BRRRR Calculator: Buy Rehab Rent Refinance Repeat Strategy Guide

BRRRR Calculator: Buy Rehab Rent Refinance Repeat Strategy Guide

Imagine buying a property for $150,000, renovating it for $40,000, refinancing to pull out $165,000, and walking away with a rental property that has only $25,000 of your capital left in it. That's the power of the BRRRR strategy.

The BRRRR Formula:

Total Invested = Purchase Price + Rehab + Closing Costs

Refinance Proceeds = (ARV × 75%) - Existing Loan

Capital Recovered = Refinance Proceeds - Total Invested

Infinite Return = Annual Cash Flow ÷ Capital Left In Deal

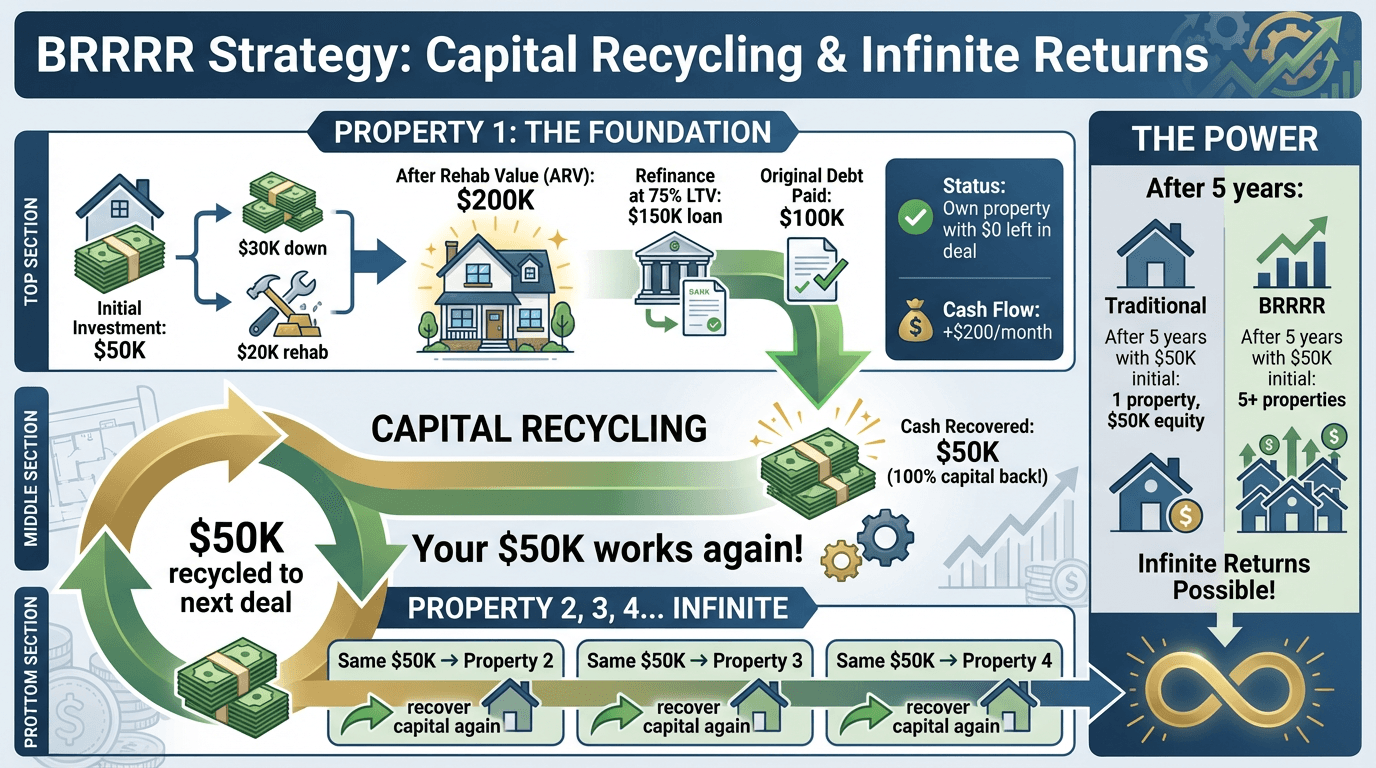

The BRRRR method (Buy, Rehab, Rent, Refinance, Repeat) is the most powerful wealth-building strategy in real estate because it allows you to recycle the same capital indefinitely—building a portfolio of 10, 20, or 50+ properties with the same initial investment.

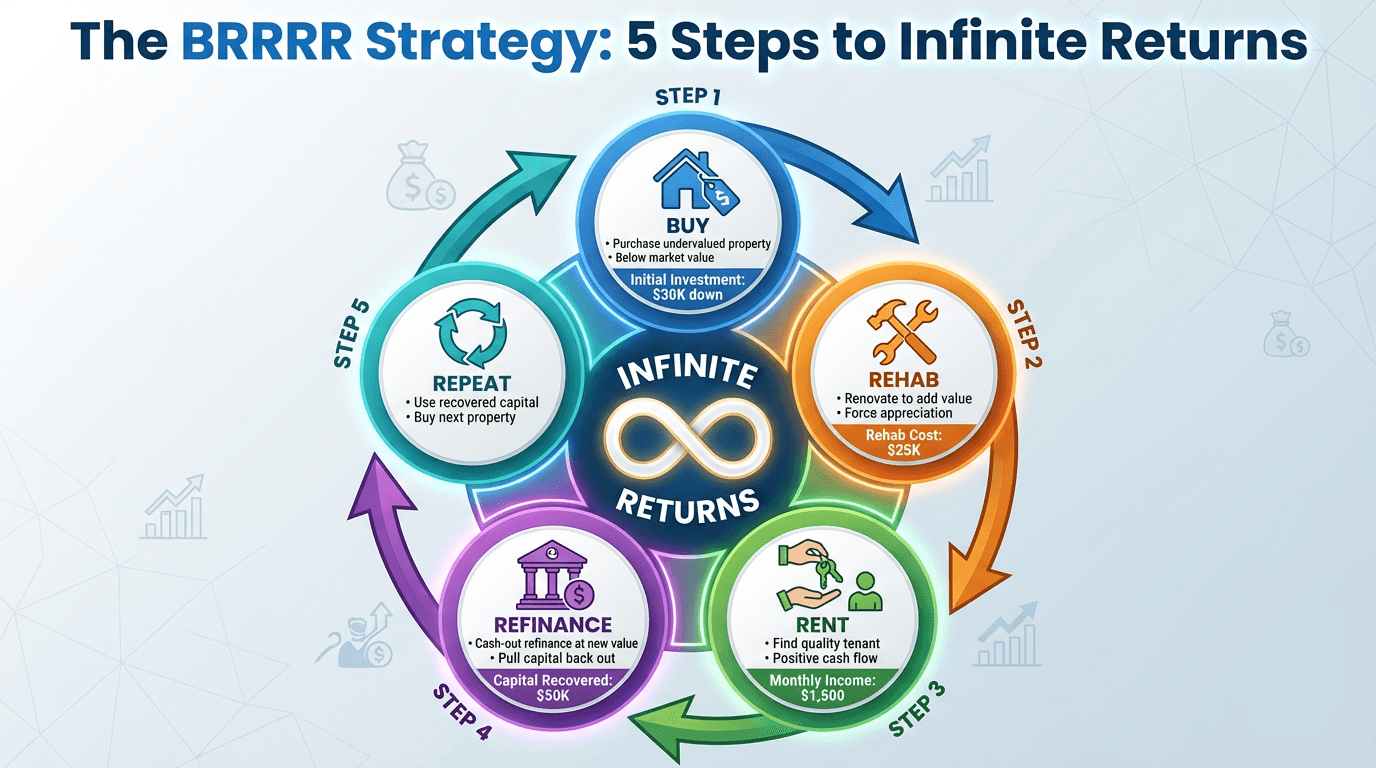

What is the BRRRR Strategy?

BRRRR stands for Buy, Rehab, Rent, Refinance, Repeat—a five-step method for acquiring rental properties, forcing appreciation through renovations, and recycling your capital into the next deal.

The Five Steps

Step 1: BUY - Purchase a distressed property below market value Step 2: REHAB - Renovate to increase the property's value Step 3: RENT - Place quality tenants and stabilize income Step 4: REFINANCE - Pull out your capital via cash-out refinance Step 5: REPEAT - Use the recycled capital for the next BRRRR deal

Why BRRRR Works

Traditional buy-and-hold investing requires new capital for every property:

- Property 1: $50,000 down payment

- Property 2: Another $50,000 (need new capital)

- Property 3: Another $50,000 (need new capital)

- 5 properties = $250,000 capital required

With BRRRR, you recycle the same capital:

- Property 1: $50,000 (pull most of it back out)

- Property 2: Same $50,000 recycled

- Property 3: Same $50,000 recycled

- 10+ properties = $50,000 capital required

The Result: Build a much larger portfolio with far less capital.

The Math Behind BRRRR: A Complete Example

Let's walk through a real BRRRR deal step by step.

Step 1: BUY - Purchase Below Market Value

Target Property:

- 3-bedroom, 2-bath single-family home

- Distressed condition (needs full rehab)

- Location: Growing suburban market

- Comparable homes (renovated): $250,000

Purchase Details:

- Purchase Price: $160,000

- Closing Costs: $3,500

- Initial Capital Required: $163,500 (cash or hard money)

Why It's a Good Buy:

- Purchased 36% below After Repair Value (ARV)

- Motivated seller (inherited property, needed quick sale)

- Solid bones, cosmetic issues only

Step 2: REHAB - Force Appreciation

Renovation Budget: $45,000

Kitchen ($15,000):

- New cabinets: $6,000

- Granite countertops: $3,500

- Stainless appliances: $3,000

- Tile backsplash: $1,500

- Plumbing fixtures: $1,000

Bathrooms ($8,000):

- Vanities and sinks: $2,500

- Tile showers: $3,000

- Toilets and fixtures: $1,500

- Lighting: $1,000

Flooring ($8,000):

- Luxury vinyl plank throughout: $6,000

- Carpet in bedrooms: $2,000

Paint & Finishes ($5,000):

- Interior paint (entire house): $3,500

- Exterior paint (touch-up): $1,500

Landscaping ($3,000):

- Front yard cleanup and curb appeal

- Sod and plants

- Mulch and edging

Systems & Misc ($6,000):

- HVAC service and repair: $2,000

- Roof repair: $2,000

- Electrical updates: $1,000

- Misc repairs: $1,000

Timeline: 8 weeks (2 months)

After Repair Value (ARV): $250,000

- Based on 5 comparable sales of renovated homes

- Conservative estimate

Step 3: RENT - Stabilize Income

Marketing & Tenant Placement:

- Professional photos: $300

- Listing on Zillow, Apartments.com: Free

- Showings: 15 prospective tenants (2 weeks)

- Applications: 6 qualified applicants

Tenant Selection:

- Credit score: 720+

- Income: 3× monthly rent ($5,400+)

- Clean rental history

- Employment verified

- References checked

Lease Terms:

- Monthly Rent: $1,800

- Security Deposit: $1,800 (one month)

- Lease Length: 12 months

- Tenant pays utilities

Holding Period Before Refinance: 6 months

- Most lenders require 6 to 12 months of seasoning

- Establishes rental income history

- Proves market rent

Step 4: REFINANCE - Recover Capital

After 6 months of rental history, you refinance to pull out your capital.

Refinance Details:

- After Repair Value (ARV): $250,000 (confirmed by appraisal)

- Loan-to-Value (LTV): 75% (standard for cash-out refinance)

- New Loan Amount: $187,500 (75% of $250,000)

- Interest Rate: 6.5%

- Loan Term: 30 years

- New Monthly Payment: $1,185 (principal and interest)

Capital Recovery Calculation:

Total Capital Invested:

- Purchase: $160,000

- Closing Costs: $3,500

- Rehab: $45,000

- Holding Costs (6 months): $6,000

- Total Invested: $214,500

Refinance Proceeds: $187,500

Capital Recovered: $187,500

Capital Left in Deal: $27,000

You pulled out $187,500 of the $214,500 you invested. $27,000 remains in the property.

Step 5: REPEAT - Recycle Capital

You now have $187,500 to invest in the next BRRRR deal. You can:

- Do 3 to 4 more BRRRR deals with this capital

- Keep repeating the process

- Build a portfolio of 10+ properties with the same initial capital

Cash Flow Analysis (Post-Refinance):

- Monthly Rent: $1,800

- Mortgage (P&I): $1,185

- Property Tax: $200

- Insurance: $120

- Maintenance Reserve: $180

- Property Management (8%): $144

- Total Expenses: $1,829

- Monthly Cash Flow: -$29 (break-even)

Why Negative Cash Flow is OK in BRRRR:

- You only have $27,000 left in the deal

- Annual loss: $350/year

- Cash-on-cash return: -1.3% (minimal loss)

- Principal paydown: ~$400/month ($4,800/year)

- Appreciation: ~3% to 5%/year ($7,500 to $12,500/year)

- Total return: $11,950 to $17,150/year on $27,000 = 44% to 63% ROI

Even with slight negative cash flow, the returns are incredible because you have so little capital left in the deal.

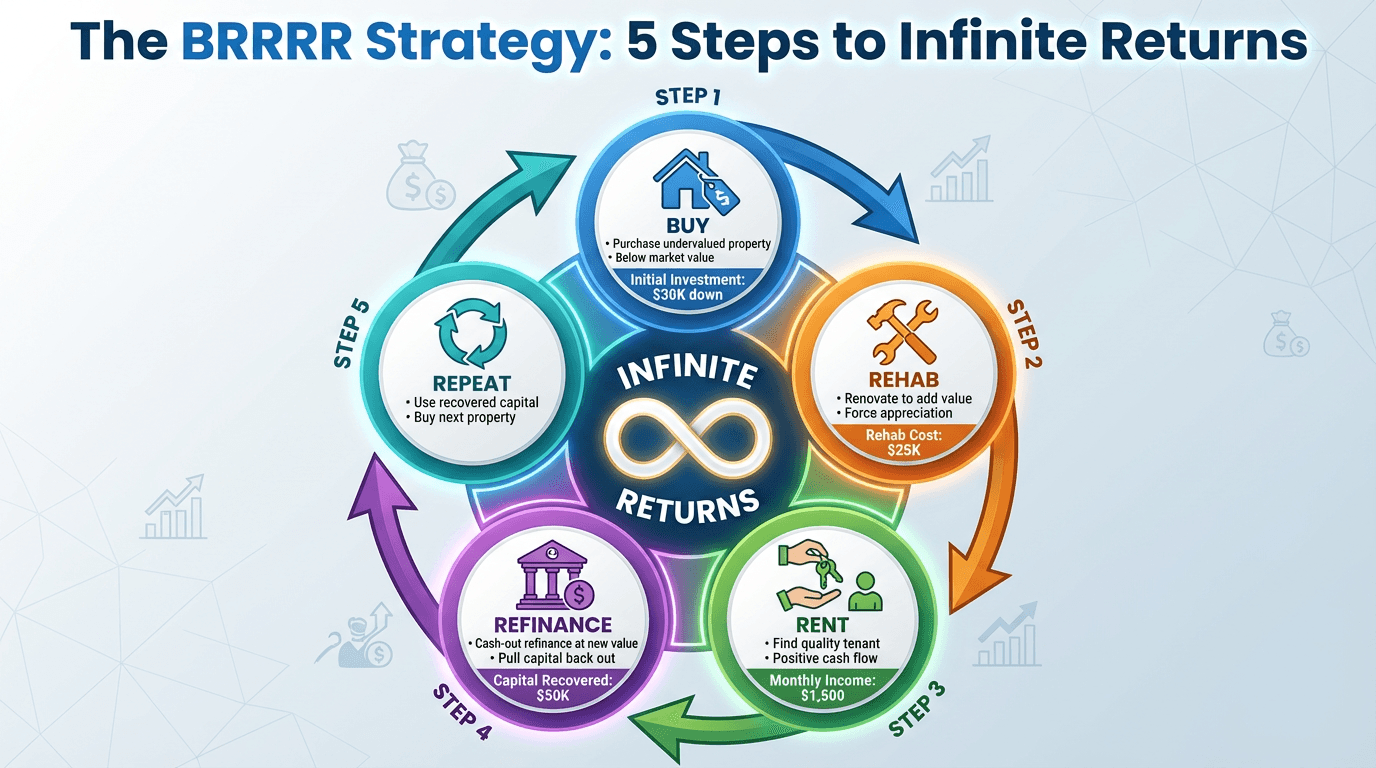

BRRRR vs Traditional Buy-and-Hold

Traditional Buy-and-Hold: Limited Scaling

Year 1:

- Buy Property 1: $50,000 down payment (20%)

- Property value: $250,000

- Equity: $50,000

Year 2:

- Save another $50,000 for down payment

- Buy Property 2: $50,000 down

- Total properties: 2

- Total equity: ~$115,000

Year 5:

- Total properties: 5

- Total capital required: $250,000

- Total equity: ~$370,000

Limitation: You need $50,000 in new capital for every property.

BRRRR Strategy: Infinite Scaling

Year 1:

- BRRRR Property 1: $50,000 invested

- Refinance: Pull out $40,000

- BRRRR Property 2: Use the $40,000

- Refinance: Pull out $35,000

- Total properties: 2

- Capital left in deals: $25,000

Year 2:

- Continue recycling capital

- BRRRR Properties 3 to 4

- Total properties: 4

- Capital left in deals: $50,000

Year 5:

- Total properties: 10 to 13

- Total capital required: $50,000 (initial only)

- Total equity: ~$450,000

Advantage: 2.6× more properties with 80% less capital!

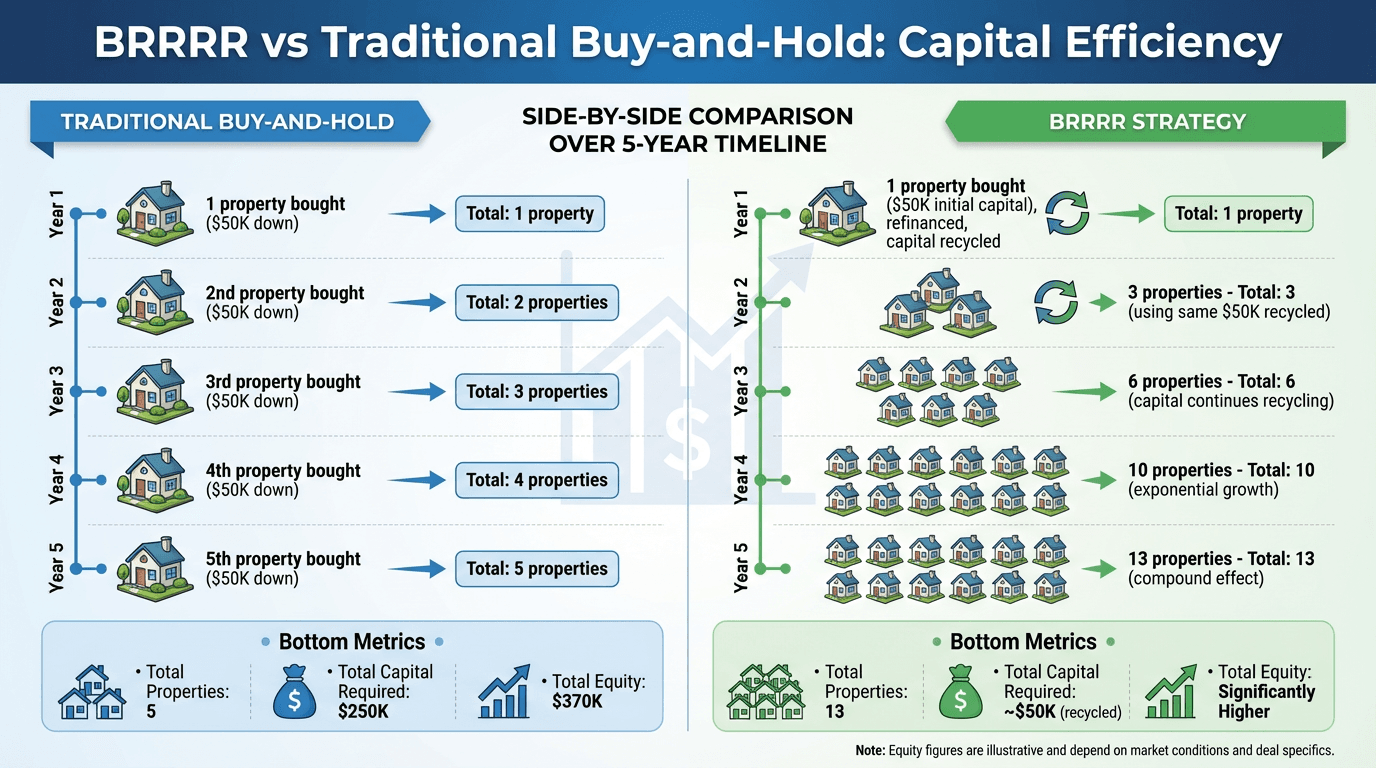

The 70% Rule: Finding BRRRR Deals

The 70% Rule is a quick screening tool to identify potential BRRRR properties.

70% Rule Formula:

Purchase Price + Rehab ≤ 70% of ARV

This ensures you buy with enough equity spread to successfully refinance and pull out most of your capital.

Example:

- ARV: $250,000

- 70% of ARV: $175,000

- Maximum All-In Cost: $175,000

If you can purchase for $160,000 and rehab for $15,000 ($175,000 total), you meet the 70% rule.

Why 70%?

- Lenders refinance at 75% LTV: 75% × $250,000 = $187,500

- Your all-in cost: $175,000

- You pull out $187,500 - $175,000 = $12,500 more than invested

- You recover 100%+ of your capital!

Modified for Different Markets:

- Hot markets (high competition): 75% rule

- Value-add heavy markets: 65% rule

- Adjust based on refinance LTV available (70% to 80%)

How to Find BRRRR Properties

BRRRR properties need two key characteristics:

- Below Market Value (distressed, motivated seller)

- Forced Appreciation Potential (cosmetic rehab, not structural)

Where to Find Deals

1. MLS (On-Market Properties)

- Search filters: "fixer-upper," "TLC," "handyman special," "as-is"

- Older listings (60+ days on market)

- Price reductions

- Estate sales

2. Off-Market Sources

- Direct mail to absentee owners

- Driving for dollars (find distressed properties)

- Wholesalers

- Probate leads

- Pre-foreclosures

- For Sale By Owner (FSBO)

3. Auctions

- Foreclosure auctions

- Tax deed sales

- Estate auctions

4. Real Estate Agents

- Work with agents who specialize in distressed properties

- Get on their list for pocket listings

5. Networking

- Local real estate investor groups (REIAs)

- Contractors (they see distressed properties)

- Property managers

- Attorneys handling estates/divorces

Red Flags to Avoid

Don't BRRRR These Properties:

- Structural Issues (foundation, roof replacement $20,000+, major systems)

- Overpriced (doesn't meet 70% rule)

- Bad Locations (declining neighborhood, high crime)

- Unpermitted Additions (can't refinance)

- Environmental Issues (mold, asbestos, lead paint requiring abatement)

- Title Issues (liens, clouds on title)

Financing Your BRRRR Deal

Phase 1: Purchase and Rehab Financing

You need short-term capital to purchase and renovate. Options:

Option 1: Cash (Best)

- Use savings, retirement funds (self-directed IRA), or partners

- No interest costs

- Fastest closings

- Most flexible

Option 2: Hard Money Loan

- Loan Amount: 70% to 80% of purchase + 100% of rehab

- Interest Rate: 9% to 12%

- Term: 6 to 12 months

- Points: 2 to 4 points upfront

- Speed: Close in 7 to 14 days

Example Hard Money Loan:

- Purchase: $160,000

- Rehab: $45,000

- Total: $205,000

- Hard Money Loan: 75% of purchase ($120,000) + 100% of rehab ($45,000) = $165,000

- Cash Needed: $40,000 down payment + $5,000 closing costs = $45,000

- Interest (6 months at 10%): $8,250

- Points (3%): $4,950

- Total Cost: $13,200 for 6 months

Option 3: Private Money

- Borrow from friends, family, or private lenders

- Interest Rate: 6% to 10% (negotiable)

- Term: Flexible

- No points typically

Option 4: Home Equity Line of Credit (HELOC)

- Borrow against your primary residence

- Interest Rate: 7% to 9%

- Revolving credit (pay back, reuse)

- Flexible terms

Option 5: Business Line of Credit

- Unsecured or secured credit line

- Interest Rate: 8% to 12%

- Good for smaller deals

Phase 2: Refinance Financing

After 6 to 12 months, you refinance into a long-term rental loan.

Conventional Cash-Out Refinance (Best):

- LTV: 75% (some lenders offer 80%)

- Seasoning Requirement: 6 to 12 months

- Interest Rate: 6% to 7.5%

- Loan Term: 30 years

- Debt Service Coverage Ratio (DSCR): 1.0 to 1.25

Example:

- ARV: $250,000

- Refinance Loan: 75% LTV = $187,500

- Pay off hard money: $165,000

- Cash out: $22,500 (goes back to you)

DSCR Calculation:

DSCR = (Monthly Rent × 75%) ÷ Monthly PITI

DSCR = ($1,800 × 0.75) ÷ $1,500 = 0.90

(Below 1.0 may not qualify—need higher rent or lower expenses)

Alternative Refinance Options:

- Portfolio Lenders: More flexible, 80% LTV, lower DSCR

- DSCR Loans: No personal income verification, based solely on rental income

- Commercial Loans: For larger properties or multiple units

BRRRR Deal Analysis Framework

Step 1: Calculate the 70% Rule

Formula: Purchase + Rehab ≤ 70% of ARV

Example:

- ARV: $250,000

- 70% of ARV: $175,000

- Purchase: $160,000

- Rehab: $45,000

- Total: $205,000

Does it meet 70% rule? NO ($205,000 > $175,000)

Action: Negotiate purchase price down to $130,000 or reduce rehab scope.

Step 2: Verify ARV with Comparable Sales

Pull 3 to 5 comparable sales:

- Similar size (within 10% square footage)

- Similar bed/bath count

- Similar condition (renovated)

- Sold within 6 months

- Within 1 mile radius

Conservative ARV Approach:

- Use the lower end of comps

- Adjust down for condition differences

- Account for market trends

Example Comps:

- Comp 1: $255,000 (1,800 sqft, 3/2)

- Comp 2: $248,000 (1,750 sqft, 3/2)

- Comp 3: $260,000 (1,900 sqft, 3/2)

- Comp 4: $245,000 (1,700 sqft, 3/2)

- Comp 5: $252,000 (1,850 sqft, 3/2)

Your Property: 1,800 sqft, 3/2 Conservative ARV: $250,000 (average of lower comps)

Step 3: Calculate Refinance Proceeds

Formula: ARV × 75% LTV = Refinance Amount

Example:

- ARV: $250,000

- Refinance at 75% LTV: $187,500

Can You Pull Out 80%+ of Capital?

- Total Invested: $214,500

- Refinance Proceeds: $187,500

- Capital Recovered: 87.4% ✓ (Goal: 80%+)

If you can't pull out 80%+: Either negotiate purchase price lower or find a lender offering 80% LTV refinance.

Step 4: Analyze Cash Flow

Monthly Cash Flow Calculation:

Rent: $1,800

- Mortgage (P&I): $1,185

- Property Tax: $200

- Insurance: $120

- Maintenance: $180

- Management: $144

- Vacancy Reserve: $90

= Monthly Cash Flow: -$119

Minimum Target: $0 to $200/month positive cash flow (or break-even)

In BRRRR: Slight negative cash flow is acceptable if:

- Total returns (cash flow + equity + appreciation) are strong

- You have reserves to cover shortfalls

- The property cash flows positive within 2 to 3 years (rent increases)

Step 5: Calculate Total Returns

BRRRR returns come from multiple sources:

1. Forced Appreciation (Equity Capture):

- Purchase: $160,000

- ARV: $250,000

- Equity Created: $90,000

2. Cash Flow:

- Annual Cash Flow: -$350/year (slight negative)

3. Principal Paydown:

- Annual Paydown: $4,800/year

4. Appreciation:

- 3% annual appreciation: $7,500/year

Total Annual Return:

- Equity Capture: $90,000 (year 1 only)

- Cash Flow: -$350

- Paydown: $4,800

- Appreciation: $7,500

- Total: $11,950/year

Cash-on-Cash Return:

- Capital Left in Deal: $27,000

- Annual Return: $11,950

- CoC Return: 44% on capital left in deal

Capital Recycling and Infinite Returns

The Infinite Return Concept

Infinite Return occurs when you have $0 (or minimal capital) left in a cash-flowing asset.

Example:

- Property cash flow: $200/month

- Capital left in deal: $5,000

- Annual cash flow: $2,400

- CoC Return: $2,400 ÷ $5,000 = 48%

If you pulled out 100% of your capital (left $0 in):

- Annual cash flow: $2,400

- Capital left in deal: $0

- CoC Return: Infinite! (Dividing by zero)

Even with $5,000 to $10,000 left in the deal, returns are extraordinary (25% to 50%+).

Scaling with Recycled Capital

Starting Capital: $200,000

BRRRR Deal 1:

- Invested: $200,000

- Refinance: Pull out $180,000

- Left in deal: $20,000

- Available for next deal: $180,000

BRRRR Deal 2:

- Invested: $180,000

- Refinance: Pull out $160,000

- Left in deal: $20,000

- Available for next deal: $160,000

BRRRR Deal 3:

- Invested: $160,000

- Refinance: Pull out $140,000

- Left in deal: $20,000

- Available for next deal: $140,000

After 3 Deals:

- Total Properties: 3

- Total Capital Left in Deals: $60,000

- Available Capital: $140,000

- Portfolio Value: $750,000

- Combined Cash Flow: $600/month

- You still have $140,000 to do more deals!

After 10 Deals:

- Total Properties: 10

- Total Capital Left in Deals: $200,000 (all of original)

- Portfolio Value: $2,500,000

- Combined Cash Flow: $2,000/month

- Every dollar is still working for you

BRRRR Risks and How to Mitigate Them

Risk 1: Overestimating ARV

The Problem: You think the property is worth $250,000 post-rehab, but it appraises at $220,000.

- Refinance at 75% LTV: $165,000 (not $187,500)

- You can't pull out enough capital

- Capital left in deal is much higher than planned

Mitigation:

- Use Conservative Comps: Pick lower-end comparables

- Get Pre-Appraisal: Some investors pay for a pre-refinance appraisal ($400 to $500)

- Work with Experienced Appraiser: Provide strong comps package

- Build in 10% Buffer: Assume ARV 10% lower than your estimate

Risk 2: Rehab Overruns (Budget and Timeline)

The Problem:

- Budgeted $45,000 for rehab, actual cost: $60,000

- Estimated 2 months, actual timeline: 5 months

- Holding costs balloon, eats into profit

Mitigation:

- Build 20% Contingency: Budget $54,000 for a $45,000 scope

- Get Multiple Bids: 3+ contractor estimates

- Use Detailed Scope of Work: Line-item budget prevents surprises

- Manage Contractors Closely: Weekly check-ins, milestone payments

- Pre-Order Materials: Avoid supply chain delays

Risk 3: Appraisal Comes in Low

The Problem: You need $187,500 refinance (75% of $250,000 ARV), but appraisal comes in at $230,000.

- Refinance: 75% × $230,000 = $172,500

- You're short $15,000

Mitigation:

- Appeal the Appraisal: Provide additional comps

- Find Better Lender: Some portfolio lenders offer 80% LTV or use different appraisers

- Wait 3 to 6 Months: Market may improve, try again

- Accept Lower Recovery: Leave more capital in the deal

- Use Alternative Exit: Sell the property if refinance fails

Risk 4: Rental Income Lower Than Expected

The Problem:

- Expected rent: $1,800/month

- Actual rent: $1,600/month

- Cash flow becomes negative, DSCR doesn't qualify for refinance

Mitigation:

- Research Rent Comps Thoroughly: Use Zillow, Rentometer, local property managers

- Get Pre-Listing Rent Assessment: Property manager provides rent estimate before purchase

- Build in Rent Buffer: Assume rent 5% to 10% lower than market

- Focus on High-Demand Areas: Strong rental markets reduce risk

Risk 5: Can't Refinance (Lender Denial)

The Problem:

- Property doesn't qualify for refinance (low DSCR, title issues, appraisal problems)

- You're stuck in high-interest hard money loan

Mitigation:

- Pre-Qualify with Refinance Lender: Before purchasing, get soft approval

- Have Multiple Lender Options: Portfolio lenders, DSCR lenders, local banks

- Backup Exit Strategy: Be prepared to sell if refinance fails

- Build DSCR Cushion: Target 1.25+ DSCR (not just 1.0)

- Ensure Clean Title: Title search before closing on purchase

Advanced BRRRR Strategies

Strategy 1: The House Hack BRRRR

Combine house hacking with BRRRR for ultimate capital efficiency.

How It Works:

- Buy a 2 to 4 unit property with FHA loan (3.5% down)

- Live in one unit, rent out the others

- Renovate units as they turn over

- After 12 months, move out and refinance as investment property

- Rent out your unit, pull out capital (if value increased)

- Repeat with another house hack

Example:

- Purchase fourplex: $400,000 (FHA 3.5% down = $14,000)

- Live in unit 1, rent units 2-4: $3,000/month

- Renovate units as leases expire: $30,000 total over 18 months

- Move out after 12 months, rent unit 1: $1,200/month

- New ARV: $480,000 (increased through renovations)

- Refinance at 75%: $360,000

- Pay off FHA loan (~$386,000)

- Result: Minimal capital left in deal, cash-flowing fourplex

Advantage: Start with only 3.5% down instead of 20% to 25%.

Strategy 2: The BRRRR to 1031 Exchange

Use BRRRR to build equity quickly, then 1031 exchange into larger properties.

How It Works:

- BRRRR 5 to 10 single-family homes over 3 to 5 years

- Each has $20,000 to $50,000 in forced appreciation equity

- Sell all properties simultaneously (or in phases)

- 1031 exchange into larger multi-family (20+ units)

- Defer all capital gains taxes

- Upgrade to commercial property with professional management

Why It Works:

- BRRRR builds equity fast (forced appreciation)

- 1031 exchange defers taxes

- Trade management-heavy single-families for passive large multi-family

Strategy 3: Partner BRRRR (Unlimited Capital)

Partner with others to access infinite capital for BRRRR deals.

Structure:

- You: Find deals, manage rehab, property management (sweat equity)

- Partner: Provides capital (money partner)

- Split: 50/50 equity and cash flow (or negotiate)

How It Works:

- Partner provides $200,000 for first BRRRR

- You execute: buy, rehab, rent, refinance

- Pull out $180,000 via refinance

- $20,000 left in deal (50/50 split: $10,000 each)

- Repeat with partner's $180,000 recycled capital

- Scale to 10+ properties with same partner

Why Partners Love BRRRR:

- Passive investment with active operator (you)

- High returns (15% to 30% CoC)

- Forced appreciation (not dependent on market)

- Cash flow from day one

BRRRR Success Stories

Success Story 1: From 0 to 10 Properties in 3 Years

Investor: Mike, age 32, marketing director

Starting Point:

- Savings: $75,000

- Goal: Build rental portfolio for financial independence

BRRRR Journey:

Year 1: Properties 1-3

- Deal 1: Purchase $140,000, rehab $35,000, ARV $225,000, refinanced $168,750, left in: $20,000

- Deal 2: Purchase $155,000, rehab $40,000, ARV $245,000, refinanced $183,750, left in: $25,000

- Deal 3: Purchase $130,000, rehab $30,000, ARV $210,000, refinanced $157,500, left in: $15,000

- Total left in 3 deals: $60,000

- Recycled capital available: $15,000 + reserves

Year 2: Properties 4-7

- Continued BRRRR strategy with recycled capital

- Added private money partner for larger deals

- Total properties: 7

- Combined cash flow: $2,800/month

Year 3: Properties 8-10

- Scaled to 10 properties

- Total portfolio value: $2,300,000

- Total equity: $650,000

- Combined cash flow: $4,200/month

- Total capital deployed: $75,000 (initial) + $120,000 (left in deals) = $195,000

Mike's Results: "I built a portfolio worth $2.3M with less than $200,000 total capital deployed. Traditional buy-and-hold would have required $500,000. BRRRR changed my life."

Success Story 2: The Part-Time BRRRR (1 to 2 Per Year)

Investor: Sarah, age 45, full-time teacher

Starting Point:

- Savings: $50,000

- Goal: Supplement income, build retirement wealth

- Limitation: Full-time job, limited time for active investing

BRRRR Approach:

- Execute 1 to 2 BRRRR deals per year

- Use contractors and property managers (hands-off)

- Focus on quality over quantity

5-Year Results:

- Properties: 8 (average 1.6/year)

- Portfolio value: $1,800,000

- Total equity: $500,000

- Monthly cash flow: $3,200

- Time invested: 5 to 10 hours/month (mostly research and oversight)

Sarah's Takeaway: "I don't need to quit my job to build wealth through real estate. One or two BRRRR deals per year, executed well, compound into serious wealth."

BRRRR Calculator: How to Use

Our BRRRR calculator helps you analyze potential deals and determine:

- Total capital required

- Refinance proceeds

- Capital left in deal

- Cash-on-cash return

- Total return (cash flow + equity + appreciation)

Step-by-Step Calculator Guide

Step 1: Enter Purchase Details

- Purchase Price

- Closing Costs (typically 2% to 3%)

- Estimated ARV (After Repair Value)

Step 2: Enter Rehab Costs

- Total renovation budget

- Include 10% to 20% contingency

Step 3: Enter Financing Details

- Initial financing type (cash, hard money, private)

- Interest rate

- Term

- Points (if hard money)

Step 4: Enter Rental Income

- Expected monthly rent

- Vacancy rate

- Property management fee

Step 5: Enter Refinance Details

- Refinance LTV (typically 75%)

- Refinance interest rate

- Loan term

- Seasoning period (months before refinance)

Step 6: Enter Monthly Expenses

- Property tax

- Insurance

- Maintenance reserve

- HOA (if applicable)

Step 7: Review Results The calculator shows:

- Total capital invested

- Refinance proceeds

- Capital recovered

- Capital left in deal

- Monthly cash flow

- Cash-on-cash return

- Total annual return

Frequently Asked Questions

How much money do I need to start BRRRR investing?

Answer: Minimum $50,000 to $75,000 for your first deal (depending on market and property price).

Breakdown:

- Down payment (cash or hard money): $30,000 to $50,000

- Rehab budget: $20,000 to $40,000

- Reserves (holding costs, contingencies): $10,000 to $15,000

Ways to Get Started with Less:

- Partner with a money partner (you contribute sweat equity)

- Start with a house hack (FHA 3.5% down)

- Use HELOC or business line of credit

- Wholesale first to build capital

How long does a BRRRR deal take from start to finish?

Answer: Typically 9 to 15 months for your first deal.

Timeline:

- Finding the deal: 1 to 3 months

- Closing: 30 to 45 days

- Rehab: 2 to 4 months

- Rent and stabilize: 1 month

- Seasoning period: 6 to 12 months

- Refinance: 30 to 45 days

Faster Timeline (6 to 9 Months):

- Use lenders with shorter seasoning (6 months)

- Have deal pipeline ready

- Experienced contractor network

What if I can't pull out all my capital in the refinance?

Answer: This happens sometimes. You have several options:

Option 1: Leave More Capital in the Deal

- Accept that you'll have $40,000 to $60,000 left instead of $20,000 to $30,000

- Cash flow will be lower

- Still better than traditional buy-and-hold

Option 2: Wait and Try Again

- Wait 12 to 18 months

- Rents may increase (better DSCR)

- Market appreciation may increase ARV

- Refinance again with better terms

Option 3: Find Better Lender

- Some lenders offer 80% LTV (vs 75%)

- Portfolio lenders may have more flexibility

- Shop 5+ lenders

Option 4: Partner on Next Deal

- Use partners' capital for next deals while yours is tied up

- Keep scaling

Can I BRRRR my primary residence?

Answer: Yes, but it's technically not a BRRRR until you convert it to a rental and refinance.

Primary Residence Version:

- Buy a fixer-upper with owner-occupied financing (FHA 3.5% down or conventional 5% down)

- Live in it while renovating

- After 12+ months, move out and rent it

- Refinance as investment property (cash-out if needed)

- Repeat with next primary residence

Benefit: Start with much lower down payment (3.5% to 5% vs 20% to 25%).

What's the biggest mistake BRRRR investors make?

Answer: Overestimating ARV (After Repair Value).

If your ARV is inflated:

- Refinance appraisal comes in low

- Can't pull out enough capital

- Deal fails or leaves too much capital in

How to Avoid:

- Use conservative comparable sales

- Get multiple real estate agent opinions

- Consider paying for pre-appraisal ($400 to $500)

- Build in 10% ARV buffer

Should I use hard money or cash for BRRRR deals?

Answer: Cash is best (if you have it) because you avoid interest and points.

Hard money makes sense when:

- You don't have enough cash for multiple deals

- You want to scale faster

- The returns justify the cost (CoC return still 20%+)

- You can refinance quickly (6 months)

Example Cost Comparison:

Using Cash:

- $200,000 cash

- No interest or points

- Cost: $0

Using Hard Money:

- $200,000 deal

- Hard money: $165,000 (you put in $35,000 cash)

- Interest (6 months at 10%): $8,250

- Points (3%): $4,950

- Total cost: $13,200

- But you can do 5 to 6 deals simultaneously with your $200,000 (vs 1 deal with cash)

If the extra deals generate 40%+ returns, hard money is worth it.

How do I find good contractors for BRRRR projects?

Answer: Finding reliable contractors is critical. Here's how:

1. Ask for Referrals:

- Other investors (REIAs, BiggerPockets local groups)

- Real estate agents

- Property managers

- Lumber yards and supply stores

2. Interview 3 to 5 Contractors:

- Ask for references from recent projects

- Check licenses and insurance

- Get detailed bids (line-item)

- Discuss timeline and payment schedule

3. Start with Small Project:

- Test contractor on minor rehab first

- Evaluate quality, communication, timeline adherence

- Scale to larger projects if satisfied

4. Use Contracts:

- Detailed scope of work

- Payment schedule (milestone-based, not upfront)

- Timeline with penalties for delays

- Warranty on work

5. Manage Closely:

- Visit job site weekly

- Require photos/updates

- Pay only for completed work

- Hold 10% to 20% until final walkthrough

What return should I target on a BRRRR deal?

Answer: Minimum Target: 15% to 20% cash-on-cash return on capital left in the deal.

Example:

- Capital left in deal: $30,000

- Annual cash flow: $2,400

- Principal paydown: $4,800

- Appreciation: $7,500

- Total annual return: $14,700

- CoC Return: 49% ✓ (Far exceeds 15% target)

If returns are under 15%:

- Negotiate better purchase price

- Reduce rehab costs

- Find higher rent property

- Pass on the deal

Can I BRRRR multi-family properties (duplexes, fourplexes)?

Answer: Yes! Multi-family BRRRR is even better than single-family because:

- Multiple income streams (lower vacancy risk)

- Higher ARV potential

- Easier to achieve cash flow

- Qualify for agency loans (Fannie/Freddie) on 2 to 4 units

Example Multi-Family BRRRR:

- Purchase fourplex: $320,000

- Rehab: $60,000 (4 units × $15,000/unit)

- ARV: $500,000

- Refinance at 75%: $375,000

- Capital left in: $5,000 to $20,000

- Monthly cash flow: $1,200

Financing Note: 2 to 4 unit properties can use conventional financing (75% LTV). 5+ units require commercial loans (70% to 75% LTV).

What if the market crashes during my BRRRR project?

Answer: Have a backup exit strategy.

Backup Plan:

- Hold and Wait: If you can afford the payments, wait for market recovery

- Rent It: Even if you can't refinance, rent it and hold until refinance is possible

- Seller Finance: Offer seller financing to a buyer (you hold the note)

- Lease Option: Lease with option to buy (tenant pays rent, option to purchase in 1 to 2 years)

- Cut Losses: Sell at a small loss if necessary (better than holding a negative cash flow property long-term)

How to Protect Yourself:

- Buy in strong rental markets (not just appreciating markets)

- Ensure positive cash flow even if refinance fails

- Keep 6 to 12 months of reserves

- Diversify across multiple properties

BRRRR Strategy Checklist

Use this checklist for every BRRRR deal:

Before Purchase

- [ ] Property meets 70% rule (purchase + rehab ≤ 70% of ARV)

- [ ] ARV verified with 3 to 5 comparable sales

- [ ] Inspection completed (no major structural issues)

- [ ] Detailed rehab scope of work created

- [ ] Contractor bids received (3+ estimates)

- [ ] Financing secured (cash, hard money, or other)

- [ ] Rent comps researched (conservative estimate)

- [ ] Pre-qualified with refinance lender

- [ ] Exit strategy identified (backup plan if refinance fails)

During Rehab

- [ ] Contractor progress monitored weekly

- [ ] Budget tracked (no major overruns)

- [ ] Timeline on track (2 to 4 months typical)

- [ ] Change orders documented and approved

- [ ] Photos taken (before, during, after)

- [ ] Permits obtained (if required)

During Rent Phase

- [ ] Professional photos taken

- [ ] Property listed on Zillow, Apartments.com, etc.

- [ ] Showings scheduled

- [ ] Tenant screening completed (credit, income, references)

- [ ] Lease signed

- [ ] Security deposit collected

- [ ] Rental income documented (for refinance)

Before Refinance

- [ ] 6 to 12 months seasoning period met

- [ ] Rental income history documented

- [ ] Property maintained (no deferred maintenance)

- [ ] Comparable sales package prepared (for appraiser)

- [ ] Lender pre-approval obtained

- [ ] Appraisal ordered

- [ ] DSCR calculated (1.2+ target)

After Refinance

- [ ] Capital recovered and allocated to next deal

- [ ] Property management in place (or self-managing system)

- [ ] Financial tracking set up (income, expenses, reserves)

- [ ] Insurance updated

- [ ] Next BRRRR deal in pipeline

Final Thoughts: BRRRR is the Ultimate Wealth Builder

The BRRRR strategy is the most powerful method for building a large real estate portfolio with limited capital. By recycling the same money over and over, you can acquire 10, 20, or even 50+ properties with the same initial investment.

Key Principles for BRRRR Success:

- Buy Below Market Value - The 70% rule ensures you have enough equity spread

- Add Value Through Rehab - Force appreciation, don't rely on market appreciation

- Verify ARV Conservatively - Overestimating ARV is the #1 BRRRR mistake

- Stabilize with Quality Tenants - Rental income is critical for refinance approval

- Refinance and Recycle - Pull out capital and repeat the process

The BRRRR Wealth Formula:

Limited Capital × Infinite Deals = Unlimited Wealth

With traditional buy-and-hold, you're limited by how much capital you have. With BRRRR, you're limited only by how many good deals you can find.

Start with one deal. Prove the concept. Then scale systematically. In 5 to 10 years, you can build a portfolio worth millions—with the same initial $50,000 to $100,000.

Ready to Analyze Your First BRRRR Deal?

Use our BRRRR calculator above to run the numbers on potential properties. Input your purchase price, rehab costs, ARV, and financing details to see:

- Total capital required

- Refinance proceeds

- Capital left in deal

- Cash-on-cash return

- Total return (cash flow + equity + appreciation)

Next Steps:

- Use the calculator to analyze 5 to 10 potential deals

- Find a deal that meets the 70% rule

- Build your team (contractor, lender, property manager)

- Execute your first BRRRR

- Repeat and scale!

The BRRRR method has created more millionaire real estate investors than any other strategy. Start your BRRRR journey today!

Related Content

📝 BRRRR Method Explained: Buy, Rehab, Rent, Refinance, Repeat

Master the BRRRR method for rapid portfolio growth. Buy, rehab, rent, refinance, and repeat to build wealth.

📝 House Hacking Calculator: Live Rent-Free Guide

Read more about this topic

📝 How to Refinance Rental Properties: When and How to Do It

Guide to refinancing rental properties. When to refinance, break-even costs, and using cash-out to grow your portfolio.

🔧 ROI Calculator

Calculate return on investment

🔧 Property Investment Analyzer

Comprehensive property analysis tool

🔧 BRRRR Calculator

Analyze buy-rehab-rent-refinance deals