Operating Expense Ratio Calculator

Calculate your rental property's operating expense ratio to understand efficiency, compare to industry benchmarks, and identify cost reduction opportunities.

Income & Expenses

Monthly Income

Parking, laundry, pet fees, etc.

Monthly Operating Expenses

Your Results

Average: 40% for single family

Monthly: $0.00

What is Operating Expense Ratio?

The Operating Expense Ratio (OER) measures the efficiency of your rental property by comparing annual operating expenses to gross income. It shows what percentage of your rental income goes toward operating costs.

Formula: OER = (Annual Operating Expenses / Annual Gross Income) × 100

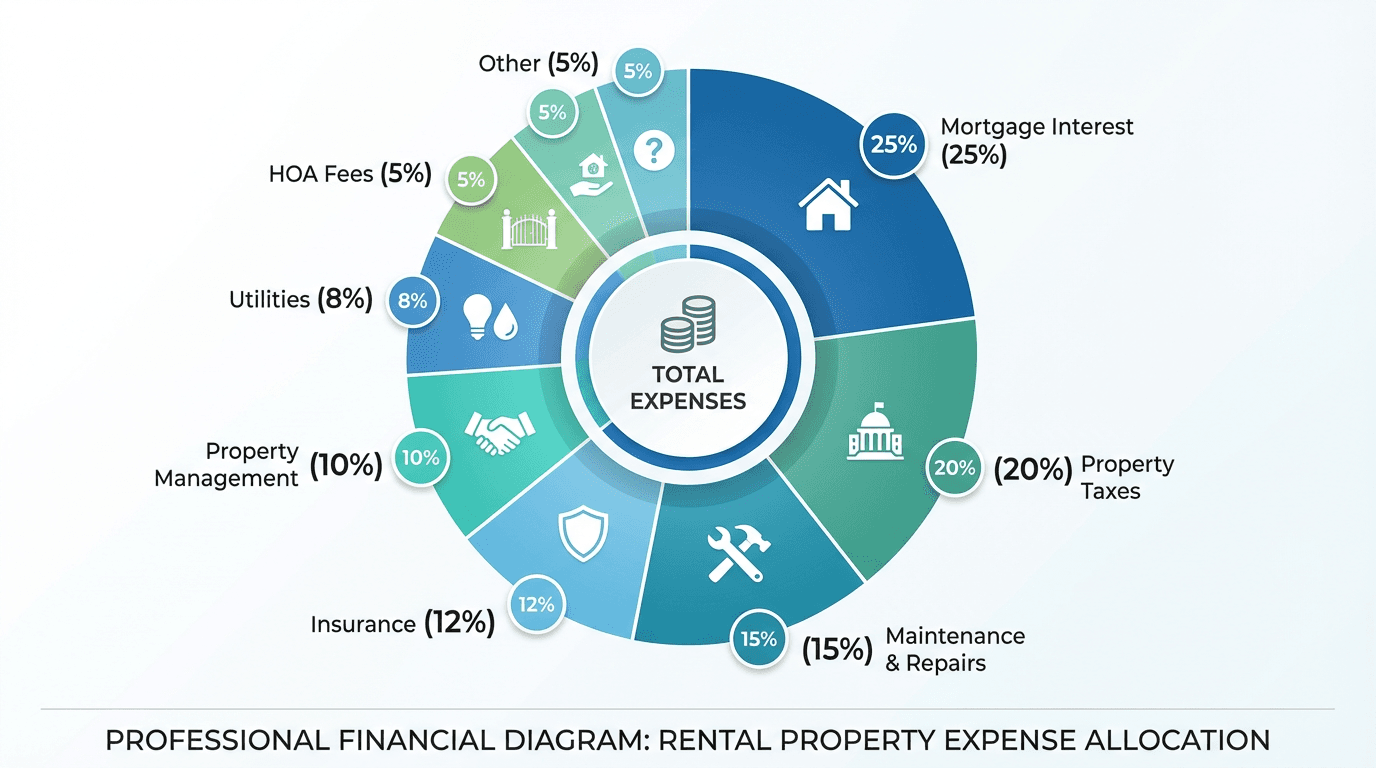

What's Included in Operating Expenses?

- ✓ Property management fees

- ✓ Maintenance and repairs

- ✓ Property taxes

- ✓ Insurance premiums

- ✓ Utilities (if landlord-paid)

- ✓ HOA fees

- ✓ Advertising and marketing

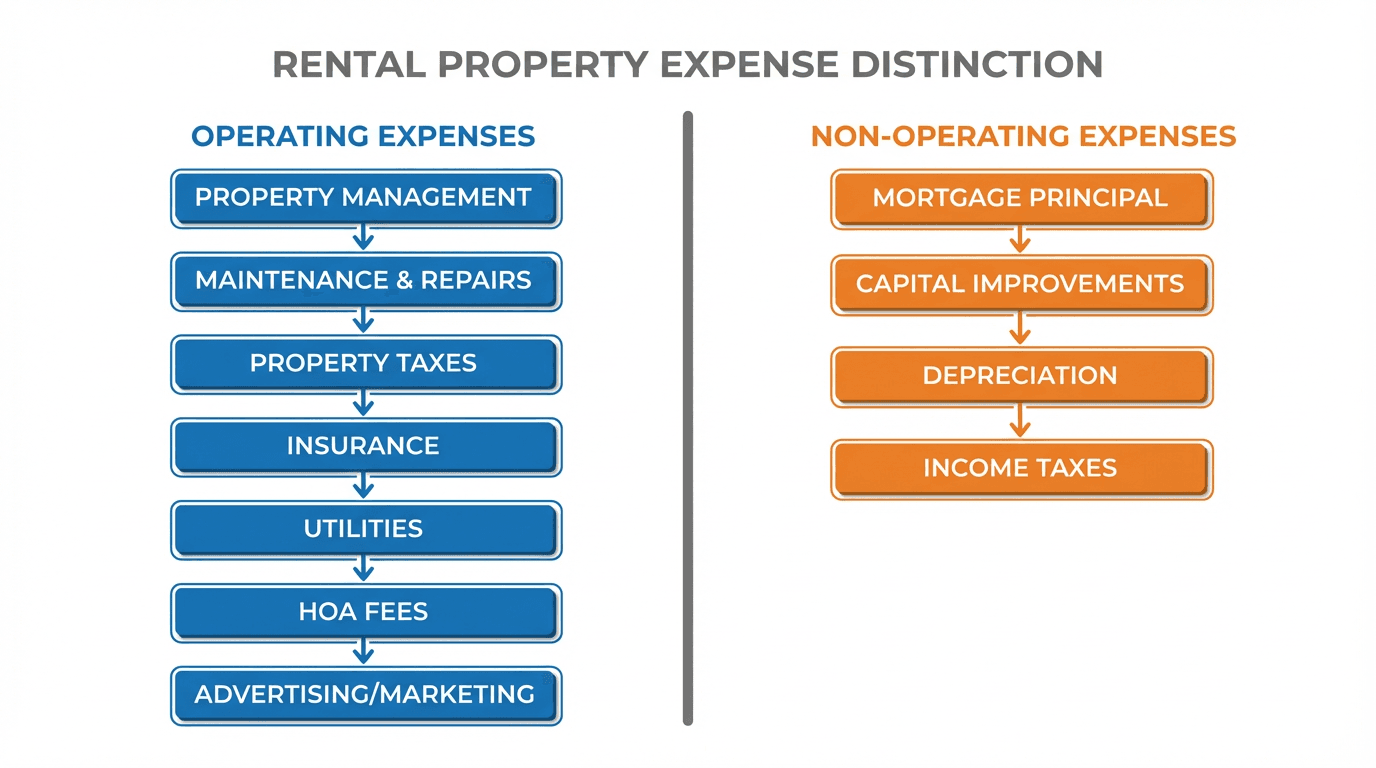

What's NOT Included?

- ✗ Mortgage principal payments

- ✗ Mortgage interest (for OER calculation)

- ✗ Capital improvements

- ✗ Depreciation

- ✗ Income taxes

Understanding Operating vs Non-Operating Expenses

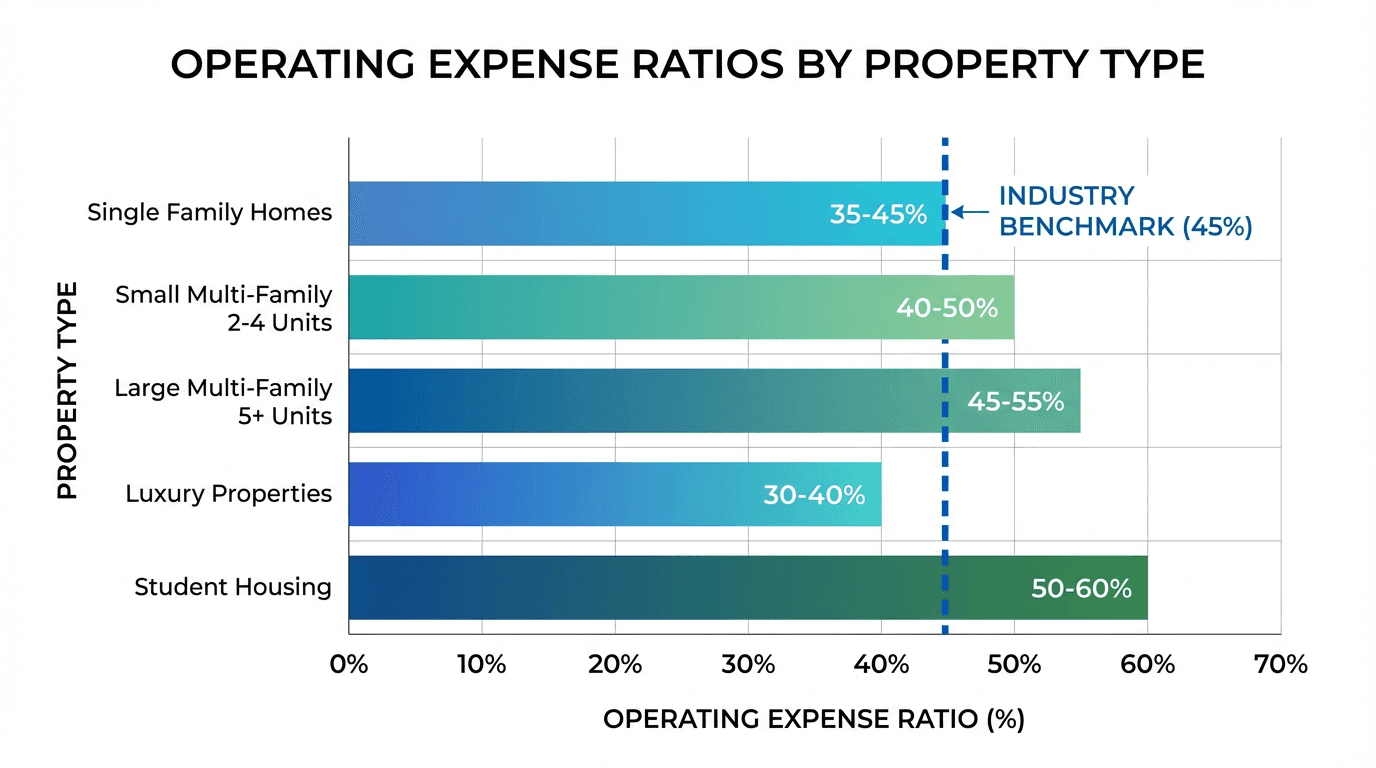

Industry Benchmarks by Property Type

Interpreting Your Results

Below 40%: Excellent efficiency. You're operating at lower costs than industry average.

40-50%: Good range for most properties. Typical operating efficiency for well-managed rentals.

50-60%: Higher than average. Look for cost reduction opportunities, especially for multi-family properties.

Above 60%: Very high expenses. Immediate action needed to identify and reduce costs.

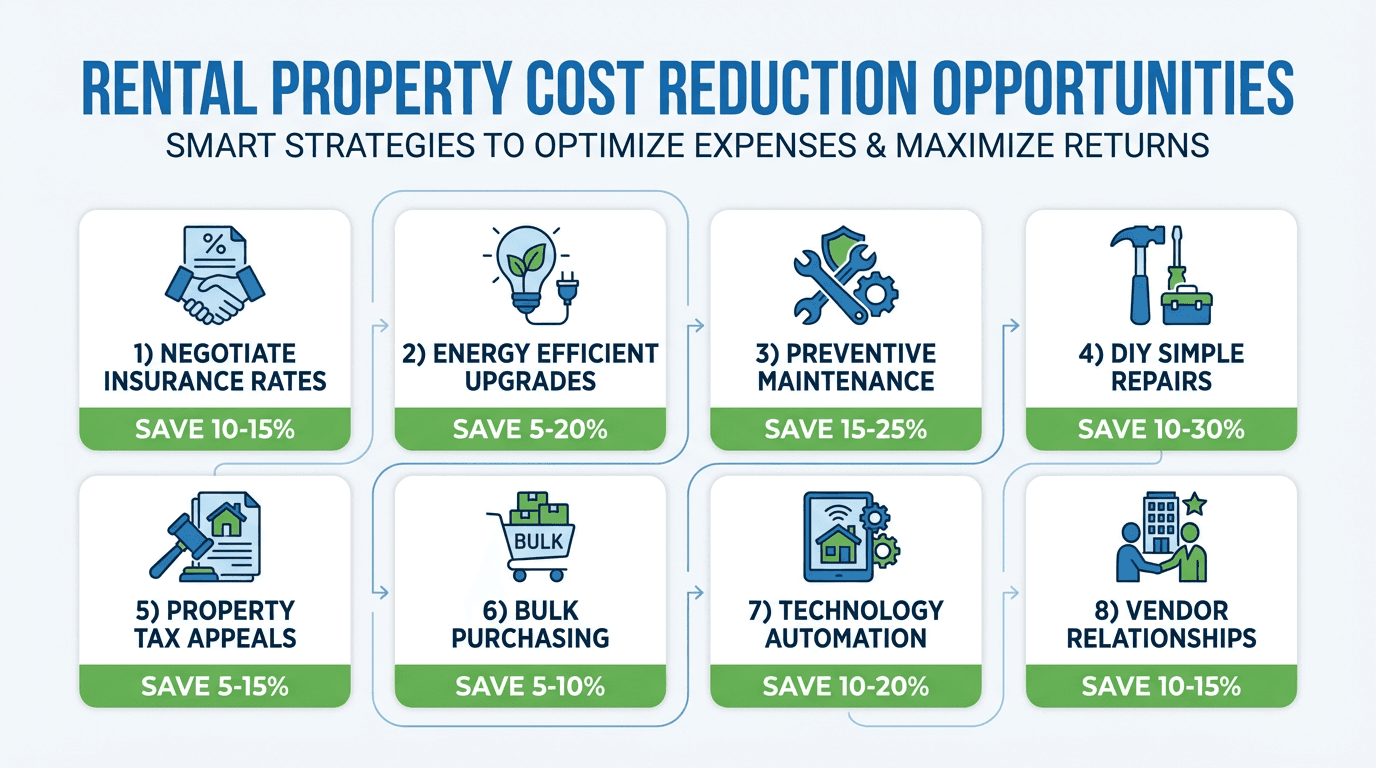

Cost Reduction Opportunities

Immediate Actions

- • Shop around for insurance quotes annually

- • Review property tax assessment for errors

- • Implement preventive maintenance schedule

- • Install energy-efficient appliances and lighting

Long-term Strategies

- • Build relationships with reliable, affordable vendors

- • Invest in durable, low-maintenance materials

- • Use property management software to reduce admin costs

- • Consider bulk purchasing for multi-property portfolios