative: Consider a Delaware Statutory Trust (DST) for 100% passive income if you want to stay in real estate but stop managing properties.

1031 Exchange Tax Reporting

Form 8824: Like-Kind Exchanges

You must file IRS Form 8824 with your tax return for the year of the exchange.

Information Required:

- Description of properties exchanged

- Dates of transfer

- Relationship to other party (if related)

- Fair market value of properties

- Adjusted basis of relinquished property

- Gain or loss (if any boot received)

Your CPA or tax preparer will complete this form.

Depreciation on Replacement Property

When you acquire the replacement property, your carryover basis from the relinquished property affects depreciation.

Example:

- Relinquished property basis: $200,000

- Replacement property value: $500,000

- Your basis in replacement: $200,000 (carryover) + any additional cash invested

- Depreciation: Based on carryover basis (not full $500,000)

This is complex. Work with a CPA to calculate correctly.

1031 Exchange Tools and Resources

Qualified Intermediaries (Sample)

- IPX1031: National QI, member of FEA

- Asset Preservation, Inc. (API): Large national QI

- 1031 Corporation: Established QI with local offices

- Accruit: Technology-focused QI

Research your QI thoroughly. Your exchange funds depend on their reliability.

Professional Advisors

Tax Advisor / CPA:

- Specializes in real estate taxation

- Experienced with 1031 exchanges

- Can model different scenarios

Real Estate Attorney:

- Needed for complex exchanges (reverse, build-to-suit)

- Reviews exchange documents

- Ensures compliance

Real Estate Agent:

- Experienced with investment properties

- Understands 1031 exchange timelines

- Works quickly under pressure

Online Resources

IRS Resources:

- IRS Publication 544: Sales and Other Dispositions of Assets

- IRC Section 1031: Like-Kind Exchanges

- Treasury Regulation 1.1031(k)-1: Delayed Exchanges

Industry Associations:

- Federation of Exchange Accommodators (FEA)

- National Association of Realtors (NAR) 1031 Exchange Resources

The 1031 Exchange Wealth-Building Blueprint

Here's a complete roadmap for using 1031 exchanges to build generational wealth:

Age 25 to 35: Accumulation Phase

Goal: Acquire your first 1 to 3 rental properties

Strategy:

- House hack a 2-4 unit property (FHA loan)

- Convert to rental when you move

- Save and buy 1-2 more rentals

- Focus on cash flow and learning

No 1031 exchanges yet (you're building, not selling)

Age 35 to 50: Growth Phase

Goal: Scale your portfolio through 1031 exchanges

Strategy:

- Sell smaller properties with low cash flow

- Exchange into larger multifamily (8 to 20 units)

- Repeat every 5 to 7 years

- Target: Grow from $500,000 to $3,000,000 in real estate equity

Example:

- Age 35: Own 3 single-family rentals worth $900,000 total

- Age 40: 1031 into 12-unit apartment worth $1,800,000

- Age 45: 1031 into 24-unit apartment worth $3,200,000

- Age 50: 1031 into 50-unit apartment worth $5,500,000

Taxes deferred: $300,000+

Age 50 to 65: Optimization Phase

Goal: Maximize cash flow and reduce management burden

Strategy:

- Exchange into triple-net lease commercial properties (100% passive)

- Or exchange into Delaware Statutory Trusts (DSTs)

- Focus on stable, hands-off income

- Prepare for retirement

Example:

- Age 50: Own $5,500,000 apartment (requires management)

- Age 55: 1031 into $6,000,000 triple-net lease Walgreens (tenant pays everything)

- Cash flow: $300,000/year passive income

Age 65+: Legacy Phase

Goal: Pass wealth to heirs tax-free

Strategy:

- Continue holding properties (don't sell)

- Live off cash flow

- When you die, heirs receive step-up in basis

- All deferred taxes eliminated

Result: You built a $10,000,000 real estate portfolio, deferred $2,000,000+ in taxes throughout your life, and passed it to your heirs tax-free.

Advanced 1031 Exchange Case Studies

Case Study 1: The Cross-Country Exchange

Investor: Maria, age 42, software engineer

Starting Position:

- Owns single-family rental in San Francisco

- Purchase Price: $800,000 (10 years ago)

- Current Value: $1,800,000

- Monthly Cash Flow: $1,200 (negative with mortgage)

- She's relocating to Austin, TX for work

The Problem:

- Property barely breaks even

- High property taxes ($18,000/year)

- Expensive property management

- CA capital gains tax would be $130,000+

The Solution: 1031 Exchange + Geographic Arbitrage

Step 1: Sell San Francisco property

- Sale Price: $1,800,000

- Deferred Taxes: $130,000 (federal + state)

Step 2: Purchase 4 properties in Austin metro

- Property 1: Duplex in Round Rock ($400,000)

- Property 2: Duplex in Pflugerville ($420,000)

- Property 3: Triplex in Georgetown ($480,000)

- Property 4: Single-family in Cedar Park ($350,000)

- Total: $1,650,000

Step 3: Add $150,000 cash from refinancing San Francisco property 2 years prior

Results After 1 Year:

- Combined Cash Flow: $6,800/month (vs $1,200 before)

- Property Management: $680/month (10% of rent)

- Net Cash Flow: $6,120/month

- Cash-on-Cash Return: 12%

5-Year Outcome:

- Property appreciation (Austin): 8%/year average

- Portfolio value: $2,425,000

- Equity: $1,100,000+

- Total cash flow collected: $367,000

Maria's Takeaway: "The 1031 exchange changed my life. I went from barely breaking even in San Francisco to generating $6,000/month in cash flow in Austin. I deferred $130,000 in taxes and built a real portfolio."

Case Study 2: The Reverse Exchange in a Hot Market

Investor: David, age 55, owns 4 rental properties

Starting Position:

- Owns 8-unit apartment building in Phoenix

- Purchase Price: $1,200,000 (5 years ago)

- Current Value: $2,000,000

- Cash Flow: $8,000/month

The Problem: David found the perfect replacement property (12-unit building in Scottsdale) listed at $2,800,000. It's priced right and in a hot market. Multiple offers expected.

But his current property isn't listed yet (needs minor repairs).

The Solution: Reverse 1031 Exchange

Step 1: Hire QI and set up Exchange Accommodation Titleholder (EAT)

Step 2: Purchase 12-unit building first

- EAT entity takes title (not David)

- David arranges financing ($2,100,000 loan)

- Closes in 30 days

Step 3: Sell 8-unit building

- Lists property

- Sells in 90 days for $2,000,000

- Proceeds go to QI

Step 4: QI transfers 12-unit building from EAT to David

- Exchange complete

- Taxes deferred

Results:

- Deferred taxes: $180,000

- New cash flow: $14,000/month (75% increase)

- Secured perfect property in hot market

Costs:

- Reverse exchange fees: $8,500

- Extra financing costs: $3,000

- Total: $11,500

David's Takeaway: "The reverse exchange cost more, but it was worth it to secure the perfect property. I couldn't risk losing it while waiting to sell my current building."

Case Study 3: The Multi-Property Consolidation Exchange

Investor: Lisa, age 60, owns 7 single-family rentals

Starting Position:

- 7 properties across 3 cities

- Combined value: $2,100,000

- Combined cash flow: $7,500/month

- Management headaches: constant

The Problem: Lisa is tired of managing 7 separate properties:

- 7 roofs to maintain

- 7 HVAC systems

- 7 sets of tenants

- 7 property tax bills

- 7 insurance policies

She wants passive income in retirement.

The Solution: Consolidation Exchange into DST

Step 1: Sell all 7 properties over 6 months

- Total sale proceeds: $2,100,000

- Deferred taxes: $320,000

Step 2: Identify Delaware Statutory Trust investments

- DST 1: Class A Multifamily in Dallas ($800,000)

- DST 2: Medical Office Building in Tampa ($700,000)

- DST 3: Industrial Warehouse in Atlanta ($600,000)

- Total: $2,100,000

Step 3: Purchase fractional interests in all 3 DSTs

- 100% passive management

- Institutional-quality properties

- Diversified across asset classes and markets

Results:

- Cash flow: $8,400/month (12% increase)

- Management time: 0 hours (100% passive)

- Hassle-free retirement income

DST Fees:

- Upfront fees: ~2% ($42,000)

- Annual management: 1% ($21,000/year)

Lisa's Takeaway: "I wish I'd known about DSTs earlier. I get better cash flow than managing 7 properties myself, and I don't lift a finger. It's perfect for retirement."

Common 1031 Exchange Questions from Real Investors

"Can I do a 1031 exchange if I owe more on the property than it's worth?"

If you owe more than the property is worth (you're underwater), you won't have proceeds to reinvest. A 1031 exchange doesn't make sense in this scenario.

Options:

- Wait for the market to recover

- Negotiate a short sale with lender (but this usually doesn't qualify for 1031)

- Hold the property until you have equity

"Can I exchange a rental property for raw land?"

Yes! Rental property and raw land are both "like-kind" real estate (held for investment).

Important: The land must be held for investment (not development for resale).

Example:

- Sell: Duplex for $400,000

- Buy: 10 acres of land for $400,000

- Hold land for appreciation

- Exchange again in 5 years

"What if I identify 3 properties but only 1 is still available by day 180?"

As long as you close on at least one property you identified, the exchange is valid.

Example:

- Identified Property A, B, and C on day 40

- Property A sells to another buyer

- Property B: You couldn't reach agreement

- Property C: You close on this one by day 180

- Exchange successful!

This is why identifying 3 properties is smart—gives you backup options.

"Can I use my 1031 exchange proceeds as a down payment and get a bigger loan?"

Yes! This is a common strategy to increase your buying power.

Example:

- Sell property: $500,000 (no mortgage)

- Use $500,000 as down payment (25%)

- Purchase property: $2,000,000 (with $1,500,000 loan)

- Defer all taxes

- 4× leverage

Key: To defer 100% of taxes, your new debt must be equal or greater than your old debt. If you had $0 debt before, any debt level on the replacement works.

"What happens if I miss the 45-day deadline by 1 day?"

The exchange is disqualified. There are no exceptions.

The IRS is strict: 45 days means 45 calendar days. If day 45 falls on a weekend or holiday, the deadline is still day 45 (not the next business day).

Best practice: Submit identification by day 40 to avoid last-minute issues.

"Can I exchange a vacation rental (Airbnb) property?"

Maybe. It depends on how you use the property.

Qualifies:

- Rented most of the year at fair market rates

- Personal use is minimal (less than 14 days or 10% of rental days)

- Held for investment (documented on Schedule E)

Does NOT Qualify:

- Used primarily as personal vacation home

- Rented only occasionally

Safe Harbor for Vacation Rentals:

- Rent the property for 14+ days per year

- Personal use is less than 14 days OR 10% of rental days (whichever is greater)

- Hold for at least 2 years before selling

Best Practice: If you have a vacation rental, rent it for 2 years before selling and minimize personal use.

Final Checklist: Preparing for Your 1031 Exchange

60 Days Before Listing:

- [ ] Consult with CPA or tax advisor

- [ ] Calculate estimated tax savings

- [ ] Research and hire Qualified Intermediary

- [ ] Research replacement property markets

- [ ] Get pre-approved for financing (if needed)

30 Days Before Listing:

- [ ] Notify real estate agent of 1031 exchange intent

- [ ] Ensure purchase agreement includes 1031 language

- [ ] Create list of potential replacement properties

- [ ] Connect with real estate agents in target markets

At Closing (Day 0):

- [ ] Confirm QI is named in closing documents

- [ ] Verify proceeds go directly to QI

- [ ] Do NOT touch the money

- [ ] Start identifying replacement properties immediately

Day 1 to Day 45:

- [ ] View and analyze replacement properties

- [ ] Make offers

- [ ] Identify 3 properties in writing by day 40

- [ ] Submit identification to QI

- [ ] Get written confirmation from QI

Day 46 to Day 180:

- [ ] Complete due diligence on accepted offer

- [ ] Arrange financing

- [ ] Coordinate closing with QI

- [ ] Ensure QI is named in closing documents

- [ ] Close by day 180

After Closing:

- [ ] File Form 8824 with tax return

- [ ] Update insurance and property management

- [ ] Begin tracking income and expenses for new property

- [ ] Plan next 1031 exchange (if desired)

Ready to Calculate Your 1031 Exchange Savings?

Use our calculator above to see exactly how much you can save by deferring taxes and reinvesting your full proceeds. Enter your property details and get instant results showing your tax savings and additional buying power.

Have questions? Consult with a qualified tax professional and Qualified Intermediary before proceeding with a 1031 exchange.

Next Steps:

- Use the calculator to estimate your tax savings

- Schedule a consultation with a CPA who specializes in real estate

- Interview and select a Qualified Intermediary

- Start identifying potential replacement properties

- Execute your exchange and build wealth tax-deferred!

The 1031 exchange is one of the most powerful tools in real estate investing. Use it wisely and you can defer taxes for decades, build substantial wealth, and pass it to your heirs tax-free.

Related Content

📝 Cash vs Leverage in Real Estate: 2026 Investment Guide

Read more about this topic

📝 LLC vs S-Corp vs Sole Proprietorship: Real Estate Guide

Read more about this topic

📝 Real Estate Tax Strategy Guide: Maximize Deductions

Read more about this topic

🔧 ROI Calculator

Calculate return on investment

🔧 Property Investment Analyzer

Comprehensive property analysis tool

🔧 BRRRR Calculator

Analyze buy-rehab-rent-refinance deals