Traditional vs Portfolio vs Hard Money Loans for Investors (2026)

Traditional vs Portfolio vs Hard Money Loans: Complete Financing Guide for Real Estate Investors

Choosing the right financing can make or break your real estate investment. The difference between a 7% traditional mortgage and a 12% hard money loan might seem obvious—until you realize the hard money loan can help you capture deals worth 3x more profit.

This comprehensive guide compares traditional mortgages, portfolio loans, and hard money financing across every critical factor: interest rates, down payments, approval times, qualification requirements, and total cost of capital.

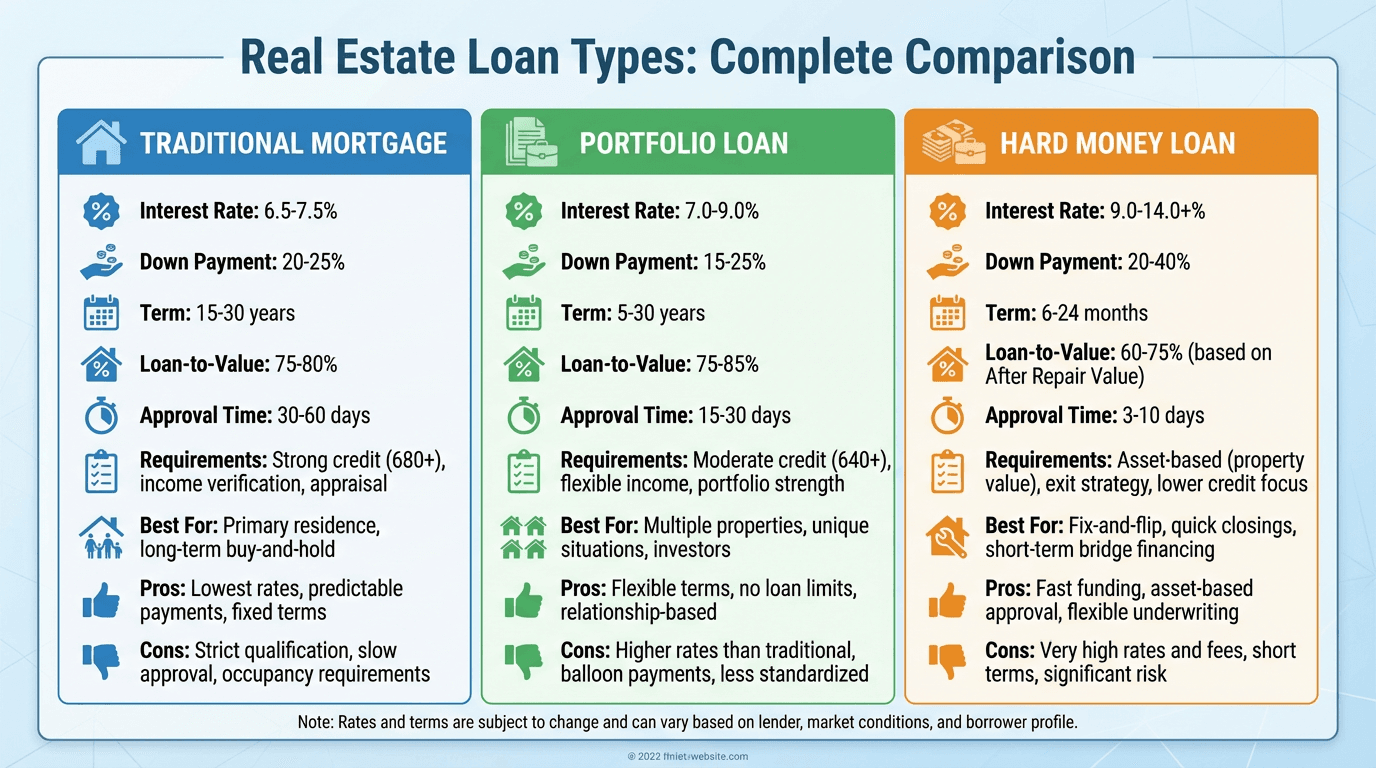

Quick Comparison: At a Glance

Traditional Mortgage excels for long-term buy-and-hold with the lowest rates (6.5-7.5%) but requires excellent credit, income verification, and 30-60 day approval.

Portfolio Loan offers flexibility for investors with multiple properties (7.0-9.0% rates) with faster approval (15-30 days) and relationship-based underwriting.

Hard Money Loan provides speed and asset-based approval (10-15% rates) with 3-7 day funding, ideal for fix-and-flip and bridge financing despite higher costs.

Traditional Mortgage: The Long-Term Foundation

What is a Traditional Mortgage?

Traditional mortgages are loans backed by government-sponsored enterprises (Fannie Mae, Freddie Mac, FHA, VA) that follow strict underwriting guidelines. These are the "vanilla" loans most homeowners use for primary residences.

Key Characteristics:

- Interest Rates: 6.5-7.5% (fixed or adjustable)

- Down Payment: 20-25% for investment properties (3.5-5% for owner-occupied)

- Loan Terms: 15-30 years

- Loan-to-Value (LTV): 75-80% for investment properties

- Approval Timeline: 30-60 days

- Credit Requirements: 680+ FICO score (720+ preferred)

- Property Limit: Maximum 10 financed properties through Fannie Mae

Advantages of Traditional Mortgages

1. Lowest Interest Rates

Traditional mortgages offer the most competitive rates in the market. At 6.5-7.5%, you'll pay significantly less interest over the life of the loan compared to alternative financing.

Example: On a $250,000 loan at 7% for 30 years, you'll pay $348,680 in total interest—substantial, but far less than other loan types.

2. Predictable, Fixed Payments

Most traditional mortgages feature fixed rates, meaning your monthly payment never changes. This predictability makes cash flow forecasting simple and reliable.

3. Longest Loan Terms Available

30-year terms minimize monthly payments, maximizing cash flow. Lower monthly obligations mean better debt service coverage ratios (DSCR) and stronger property performance.

4. Standardized, Regulated Process

Because traditional mortgages follow strict guidelines, the process is well-documented and consumer protections are built in. You know exactly what's required.

5. Mortgage Interest Tax Deduction

Interest paid on mortgages for investment properties is tax-deductible as a business expense, reducing your effective interest rate.

Disadvantages of Traditional Mortgages

1. Strict Qualification Requirements

Traditional lenders require:

- Strong credit (680+ minimum, 720+ preferred)

- Verifiable income (W-2s, tax returns, pay stubs)

- Low debt-to-income ratio (typically 43% maximum, 36% preferred)

- Significant cash reserves (6+ months of payments)

- Property must be in good condition and appraise appropriately

2. Slow Approval Process

The 30-60 day timeline includes:

- Application and initial underwriting (7-10 days)

- Appraisal (7-14 days)

- Title search and insurance (10-14 days)

- Final underwriting and conditions (7-14 days)

- Closing preparation (3-5 days)

In competitive markets, this slow timeline means losing deals to cash or hard money buyers.

3. Property Limit Restrictions

Fannie Mae limits investors to 10 financed properties. Once you hit this ceiling, you must transition to portfolio or commercial loans regardless of your financial strength.

4. Occupancy and Property Condition Requirements

Investment property mortgages require:

- Property must be habitable and pass appraisal

- No significant repairs needed

- Cannot be actively under renovation

- Must have functioning systems (electrical, plumbing, HVAC)

This eliminates most distressed properties and value-add opportunities.

5. Strict Appraisal Standards

Traditional appraisals focus on comparable sales, not potential value. If you're buying below market to add value, the appraisal may come in low, killing your deal.

When Traditional Mortgages Make Sense

✅ Long-term buy-and-hold strategy (5+ years minimum) ✅ Turnkey or recently renovated properties in good condition ✅ Stable cash flow is your priority over equity acceleration ✅ Strong personal credit and income meet traditional standards ✅ Not time-sensitive deals where you can wait 45-60 days ✅ Owner-occupied house hacking to access ultra-low down payments

Real-World Example:

Sarah purchases a turnkey fourplex for $400,000 with a traditional mortgage at 7% for 30 years. Her 25% down payment ($100,000) gives her a $300,000 loan with monthly principal and interest of $1,996.

Each unit rents for $1,200/month ($4,800 total). After expenses of $1,800/month (taxes, insurance, maintenance, vacancy), her net operating income is $3,000/month.

Cash flow after mortgage: $3,000 - $1,996 = $1,004/month ($12,048/year)

Cash-on-cash return: $12,048 ÷ $100,000 = 12.05%

This solid return is sustainable for decades with minimal risk and maximum cash flow stability.

Portfolio Loan: The Investor's Middle Ground

What is a Portfolio Loan?

Portfolio loans are mortgages that lenders keep on their own books rather than selling to Fannie Mae or Freddie Mac. This gives lenders flexibility to set their own underwriting standards.

Key Characteristics:

- Interest Rates: 7.0-9.0% (typically 0.5-1.5% above traditional)

- Down Payment: 15-25% (sometimes negotiable)

- Loan Terms: 5-30 years (often with balloon payments)

- Loan-to-Value (LTV): 75-85%

- Approval Timeline: 15-30 days

- Credit Requirements: 640+ FICO score (more flexible evaluation)

- Property Limit: No limit (major advantage)

Advantages of Portfolio Loans

1. No Property Limit

The single biggest advantage: no Fannie Mae 10-property limit. Once you own 10+ properties, portfolio loans become your primary financing option.

2. Flexible Underwriting Standards

Portfolio lenders can consider:

- Rental income from your existing portfolio

- Non-traditional income sources (contract work, business income)

- Complex financial situations (self-employed, multiple entities)

- Unique property types (mixed-use, non-conforming properties)

- Higher DTI ratios if compensated by strong portfolio performance

3. Relationship-Based Approval

Portfolio lenders build relationships with successful investors. Once you prove yourself with one or two properties, subsequent loans become easier with:

- Faster approval

- Better terms

- Fewer conditions

- More flexible requirements

4. Blanket Loan Options

Many portfolio lenders offer blanket mortgages—one loan covering multiple properties. This simplifies management and can offer better overall terms.

Example: Instead of 8 individual mortgages, you have one blanket loan at a blended rate, with the ability to release properties individually as you sell.

5. Creative Structuring

Portfolio lenders can offer:

- Interest-only periods

- Custom balloon payment schedules

- Cross-collateralization strategies

- Construction-to-permanent financing

- Refinance flexibility

Disadvantages of Portfolio Loans

1. Higher Interest Rates

Expect to pay 0.5-1.5% more than traditional mortgages. On a $250,000 loan, 8% vs 7% means an extra $48/month ($576/year), or $17,280 over 30 years.

2. Prepayment Penalties

Many portfolio loans include prepayment penalties—fees if you pay off the loan early. Common structures:

- 5-4-3-2-1 Step-down: 5% penalty in year 1, 4% in year 2, etc.

- Yield Maintenance: Penalty equals the interest the lender would have earned

- Defeasance: Complex calculation based on treasury rates

These penalties protect the lender's return but limit your flexibility to refinance or sell.

3. Balloon Payments

Portfolio loans often feature balloon payments—full remaining balance due after 5-10 years despite a 30-year amortization schedule.

Example: $250,000 loan at 8% amortized over 30 years but with a 10-year balloon. After 10 years of $1,834/month payments, you owe $214,600 in one lump sum.

You must either:

- Refinance (subject to new rates and terms)

- Sell the property

- Pay off the balloon from other sources

4. Fewer Lenders Available

Portfolio lending is concentrated among:

- Community banks and credit unions

- Smaller regional banks

- Specialized investment property lenders

Finding the right lender requires research and relationship-building.

5. More Variable Terms

Unlike standardized traditional mortgages, portfolio loan terms vary significantly between lenders. You must carefully compare:

- Interest rates and adjustment terms

- Prepayment penalty structures

- Balloon payment timing

- Fees and closing costs

- Cross-collateralization requirements

When Portfolio Loans Make Sense

✅ You own 5+ properties and approaching or exceeding Fannie Mae limits ✅ Self-employed or complex income that doesn't fit traditional guidelines ✅ Building a long-term relationship with a local bank for future growth ✅ Buying unique or non-conforming properties that don't qualify for traditional loans ✅ Need faster approval (2-3 weeks vs 6-8 weeks) but want reasonable rates ✅ Interested in blanket financing to consolidate multiple properties

Real-World Example:

Marcus owns 9 rental properties through traditional mortgages and wants to buy his 10th and 11th properties. He establishes a relationship with a local community bank offering portfolio loans.

Property #10: $220,000 purchase, 20% down ($44,000), $176,000 loan at 8.25% for 30 years with a 7-year balloon. Monthly payment: $1,324. Despite the higher rate (vs 7% traditional), Marcus can continue expanding his portfolio.

After proving himself, the bank offers Property #11 at 7.75% (better terms based on relationship) and discusses a future blanket loan to consolidate all his properties at a blended 8% rate.

Portfolio loans enable Marcus to scale beyond the 10-property limit, trading slightly higher rates for unlimited growth potential.

Hard Money Loan: Speed and Opportunity

What is a Hard Money Loan?

Hard money loans are short-term, asset-based loans funded by private lenders or investor groups. The loan is secured primarily by the property's value (collateral), not your personal financial profile.

Key Characteristics:

- Interest Rates: 10-15% (often interest-only)

- Down Payment: 10-30% (varies by deal and LTV)

- Loan Terms: 6-24 months (short-term bridge financing)

- Loan-to-Value (LTV): 65-75% (sometimes up to 80% for strong borrowers)

- Approval Timeline: 3-7 days (sometimes 24-48 hours)

- Credit Requirements: Minimal—focus is on the deal, not the borrower

- Points/Fees: 2-5 points (2-5% of loan amount) upfront

Advantages of Hard Money Loans

1. Lightning-Fast Funding

The primary advantage: speed. Hard money lenders can close in 3-7 days, sometimes within 48 hours for strong deals.

In competitive markets, this speed lets you:

- Compete with cash buyers

- Capture off-market deals

- Close before other buyers can secure financing

- Lock in time-sensitive opportunities

2. Asset-Based Approval

Hard money lenders focus on:

- Property value and potential (ARV - After Repair Value)

- Exit strategy (flip, refinance, or rent)

- Equity cushion (LTV ratio)

Your personal credit, income, or employment matter far less. Perfect for:

- Self-employed investors with complex income

- Borrowers with credit issues (foreclosures, bankruptcies)

- Foreign nationals without US credit history

- Investors who have exhausted traditional financing capacity

3. No Property Limits

Unlike traditional mortgages (10-property limit), hard money has no cap. You can finance 1 deal or 100 deals simultaneously if you have the equity and exit strategies.

4. Flexible on Property Condition

Hard money lenders fund:

- Distressed properties needing major renovation

- Properties that don't pass traditional appraisal

- Non-conforming or unique properties

- Properties mid-renovation

- Properties with title issues that can be resolved

5. Interest-Only Payments

Most hard money loans are interest-only, minimizing monthly payments during your hold period. This maximizes cash flow during renovation.

Example: $150,000 hard money loan at 12% = $1,500/month interest-only (vs $1,500-2,000+ with principal and interest on amortizing loans).

6. Relationship-Based Rate Improvements

Successful repeat borrowers often negotiate:

- Lower interest rates (10-11% instead of 12-14%)

- Reduced points (2 points instead of 3-4)

- Higher LTV ratios (75-80% instead of 70%)

- Faster approval and funding

Disadvantages of Hard Money Loans

1. High Interest Rates

At 10-15%, hard money costs significantly more than traditional or portfolio financing. This is acceptable for short-term holds but devastating for long-term holds.

Example: $150,000 loan at 12% for 12 months = $18,000 interest + $4,500 points (3%) = $22,500 total cost (15% of loan amount for just one year).

2. Upfront Points

Points (loan origination fees) of 2-5% are paid upfront at closing, reducing your available capital.

3-point example: $150,000 loan × 3% = $4,500 due at closing before you start the project.

3. Short Loan Terms

6-24 month terms create urgency. You must:

- Complete renovation quickly

- Sell or refinance before maturity

- Have a clear exit strategy

- Budget for potential extension fees (1-2% per month) if needed

If your project runs over timeline or the market slows, you face expensive extensions or potential foreclosure.

4. Lower Loan-to-Value Ratios

65-75% LTV means you need more cash upfront compared to traditional mortgages (75-80% LTV).

Example Comparison:

- Traditional: $200,000 property, 20% down = $40,000 cash needed

- Hard Money: $200,000 property, 30% down = $60,000 cash needed

This higher cash requirement limits how many deals you can do simultaneously.

5. Expensive if Project Drags On

Hard money is designed for quick flips (6-12 months). If your project takes longer:

- Interest compounds monthly

- Extension fees add 1-2% per month

- Total costs can spiral quickly

Example: 12-month flip takes 18 months. Original plan: $18,000 interest + $4,500 points = $22,500 total. Extended reality: $27,000 interest + $4,500 points + $9,000 extension fees (6 months × 1.5%) = $40,500 total.

When Hard Money Loans Make Sense

✅ Fix-and-flip projects with clear 6-12 month exit timelines ✅ Bridge financing to buy now, refinance later into traditional/portfolio loans ✅ Time-sensitive opportunities where fast closing wins the deal ✅ Distressed properties that don't qualify for traditional financing ✅ Credit challenges that prevent traditional approval but you have equity ✅ Need to close quickly to beat competition or capture off-market deals ✅ BRRRR strategy (Buy, Rehab, Rent, Refinance, Repeat) - hard money for acquisition and renovation, then refinance into traditional mortgage

Real-World Example:

Jennifer finds an off-market deal: a distressed property listed at $180,000 (market value $280,000 after $40,000 rehab). She needs to close in 10 days to beat other investors.

Hard Money Structure:

- Purchase Price: $180,000

- Hard Money Loan (70% LTV): $126,000

- Down Payment (30%): $54,000

- Rehab Budget: $40,000 (from savings)

- Points (3%): $3,780

- Interest Rate: 12% (interest-only)

- Monthly Interest: $1,260

- Hold Time: 8 months (2 months renovation, 6 months marketing/selling)

Total Costs:

- Down payment: $54,000

- Rehab: $40,000

- Interest (8 months × $1,260): $10,080

- Points: $3,780

- Selling costs (6% of $280,000): $16,800

- Total invested: $124,660

Sale Outcome:

- Sale Price: $280,000

- Hard Money Payoff: $126,000

- Gross Profit: $154,000

- Net Profit: $154,000 - $124,660 = $29,340

- ROI: $29,340 ÷ $94,000 cash invested = 31.2% in 8 months (47% annualized)

Despite the high interest rate, Jennifer's fast closing secured a deal worth $29,340 profit that traditional financing couldn't capture.

Total Cost Analysis: The Real Numbers

The Long-Term Cost Calculation

Understanding total cost of capital requires looking beyond interest rates:

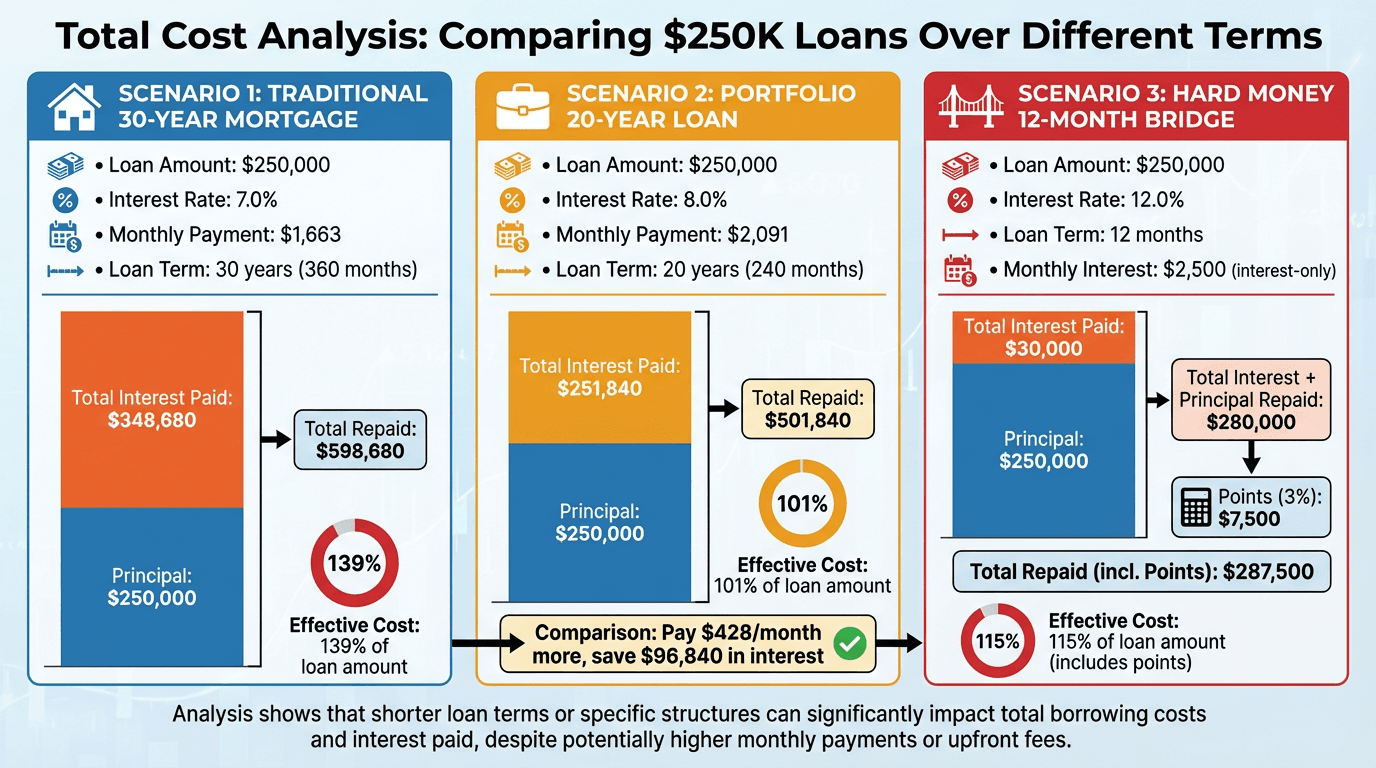

Traditional 30-Year Mortgage ($250,000 at 7.0%)

- Monthly Payment: $1,663

- Total Interest Over 30 Years: $348,680

- Total Repaid: $598,680

- Effective Cost: 139% of loan amount

Portfolio 20-Year Loan ($250,000 at 8.0%)

- Monthly Payment: $2,091

- Total Interest Over 20 Years: $251,840

- Total Repaid: $501,840

- Effective Cost: 101% of loan amount

- Tradeoff: Pay $428/month more, save $96,840 in interest

Hard Money 12-Month Bridge ($250,000 at 12.0%)

- Interest (interest-only): $2,500/month

- Total Interest Over 12 Months: $30,000

- Points (3%): $7,500

- Total Cost: $37,500

- Effective Cost: 15% for 1 year

The Time Value of Money Matters

The traditional mortgage's $348,680 total interest sounds terrible—until you consider:

-

Inflation reduces real cost: At 3% annual inflation, $1,663 in 2056 (year 30) has the purchasing power of about $755 in 2026 dollars.

-

Opportunity cost of higher payments: Portfolio loan requires $428/month more. Invested at 8% annual return for 30 years, that $428/month grows to $608,000—far exceeding the $96,840 interest savings.

-

Cash flow maximization: Lower monthly payments on traditional loans maximize cash flow for acquisitions, reserves, and quality of life.

When Higher Rates Make Sense

Hard money's 12-15% makes sense when:

- Speed captures an opportunity worth 2-3x the interest cost

- Short hold period (6-12 months) limits total interest paid

- Property appreciation and forced equity far exceed interest costs

- Alternative is losing the deal entirely

Portfolio loans' 7-9% make sense when:

- You're scaling beyond 10 properties (no choice)

- Relationship benefits exceed 1-1.5% rate premium

- Faster approval (15-30 days) captures more deals

- Flexible underwriting is required (self-employed, complex income)

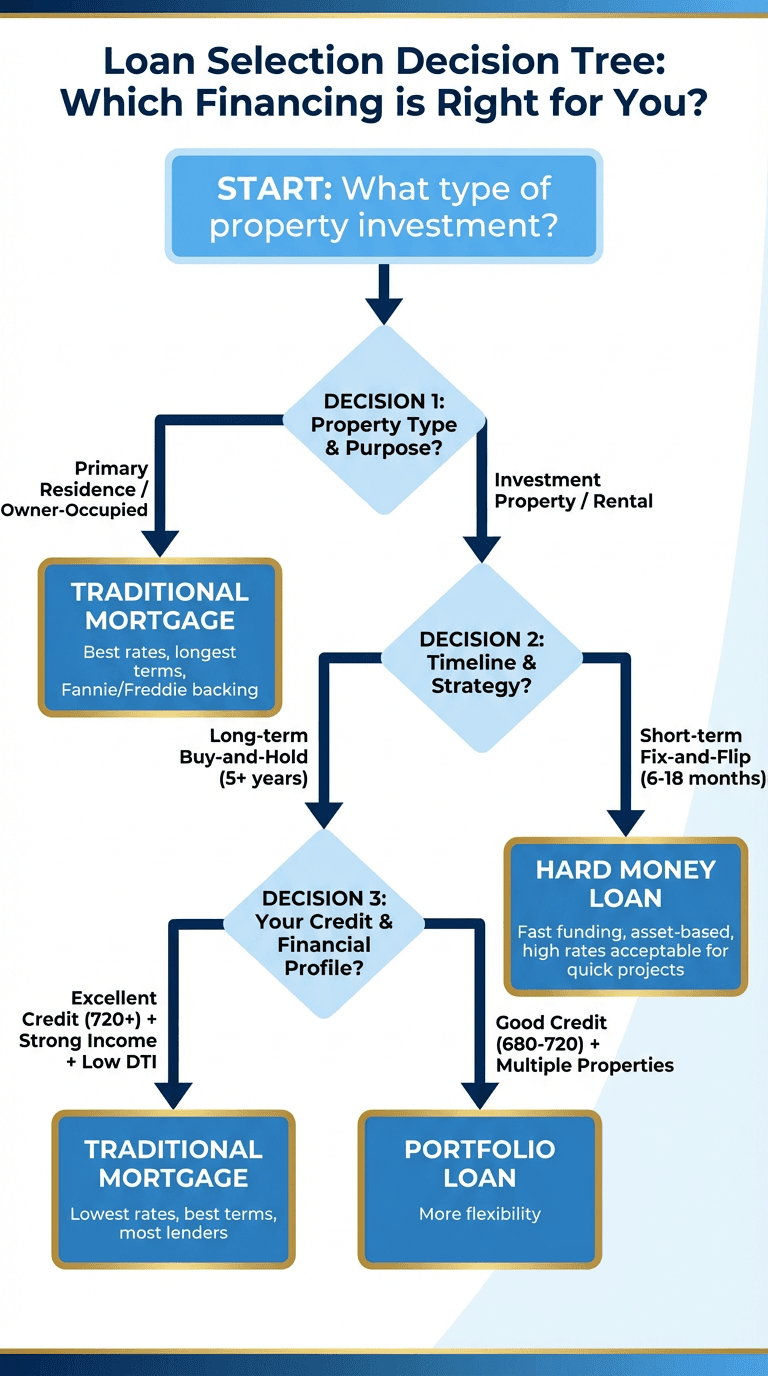

Decision Framework: Choosing Your Loan Type

Step 1: Define Your Investment Strategy

Are you pursuing:

Long-term buy-and-hold? → Traditional or Portfolio Loan

- Focus on low rates for maximum cash flow

- Prioritize 30-year fixed terms for stability

- Minimize monthly payments to weather vacancies

Fix-and-flip or short-term value-add? → Hard Money Loan

- Speed and flexibility trump interest rate

- Short hold period limits total interest cost

- Asset-based approval for distressed properties

BRRRR (Buy, Rehab, Rent, Refinance, Repeat)? → Start with Hard Money, Refinance to Traditional

- Use hard money for acquisition and renovation (6-12 months)

- Refinance into traditional mortgage once property is stabilized and rented

- Best of both worlds: speed initially, low rates long-term

Step 2: Assess Your Financial Profile

Strong Credit (720+) + Verifiable Income + Low DTI → Traditional Mortgage

- You qualify for best rates and terms

- Maximize your strong financial profile

- Save thousands annually in interest

Good Credit (640-680) + Self-Employed + Multiple Properties → Portfolio Loan

- Flexible underwriting accommodates your situation

- No 10-property limit for scaling

- Relationship potential for improving terms

Credit Challenges (below 640) OR Need Speed OR Distressed Property → Hard Money Loan

- Credit and income matter less

- Asset-based approval focuses on the deal

- Fast funding captures opportunities

Step 3: Consider Your Timeline

Can wait 45-60 days for approval? → Traditional Mortgage (if you qualify) or Portfolio Loan

Need to close in 15-30 days? → Portfolio Loan (established relationship) or Hard Money

Must close in 7 days or less? → Hard Money Only

Step 4: Evaluate Property Condition

Turnkey or recently renovated, ready to rent/occupy? → Traditional Mortgage (best rates for ready properties)

Needs minor cosmetic work but structurally sound? → Traditional or Portfolio (depending on specific lender)

Distressed, needs major renovation, or doesn't pass appraisal? → Hard Money (only option for properties that won't appraise)

Step 5: Calculate True ROI

Don't choose based on interest rate alone—calculate total return on investment:

Example 1: Traditional Mortgage on Turnkey Property

- $300,000 purchase

- 20% down ($60,000)

- 7% traditional mortgage

- Monthly cash flow: $400

- Annual return: $4,800

- Cash-on-cash return: 8%

- Benefit: Low risk, stable cash flow, low maintenance

Example 2: Hard Money on Value-Add Flip

- $200,000 purchase (ARV $300,000)

- 30% down ($60,000)

- $40,000 rehab

- 12% hard money for 10 months

- Net profit after all costs: $22,000

- ROI: 22% in 10 months (26% annualized)

- Benefit: Higher return despite higher rate

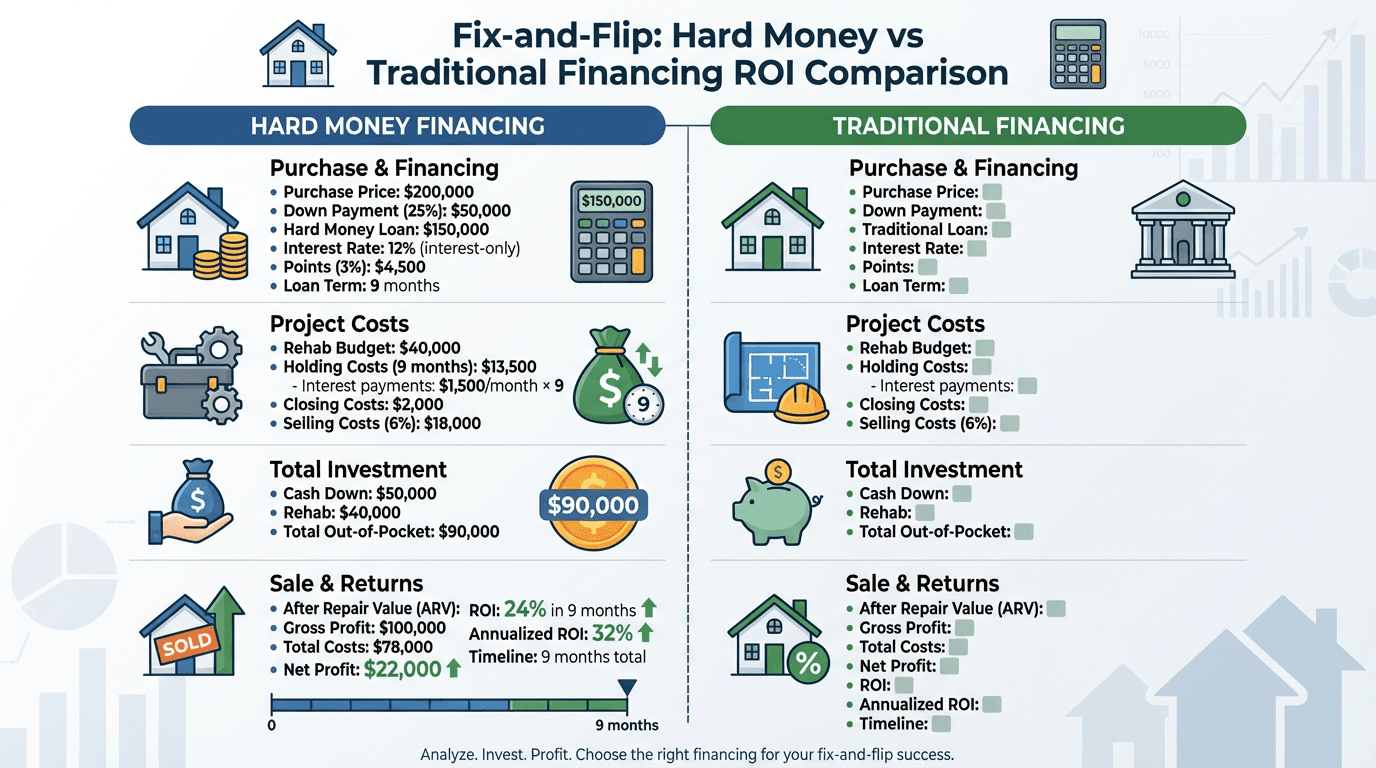

Fix-and-Flip: Hard Money vs Traditional ROI

The Speed Premium: Why Hard Money Wins Flips

For fix-and-flip projects, speed is worth the premium. This analysis shows why:

Hard Money Scenario:

- Close in 7 days, beat 5 other investors

- 12% interest + 3 points = 15% total first-year cost

- Complete project in 8 months

- Net profit: $22,000 (24% ROI, 32% annualized)

- Deal captured ✓

Traditional Financing Scenario:

- 45-60 day approval timeline

- Property sells to hard money buyer during your approval process

- Deal lost ✗

- Opportunity cost: $22,000 in profit you didn't earn

Even if you win the deal with traditional financing, hard money completes the project 4-6 weeks faster, getting your capital back sooner for the next deal.

The Velocity of Capital Matters:

At 24% ROI per project with 8-month timelines:

- Hard Money: 1.5 flips per year = 36% annual return

- Traditional: 1.0 flips per year (longer approval) = 24% annual return

Hard money's speed generates 50% more annual return despite costing more per project.

Hybrid Strategies: Using Multiple Loan Types

Strategy 1: BRRRR with Hard Money + Traditional Refinance

The approach:

- Use hard money to acquire and renovate (6-9 months)

- Stabilize property with tenant and rent history

- Refinance into traditional mortgage at 6.5-7.5%

- Pull out most or all of your capital

- Repeat with next property

Example:

- Purchase distressed property: $180,000 (hard money, 12%)

- Renovate: $40,000 (6 months)

- After Repair Value: $280,000

- Place tenant, establish rent history (3 months)

- Refinance at 75% LTV: $210,000 new traditional mortgage at 7%

- Pay off hard money ($180,000), recover $30,000 cash

- Net investment: $40,000 (rehab) + $10,000 (hard money interest/points) = $50,000

- Cash recovered via refinance: $30,000

- Net cash left in deal: $20,000

- Property worth: $280,000 with $70,000 equity

- Monthly cash flow: $1,200 rent - $800 expenses - $1,398 mortgage = ($998)... Wait, that doesn't work!

Adjusted Example (Realistic BRRRR):

- Purchase: $100,000 (hard money)

- Renovate: $30,000 (4 months)

- ARV: $180,000

- Refinance at 75% LTV: $135,000 traditional mortgage at 7%

- Pay off hard money ($100,000), recover $35,000

- Net investment: $30,000 rehab + $5,000 hard money costs = $35,000

- Cash recovered: $35,000

- Net cash left in deal: $0 (infinite return!)

- Property worth $180,000, you own it with $45,000 equity

- Monthly cash flow: $1,400 rent - $600 expenses - $898 mortgage = negative $98... hmm

Even Better Adjusted Example:

- Purchase: $100,000 (hard money, 70% LTV = $70,000 loan, $30,000 down)

- Renovate: $20,000

- ARV: $160,000

- Refinance at 80% LTV: $128,000 traditional mortgage at 7%

- Pay off hard money ($70,000), recover cash: $128,000 - $70,000 = $58,000

- Original cash invested: $30,000 down + $20,000 rehab = $50,000

- Cash recovered: $58,000

- Net result: You removed $8,000 MORE than you invested (infinite return + profit!)

- Property worth $160,000, you own it with $32,000 equity

- Monthly rent: $1,300 | Expenses: $500 | Mortgage: $852 (P&I)

- Monthly cash flow: negative $52/month

- Cash flow note: Slightly negative, but you own a $160,000 property with ZERO dollars invested + $8,000 cash profit!

This is the BRRRR magic: hard money's speed and flexibility for acquisition/renovation, traditional mortgage's low rates for long-term hold, and potential infinite returns through strategic refinancing.

Strategy 2: Portfolio Relationship + Traditional for Best Deals

The approach:

- Use traditional mortgages for best properties (lowest rates)

- Build portfolio lender relationship for properties 5-10+

- Use portfolio loan for unique opportunities that don't fit traditional guidelines

- Keep traditional financing capacity for future best deals

Example Portfolio:

- Properties 1-7: Traditional mortgages at 6.5-7.0%

- Properties 8-10: Portfolio loans at 7.5-8.0% (established relationship, better terms)

- Property 11 (unique opportunity): Portfolio loan at 8.5% (outside traditional guidelines)

- Properties 12-15: Back to traditional where possible, portfolio where needed

This hybrid approach optimizes rates while maintaining scalability.

Strategy 3: Hard Money → Portfolio Refinance for Problem Properties

The approach:

- Use hard money to buy distressed property

- Complete renovation (make property lendable)

- Refinance into portfolio loan (more flexible than traditional)

- Hold long-term or continue improving for eventual traditional refinance

Example:

- Buy severely distressed fourplex: $200,000 (hard money, 12%)

- Major renovation: $80,000 (8 months)

- After Repair Value: $400,000

- Portfolio refinance at 80% LTV: $320,000 at 8.25%

- Pay off hard money ($200,000) + interest ($16,000) = $216,000

- Recover: $320,000 - $216,000 = $104,000

- Original investment: $80,000 (rehab) + $40,000 (down payment at 20%) + $16,000 (interest) = $136,000

- Recovered: $104,000

- Net cash in deal: $32,000

- Property worth $400,000 with $80,000 equity

- Monthly cash flow: $4,800 rent - $2,000 expenses - $2,406 mortgage = $394/month

- Cash-on-cash return: $4,728 annual ÷ $32,000 invested = 14.8%

This strategy works for properties that:

- Don't qualify for traditional even after renovation (non-conforming, mixed-use, etc.)

- Are in your 10+ property range anyway

- Benefit from portfolio lender's flexible evaluation

Common Mistakes to Avoid

Mistake #1: Choosing Based on Rate Alone

The error: "7% is better than 12%, so I'll wait for traditional financing."

Why it's wrong: You lose time-sensitive deals, miss market opportunities, and fail to consider total return on investment.

The fix: Evaluate total profit potential, not just interest cost. A 12% hard money loan that captures a $30,000 profit opportunity beats a 7% traditional mortgage that loses the deal.

Mistake #2: Using Hard Money for Long-Term Holds

The error: "I'll use hard money now and refinance later… eventually."

Why it's wrong: If market conditions change, rates rise, or property doesn't appraise as expected, you're stuck with 12-15% debt long-term, destroying cash flow.

The fix: Have a concrete refinance strategy before closing with hard money. Know exactly when and how you'll refinance, with backup plans if primary strategy fails.

Mistake #3: Ignoring Prepayment Penalties

The error: "I'll take this portfolio loan, and if I need to sell or refinance, I'll do it."

Why it's wrong: A 5-4-3-2-1 prepayment penalty on a $250,000 loan means $12,500 penalty in year 1, $10,000 in year 2, etc. This can eliminate your profit.

The fix: Negotiate prepayment terms upfront. If possible, get loans without penalties or with step-down structures that minimize pain.

Mistake #4: Maxing Out at 100% LTV with Hard Money

The error: "This hard money lender offers 90% LTV, so I'll put minimal cash down."

Why it's wrong: Higher LTV means:

- Higher monthly interest payments

- Less equity cushion if project goes wrong

- More expensive financing overall

The fix: Put down 20-30% to reduce interest costs, create equity cushion, and improve your approval odds with the lender.

Mistake #5: Forgetting About Points

The error: "12% interest isn't that much more than 7%."

Why it's wrong: Forgetting to include 2-5 points (2-5% of loan amount) paid upfront means underestimating true cost.

Example:

- $150,000 hard money loan at 12% + 3 points

- Year 1 interest: $18,000

- Points paid upfront: $4,500

- Total first-year cost: $22,500 (15% of loan amount, not 12%!)

The fix: Always calculate total cost including points when comparing options.

Negotiation Tips for Each Loan Type

Traditional Mortgage Negotiation

Traditional mortgages have less negotiation flexibility (rates are set by market), but you can:

1. Shop Multiple Lenders

- Get quotes from 3-5 lenders (banks, credit unions, mortgage brokers)

- Rates can vary by 0.25-0.5%, saving thousands

2. Negotiate Closing Costs

- Origination fees (often 0.5-1% of loan) may be negotiable

- Ask for lender credits toward closing costs

- Compare loan estimates line-by-line

3. Consider Discount Points

- Pay 1% upfront to reduce rate by 0.25%

- Calculate break-even: $2,500 paid to save $35/month = 71 months to break even

- Only worth it if you'll hold the loan 6+ years

4. Time Your Lock

- Rate locks typically last 30-60 days

- Lock when rates are favorable

- Float if rates are trending down (risky)

Portfolio Loan Negotiation

Portfolio loans offer significant negotiation opportunities:

1. Leverage Existing Relationships

- If you have accounts with the bank, mention them

- Show your full financial picture (assets, income, other properties)

- Promise future business (multiple properties planned)

2. Negotiate Terms, Not Just Rate

- Request no prepayment penalty or shorter penalty period

- Negotiate longer balloon period (10 years instead of 5)

- Ask for higher LTV if you have strong portfolio

- Request interest-only period for first 1-2 years

3. Demonstrate Portfolio Strength

- Provide rent rolls showing strong cash flow

- Show track record of successful properties

- Highlight low vacancy rates and property management skills

4. Cross-Sell for Better Terms

- Open business checking account

- Move personal banking relationship

- Commit to using their bank for multiple future deals

Real Example: A portfolio lender initially offered 8.5% with a 5-year balloon and 5-4-3-2-1 prepayment penalty. After demonstrating a strong portfolio (7 properties, all cash-flowing) and committing to moving his business checking account, the borrower negotiated down to 8.0% with a 10-year balloon and no prepayment penalty after year 3.

Hard Money Loan Negotiation

Hard money is relationship-based and highly negotiable:

1. Build a Track Record

- Complete 1-2 projects successfully

- Develop reputation as reliable borrower who closes and pays on time

- Ask for repeat borrower discounts (10-11% vs 12-14%)

2. Negotiate Points Aggressively

- Standard is 3-4 points; try for 2-2.5 points

- Larger loans (higher dollar amount) should have lower points

- Offer to pay slightly higher interest for lower points if cash-tight upfront

3. Request Higher LTV for Strong Deals

- Show conservative ARV (after repair value) backed by solid comps

- Demonstrate experience with similar projects

- Prove strong exit strategy (pre-approved buyer, refinance commitment, etc.)

4. Shop Multiple Hard Money Lenders

- Local hard money lenders

- National hard money platforms

- Private lenders (wealthier individuals)

- Real estate investor groups and networks

Rates vary significantly—one lender might offer 11% + 2 points while another offers 13% + 4 points.

5. Negotiate Exit Strategy Flexibility

- Request extension options (1-2% fee per month) agreed upfront

- Ask for refinance flexibility if market conditions change

- Negotiate early payoff discounts (pay off in 6 months, get 1 point rebate)

Real Example: A first-time hard money borrower was quoted 13% + 4 points. After showing detailed project plans, contractor bids, and a pre-approved portfolio loan refinance, she negotiated to 12% + 3 points, saving $1,500 upfront and $150/month in interest on her $150,000 loan.

Frequently Asked Questions

Can I get a traditional mortgage with less than 20% down for investment property?

Answer: Yes, but it's rare and expensive. Options include:

- FHA/VA loans for owner-occupied properties (3.5-5% down, but must live there 1+ years)

- HomeReady/Home Possible programs (some allow 5-15% down for investment properties, but strict income limits)

- PMI (Private Mortgage Insurance) for 10-15% down investment properties (costs 0.5-1.5% annually until you reach 20% equity)

Most investors stick to 20-25% down for investment properties to avoid PMI and get better rates.

How many properties can I finance with portfolio loans?

Answer: No limit. Unlike Fannie Mae's 10-property limit, portfolio lenders set their own policies. Some lenders finance 20, 50, or 100+ properties to one investor.

The practical limits are:

- Your portfolio performance (cash flow, vacancy rates, management quality)

- Your debt service coverage ratio (rental income must exceed debt payments by 20-30%)

- Lender's risk appetite (diversification across properties and markets)

- Your personal financial strength (liquidity, net worth, income)

Can I refinance from hard money to traditional if I originally didn't qualify?

Answer: Yes, but you'll need to meet traditional lending standards at the time of refinance:

- Improve credit if it was the original issue (pay down debts, resolve collections, wait for foreclosures/bankruptcies to age)

- Establish rental income with 6-12 months of rent receipts to show the property performs

- Complete renovation so property passes traditional appraisal (habitable, functioning systems, no major deferred maintenance)

- Build reserves to show 6+ months of payment reserves

Typical timeline: 6-12 months of hard money, then refinance to traditional once property is stabilized and you meet qualifications.

Do I have to pay off my hard money loan early, or can I hold it the full term?

Answer: You can hold it the full term (12-24 months), but most investors don't because:

- Interest-only payments mean you're not building equity

- High interest rates (12-15%) destroy cash flow for longer holds

- Balloon payment at maturity means you must pay off the full balance anyway

- Extension fees (1-2% per month) add significant cost if you exceed the term

Hard money is designed for short-term use. If your project timeline extends, plan to:

- Refinance into traditional or portfolio loan

- Sell the property

- Have capital to pay off the loan

Holding hard money long-term is expensive and inefficient.

Can I use hard money for buy-and-hold rental properties?

Answer: Technically yes, but it's a terrible strategy unless you have a clear refinance plan.

Example of what NOT to do:

- Buy rental property with hard money at 12%

- Hold it long-term while paying $1,500/month in interest

- Rental income: $1,800/month

- Expenses: $600/month

- Cash flow: $1,800 - $600 - $1,500 = negative $300/month

You lose money every month, burning through cash.

The right approach:

- Use hard money for acquisition and renovation (BRRRR)

- Refinance into traditional/portfolio loan at 6.5-8% within 6-12 months

- Now your monthly payment is $850 instead of $1,500

- Cash flow: $1,800 - $600 - $850 = $350/month positive

Hard money is a bridge, not a destination for buy-and-hold investors.

Actionable Next Steps

For First-Time Investors

Step 1: Establish traditional mortgage capacity first

- Ensure credit is 680+ (720+ ideal)

- Document income thoroughly (W-2s, tax returns, bank statements)

- Save 25% down payment + 6 months reserves

- Get pre-approved with 2-3 traditional lenders

Step 2: Find your first buy-and-hold property

- Turnkey or light cosmetic work (qualifies for traditional financing)

- Use traditional mortgage to minimize monthly payment

- Build landlord experience with lower-risk first property

Step 3: Build relationship with portfolio lender

- Meet with local banks and credit unions

- Share your investment plan (scaling to 10+ properties)

- Ask about portfolio loan programs and requirements

- Establish checking/business accounts to strengthen relationship

Step 4 (Optional): Explore hard money for next deal

- Find a value-add or distressed property opportunity

- Get hard money pre-approval to move quickly

- Execute BRRRR strategy (hard money → renovate → refinance to traditional)

- Gain experience with value-add investing

For Experienced Investors (5+ Properties)

Step 1: Optimize existing financing

- Review current loans—are any candidates for refinancing at better terms?

- Consider blanket loan with portfolio lender to consolidate multiple properties

- Negotiate better terms with existing lenders based on track record

Step 2: Build multiple lender relationships

- Maintain relationships with 2-3 portfolio lenders (diversify funding sources)

- Establish hard money lender relationships for future opportunities

- Keep traditional mortgage capacity available for best deals

Step 3: Develop hybrid strategy

- Use traditional mortgages for turnkey properties (properties 1-7)

- Use portfolio loans for properties 8+ and unique opportunities

- Use hard money for quick flips and BRRRR projects

- Match financing type to deal type for optimal returns

Step 4: Scale strategically

- Plan for 10+ property portfolio (portfolio loans required)

- Consider forming LLC or entity structure (discuss with CPA and attorney)

- Build systems for property management and cash flow management

- Monitor portfolio-wide metrics: cash flow, equity, vacancy, DSCR

For Fix-and-Flip Investors

Step 1: Build hard money lender network

- Interview 3-5 hard money lenders

- Compare rates, points, LTV ratios, and terms

- Understand their funding speed and reliability

Step 2: Create repeatable systems

- Develop renovation budgets and timelines

- Build contractor network for fast, reliable execution

- Establish exit strategies (buyer list, agent relationships, refinance options)

Step 3: Track metrics religiously

- Average project timeline (acquisition to sale)

- Average profit per project

- Total cost of capital (interest + points as % of profit)

- Success rate (projects completed on time and on budget)

Step 4: Negotiate better terms with volume

- Prove yourself with 2-3 successful projects

- Request repeat borrower discounts (lower rates, fewer points)

- Ask for higher LTV and faster funding as track record builds

Final Recommendations

Choosing between traditional mortgages, portfolio loans, and hard money isn't about finding the "best" loan type—it's about matching the right financing to the right strategy:

Use Traditional Mortgages When:

- You qualify (credit 680+, verifiable income, low DTI)

- Buying turnkey or recently renovated properties in good condition

- Pursuing long-term buy-and-hold for stable cash flow

- You can afford 45-60 day approval timelines

- You want the absolute lowest interest rates and monthly payments

Use Portfolio Loans When:

- You're scaling beyond 10 financed properties

- You're self-employed or have complex income that doesn't fit traditional guidelines

- You need flexibility on property type, condition, or terms

- You can afford 7-9% rates in exchange for relationship benefits

- You want to consolidate multiple properties under one blanket loan

Use Hard Money When:

- You need to close in 3-7 days to win competitive deals

- Buying distressed properties that don't qualify for traditional appraisal

- Executing fix-and-flip or BRRRR strategies with clear 6-12 month exit timelines

- Your credit or financial profile doesn't qualify for traditional financing

- Speed and flexibility trump interest cost

The sophisticated investor uses all three strategically:

- Traditional mortgages for best properties at best rates

- Portfolio loans for scaling and unique opportunities

- Hard money for quick acquisitions, value-add projects, and bridge financing

Master each loan type, build relationships with multiple lenders, and match your financing strategy to your investment strategy for maximum returns.

Ready to explore financing options for your next investment? Start by getting pre-approved with traditional lenders to understand your baseline capacity, then build relationships with portfolio and hard money lenders to expand your options. The more financing tools in your toolkit, the more opportunities you can capture.

Related Content

📝 BRRRR Method Explained: Buy, Rehab, Rent, Refinance, Repeat

Master the BRRRR method for rapid portfolio growth. Buy, rehab, rent, refinance, and repeat to build wealth.

📝 Cash vs Leverage in Real Estate: 2026 Investment Guide

Read more about this topic

📝 DIY vs Professional Property Management: 2026 Guide

Read more about this topic

🔧 ROI Calculator

Calculate return on investment

🔧 Property Investment Analyzer

Comprehensive property analysis tool

🔧 BRRRR Calculator

Analyze buy-rehab-rent-refinance deals